Tom Woods’ bestseller Meltdown placed the blame for the financial debacle of 2008–09 on the government’s counterfeiter, the Federal Reserve. It was the Fed’s policies that created the problems, although most economists and economic talking heads didn’t see it that way. The Fed’s loose monetary policies funded the meltdown and became the “elephant in the living room” most pundits couldn’t see. Woods was right, of course; putting a monopoly counterfeiter in charge of...

Read More »Sky High Inflation May Mean Another Hefty Social Security Increase in 2023

In 2022, Social Security recipients got a 5.9% cost-of-living adjustment (COLA). That was the largest increase in 40 years. The COLA coming in 2023 may be even bigger. Social Security calculates cost-of-living increases based on changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) from September to September each year. According to the Bureau of Labor Statistics, the CPI-W has increased 9.4% from March 2021 to March 2022. So,...

Read More »A Look at Switzerland’s Booming Digital Asset Ecosystem

In recent years, Switzerland’s blockchain and digital asset ecosystem has matured rapidly and grown into one of the world’s leading blockchain hubs, a position that’s asserted by its expanding workforce and a rising number of foreign companies setting up operations locally. A report by Home of Blockchain.swiss, a new public-private promotion initiative for the Swiss blockchain industry, looks at the state of the Swiss digital asset market, sharing findings from a...

Read More »Bored Apes Meta Projekt gehacked

Die Bored Apes gehören zu den bekanntesten NFTs. Ihre Popularität wird derzeit genutzt, um einen Immobilienmarkt aufzubauen, der sich im virtuellen Meta-Universum befindet. Der dazugehöroge Discord-Server wurde jedoch zum Ende der letzten Woche gehacked – ungefähr 380.000 US-Dollar gingen verloren. Crypto News: Bored Apes Meta Projekt gehackedOffenbar schickten die Betrüger Phishing-E-Mails an Mitglieder des Servers, auf die einige der Nutzer reinfielen. Die Betrüger...

Read More »Reserve Bank of Australia Surprises, but Aussie Struggles

Overview: The jump in US interest rates helped lift the greenback to new 20-year highs against the Japanese yen and pushed the euro back below $1.07. US equities saw initially strong gains pared and this set the tone for today’s activity. Most of the equity markets in the Asia Pacific region fell, but Japan and China. Europe’s Stoxx 600 is giving back more than half of yesterday’s 0.9% gain. US futures are off about 0.5%. The US 10-year yield is off a couple of...

Read More »May Payrolls (and more) Confirm Slowdown (and more)

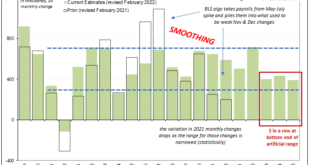

May 2022’s payroll estimates weren’t quite the level of downshift President Phillips had warned about, though that’s increasingly likely just a matter of time. In fact, despite the headline Establishment Survey monthly change being slightly better than expected, it and even more so the other employment data all still show an unmistakable slowdown in the labor market. What’s left open for argument and concern is now a matter of how much of a downside there might end...

Read More »Swiss government changes solar electricity rules

On 2 June 2022, Switzerland’s parliament adopted two motions to accelerate the adoption of solar panels. Photo by Los Muertos Crew on Pexels.com The first motion aimed to allow private individuals to earn better returns on the electricity they produce. Under the proposal they would be able to sell electricity to other individuals, municipalities and cantons without paying heavy network charges. 140 versus 48 voted in favour of this plan. A second change compels the...

Read More »Does Capitalism Make Us More Materialistic?

There was a time when the advocates of socialism argued that it would lead man to material abundance, whereas free-market capitalism would lead only to increasing misery and would ultimately collapse under its own internal stresses. You don’t hear that too much these days, and for good reason. A century of empirical evidence has shown the contrary—that the free market leads to increasing wealth and material freedom, while socialism leads us only to poverty, state...

Read More »Finland and Sweden in NATO: Disregarding the Benefits of Neutrality

Finland and Sweden’s recent decision to apply for North Atlantic Treaty Organization membership is a major win for the military alliance, but a far more dubious one for these two countries. NATO badly needs a success at this moment, since neither the economic war on Russia nor the conflict in Ukraine seems to be going the West’s way. Whether officially adding two more Nordic countries would have a real military advantage for NATO remains to be seen, but at least it...

Read More »“Pay-to-Play” for the Rest of Us

The more kafkaesque quagmires you’ve slogged through, the more you hope “pay-to-play for the rest of us” beomes ubiquitous. You know how “pay-to-play” works: contribute a couple of million dollars to key political players, and then get your tax break, subsidy, no-bid contract, etc., slipped into some nook or cranny of the legislative process that few (if any) will notice because the legislation is hundreds of pages long or a “gut and replace” magic wand was wielded...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org