Central banks have come to the fore in recent years by printing money to keep economies afloat. Keystone / Lm Otero Every other month, the world’s most influential central bank governors gather in Basel to swap notes, reinforce personal ties and untangle the technical details of keeping money flowing around the world. Since the financial crisis of 2007-2008, central banks have emerged from dull obscurity to print trillions in multiple currencies. The pandemic has...

Read More »US charge extradited Russian businessman with hacking, insider trading

According to the US Securities and Exchange Commission, the hacking and insider trading scheme made a total of $82 million from 2018 through 2020. Keystone / Anonymous The Russian businessman extradited from Switzerland to the United States and four other Russians have been charged with carrying out a $82-million (CHF75 million) insider trading scheme using data stolen during hacks of US computer networks. US federal prosecutors in Boston announcedExternal link on...

Read More »An Incriminating Piece in the JFK Assassination Puzzle

My immediate reaction to the National Archives’ very limited release of a few of the CIA’s JFK-assassination records is this: I’m not interested in seeing what they’re releasing. I’m interested in seeing what they’re still hiding. However, there was at least one document that they recently released that is incriminating. It’s a document that the CIA published on the Sunday morning after the assassination. It is entitled “SUMMARY of Relevant Information on Lee...

Read More »TIC October: The Deflationary ‘Dollars’ Behind The Flat, Inverting Curves

Seems like ancient history given all that’s happened since, but on October 13 Treasury Secretary Janet Yellen announced a planned deluge of cash management bills in the wake of the debt ceiling resolution (the first one). The next day, China’s currency, CNY, broke free from its previous and suspiciously narrow range. Speculating a connection a few days thereafter, I wrote: …it had been on the 13th when Treasury announced its intention to unleash a CMB (cash...

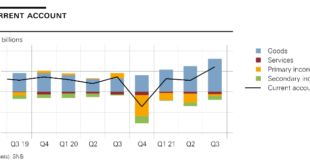

Read More »Swiss balance of payments and international investment position: Q3 2021

In the third quarter of 2021, the current account surplus amounted to CHF 24 billion, CHF 10 billion more than in the same quarter of 2020. The increase was mainly attributable to the significantly higher receipts surplus in goods trade. This surplus was due to traditional goods trade (foreign trade total 1), non-monetary gold trading, as well as to merchanting. Primary income counteracted the rise in the current account balance. While a receipts surplus was...

Read More »One Shock Case For ‘Irrational Exuberance’ Reaching A Quarter-Century

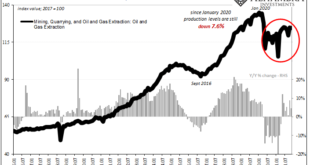

Have oil producers shot themselves in the foot, while at the same time stabbing the global economy in the back? It’d be quite a feat if it turns out to be the case, one of those historical oddities that when anyone might honestly look back on it from the future still hung in disbelief. Let’s start by reviewing just the facts. First up, yesterday the Federal Reserve published the November 2021 estimates for Industrial Production in the United States. As has been the...

Read More »Mexikanische Supermarktkette akzeptiert Bitcoin als Zahlungsmittel

Elektra gehört zu den größten Supermarktketten Mexikos. Auf Twitter gab der Besitzer dieser Kette nun bekannt, dass man in den Filialen für alle Produkte mit Bitcoin bezahlen könne, wodurch Elektra zur ersten Kette seiner Art in Mexiko wird. Bitcoin News: Mexikanische Supermarktkette akzeptiert Bitcoin als Zahlungsmittel Elektra ist nicht nur eine Supermarkt-, sondern auch eine Bankenkette. Elektras Besitzer gehört zu den reichsten Menschen des Landes und hat nach...

Read More »Omicron forces WEF to postpone flagship event again

The World Economic Forum has been forced to roll up its plans once again. Keystone / Jean-christophe Bott The Covid-19 pandemic has severely disrupted plans to hold the World Economic Forum’s (WEF) main annual meeting in Davos for a second year in a row. On Monday, WEF said it would defer the gathering of influential global business and political heads from the planned date in January to an undefined time in early summer. WEF organisers said the spread of the Omicron...

Read More »Why “Macro” Thinking in Economics Is Such a Problem

As someone who teaches public finance (better termed the economics of government), I can’t count how many times I have heard politicians promise “comprehensive” reforms to some major problem. But what such efforts actually produce is always different from what is promised, because such achievements are beyond government’s competence. The more comprehensive the “reforms” (say, measured by the number of pages in a bill), the more adverse incentives undermining social...

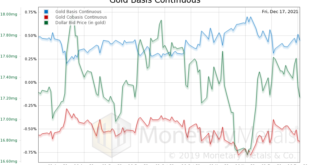

Read More »Inflation and Gold: What Gives?

Listen to the audio version of this article here! In the last Supply and Demand update, we discussed some different theories which attempt to explain what causes the gold and silver prices to move. We mentioned the: “…attempt to hold up a famous buyer of metal, while ignoring the thousands of not-famous sellers who sold the metal to said famous buyer.” Since then, Ireland has bought gold for the first time in over a decade. And predictably, most voices in the gold...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org