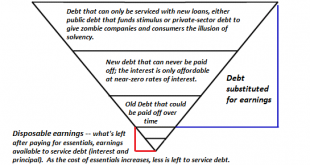

One glance at this chart explains why the status quo is locked on “run to fail” and will implode in a spectacular collapse of the unsustainable debt super-nova.. For those who suspect the status quo is unsustainable but aren’t quite sure why, I’ve prepared a simple chart that explains the financial precariousness many sense. The chart depicts the two core elements of a debt-based, consumerist economy: disposable earnings, defined as the earnings left after paying...

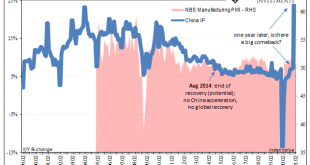

Read More »Looking Past Gigantic Base Effects To China’s (Really) Struggling Economy

The Chinese were first to go down because they had been first to shut down, therefore one year further on they’ll be the first to skew all their economic results when being compared to it. These obvious base effects will, without further scrutiny, make analysis slightly more difficult. What we want to know is how the current data fits with the overall idea of recovery: is it on track, perhaps going better than thought, or falling short. Another set of huge positives...

Read More »Hack on US security-camera company sparks Swiss police raid

The hackers said they wanted to raise awareness about mass surveillance © Keystone / Christian Beutler Swiss authorities on Monday confirmed a police raid at the home of a Swiss hacker who took credit for helping to break into a US security-camera company’s online networks, part of what the hacker cited as an effort to raise awareness about the dangers of mass surveillance. The Federal Office of Justice said regional police in central Lucerne, acting on a legal...

Read More »FX Daily, March 15: Big Week Begins Quietly

Swiss Franc The Euro has fallen by 0.24% to 1.1077 EUR/CHF and USD/CHF, March 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The capital markets are beginning a new and busy week in a non-committal fashion. Equities are mixed. Except for Japan, Hong Kong, and Australia, most markets in the Asia Pacific region were lower, led Chinese and Indian shares. Europe’s Dow Jones Stoxx 600 ended a four-day advance...

Read More »Das staatliche Geldmonopol und der „Große Reset“

Das ungedeckte Papiergeldgeldsystem – man kann es auch als Fiat-Geldsystem bezeichnen – ist wirtschaftlich und sozial äußerst problematisch. Es verursacht Schäden, die vermutlich weit über die Vorstellungen der meisten Menschen hinausgehen. Beispielsweise ist das Fiat-Geld inflationär; es begünstigt einige wenige auf Kosten vieler; es verursacht Konjunkturzyklen („Boom-und-Bust“); es korrumpiert das Moral- und Wertesystem...

Read More »Flu deaths surprisingly rare in Switzerland

© Udra11 | Dreamstime.com Sometimes comparisons are drawn between the seasonal flu and Covid-19. But how many die from the seasonal flu in a typical year? According to Switzerland’s Federal Statistical Office, surprisingly few. Over the ten years from 2009 to 2018, an annual average of 1181 people died from the flu in Switzerland, according to death certificate data collated by the Federal Statistical Office, a rate of around 14 per million. From 2009 to 2018, the...

Read More »Moral Courage and the Austrian School

When economic crises hit, most pundits and intellectuals never see it coming. That is because they have never learned the lesson that Bastiat sought to teach, namely that we need to look beneath the surface, to the unseen dimensions of human action, in order to see the full economic reality. It is not enough just to stand back and look at points on a chart going up and down, smiling when things go up and frowning when things go down. That is the nihilism of an...

Read More »Farming lobby hurting Swiss chocolate sector, says industry association

© Phattha Intharakamhaeng | Dreamstime.com Swiss chocolate sales went into steep decline in 2020, according to ChocoSuisse, Switzerland’s chocolate industry association. The amount of chocolate produced in Switzerland in 2020 was 10% lower than in 2019 and sales revenue was down by 14.5%, a sharp drop. In 2020, Swiss chocolatiers produced around 180,000 tons, 20,000 tons less than the year before and sales fell by CHF 260 million to CHF 1.53 billion. The export...

Read More »What Really Happened With the Texas Power Grid

Since the deep freeze in February caused millions of Texas homes to lose their power, partisans have been fighting over the blame. The governor blamed wind turbines and the green agenda, whereas Paul Krugman said the fault was with natural gas. Bob shows the numbers; natural gas was to blame only in the sense that nobody expected wind to be useful during a winter crisis. Mentioned in the Episode and Other Links of Interest: Bob’s article at Mises.org, which gives...

Read More »Regulators want firms to own up to climate risks

AMERICA’S MAIN financial regulator is taking an interest in climate change—and wants everyone to know. The Securities and Exchange Commission (SEC) has created a task-force to examine environmental, social and governance (ESG) issues, appointed a climate tsar and said it will “enhance its focus” on climate-related disclosures for listed firms. It looks poised to introduce, among other things, rules forcing firms to reveal how climate change or efforts to fight it may...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org