Romeo Lacher ist Verwaltungsratspräsident von Julius Bär. Bild: ZVG At its meeting today, the Bank Council of the Swiss National Bank decided to propose to the General Meeting of Shareholders of 30 April 2021 that Romeo Lacher and Christoph Mäder be elected to the SNB Bank Council for the remainder of the 2020–2024 term of office. Romeo Lacher is Chairman of the Board of Directors of Julius Baer Group Ltd. and Bank Julius Baer & Co. Ltd. Christoph Mäder is...

Read More »Covid: Swiss government announces new measures

On 28 October 2020, after a record number of 8,616 daily new cases of infection were reported, Switzerland’s federal government announced new measures to fight against the spread of Covid-19. These rules come into effect from Thursday 29 October 2020.Nightclubs to close Discos and nightclubs will be closed. New rules for restaurants and bars No more than four people will be allowed to sit at a table in restaurants and bars, with the exception of families with...

Read More »Coronavirus: a record 9,386 new daily cases in Switzerland

© Niccolo Pontigia | Dreamstime.com On 29 October 2020, Switzerland’s Federal Office of Public Health (FOPH) reported 9,386 new cases of SARS-CoV-2 infection over 24 hours, bringing the total to 145,044. New daily cases continue to rise in Switzerland. The number of reported laboratory-confirmed cases today was 9% higher than yesterday. Over the last 14 days, Switzerland has recorded 837 new cases per 100,000, with nearly half of Switzerland’s laboratory-confirmed...

Read More »Understanding the Proper Meaning of “Equality”

[A Selection from Liberalism: In the Classical Tradition.] Equality Nowhere is the difference between the reasoning of the older liberalism and that of neoliberalism clearer and easier to demonstrate than in their treatment of the problem of equality. The liberals of the eighteenth century, guided by the ideas of natural law and of the Enlightenment, demanded for everyone equality of political and civil rights because they assumed that all men are equal. God created...

Read More »Populism Worked for the Pro-Freedom Party in the Past. Can It Work Again?

Although he was a scholar with degrees in mathematics and economics, Murray Rothbard was very much a fan of the American layman. Indeed, he was a populist both in temperament and in his political views. In a 1992 column outlining his populist strategy, Rothbard noted the importance of reaching out to the general public and especially to those groups that were most negatively impacted by state power: This two-pronged strategy is (a) to build up a cadre of our own...

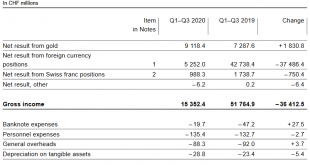

Read More »SNB Profit in Q1 to Q3 2020: CHF 15.1 billion Despite Covid19

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Low Inflation, Crashes and Central Bank Money Printing The crisis caused by the Covid19 virus,is a typical crisis with low inflation (at least for now). During such a crisis, central bank money...

Read More »Switzerland cuts its quarantine list as infections rise steeply

© Piccaya | Dreamstime.com On 28 October 2020, Switzerland’s federal government removed all but 6 nations/regions from its quarantine list, effective from 29 October 2020. The rate of SARS-CoV-2 infection has risen so high in Switzerland that most of the world is less infected. Quarantining those arriving in Switzerland from all but a few places is now senseless. Currently, there are 90 nations or regions from where people must quarantine on arrival in Switzerland....

Read More »Novartis boosts involvement in anti-Covid treatment

The biotech company and the pharmaceutical giant want to develop and market a drug with a unique approach for the prevention and treatment of Covid-19. Keystone/Alexandra Wey Swiss pharmaceutical company Novartis says it has signed a deal with biotech firm Molecular Partners to develop, manufacture and commercialise an anti-Covid-19 treatment drug. The Basel-based company said the option and licence agreement was aimed at boosting a programme consisting of two...

Read More »Unless the US stops printing money, the dollar will collapse

Interview with Patrick Barron – Part II of II Claudio Grass (CG): This crisis has shaken a lot of industries and core functions of the global economy and international trade. How do you assess its impact on the most important part of the machine, the banking system? Do you see risks there that investors should be worrying about? Patrick Barron (PB): Banks are financial intermediaries. They take deposits and make loans. That has been going on for millennia. What we...

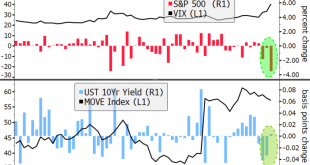

Read More »Dollar Bid as Markets Steady Ahead of ECB Decision

Global equity markets are gaining limited traction today after yesterday’s bloodbath; that sell-off helped test a now prevalent hedging thesis for investors The dollar remains bid; US Q3 GDP data will be the data highlight; weekly jobless claims will be reported BOC delivered a dovish hold yesterday; Canada Finance Minister Freeland defended the government’s aggressive fiscal stimulus plans; Brazil left rates unchanged, as expected ECB is expected to deliver a...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org