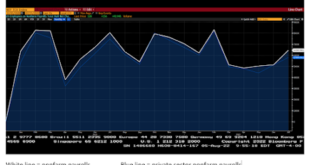

Are 55 and older workers propping up the U.S. economy? The data is rather persuasive that the answer is yes. The chart of U.S. employment ages 25 to 54 years of age and 55 and older reveals a startling change. There are now 20 million more 55+ employed than there were in 2000, an equivalent of the entire workforce of Spain. This unprecedented demographic / employment transition is worth a closer look. As the second chart shows, some of this increase is due to the...

Read More »It Is Time to Put the Red Flag to Red-Flag Laws

Nothing is certain except death and taxes, but antigunners exploiting tragedy to pass more gun control laws is close behind. On cue, the recent mass shootings in Buffalo, Uvalde, and Highland Park have brought demands for the typical disarmament stew of “assault weapon” and “high-capacity” magazine bans, licensing requirements, and universal background checks. Increasingly, red-flag laws or extreme risk protection orders (ERPOs) are being added to that list of...

Read More »Vitalik Buterin glaubt an Crypto-Zahlungen für den Mainstream

Immer mehr Anbieter ermöglichen Crypto-Zahlungen – vor allem online. Doch von einer Akzeptanz dieser Zahlungen des Mainstreams sind wir dennoch weit entfernt. Vielmehr sind Cryptocoins primär zu einem Investitions- und Spekulationsobjekt geworden. Ethereum News: Vitalik Buterin glaubt an Crypto-Zahlungen für den MainstreamVitalik Buterin jedoch glaubt an diese Akzeptanz und die damit verbundene Mass Adoption für die nahe Zukunft. Auf der Korean Blockchain Week 2022...

Read More »US Dollar Offered but Stretched Intraday

Overview: The US dollar is trading heavily against all the major currencies, led by the Norwegian krone and euro. Emerging market currencies are also firmer. However, risk-appetites seem subdued. Even though most large bourses in Asia Pacific advanced but Japan and Hong Kong, European markets are nursing small losses and US futures are little changed. Benchmark 10-year yields are firmer with European yields 3 bp firmer and Italy’s premium over Germany slightly...

Read More »Dog Days

Overview: The dog days of August for the Northern Hemisphere are here and the capital markets are relatively subdued. Equities are firmer. The notable exceptions in Asia was China, Hong Kong, and Taiwan. The MSCI Asia Pacific Index has advanced for the last three weeks. Europe’s Stoxx 600 slipped almost 0.6% last week and has recouped most of it today. US futures are steady to firmer. The US 10-year yield is struggling to stay above 2.8%, while European benchmarks...

Read More »CME Group to Launch Euro-Denominated Bitcoin and Ether Futures on August 29

CME Group, the world’s leading derivatives marketplace, announced it plans to further expand its cryptocurrency derivatives offering with the introduction of Bitcoin Euro and Ether Euro futures on August 29, pending regulatory review. Designed to match their U.S. dollar-denominated counterparts, Bitcoin Euro and Ether Euro futures contracts will be sized at five bitcoin and 50 ether per contract. These new contracts will be cash-settled, based on the CME CF...

Read More »CME Group to Launch Euro-Denominated Bitcoin and Ether Futures

CME Group, the world’s leading derivatives marketplace, announced it plans to further expand its cryptocurrency derivatives offering with the introduction of Bitcoin Euro and Ether Euro futures on August 29, pending regulatory review. Designed to match their U.S. dollar-denominated counterparts, Bitcoin Euro and Ether Euro futures contracts will be sized at five bitcoin and 50 ether per contract. These new contracts will be cash-settled, based on the CME CF...

Read More »Meta: Digital Collectibles to Showcase NFTs on Instagram

Starting this week on Instagram, Meta is testing digital collectibles with select US creators and collectors to share NFTs that they have created or bought. Meta/Instagram started with the international expansion to 100 countries in Africa, Asia-Pacific, the Middle East, and the Americas. Additionally, they now support wallet connections with the Coinbase Wallet and Dapper, as well as the ability to post digital collectibles minted on the Flow blockchain. In order...

Read More »Garet Garrett: Far Forward of the Trenches

Joseph Sobran discovered these Garet Garrett essays “one night, long ago, at the office of National Review, where I then worked.” As the flagship of modern conservatism, National Review supported the Cold War and the hot war then raging in Vietnam. “Two questions occurred to me,” Sobran writes. “One: ‘Why haven’t I heard of this man before?’ Two: ‘If he’s right, what am I doing here?” I discovered these essays at 16 in a Seattle bookstore that specialized in...

Read More »Inflation

(Traveling and unable to provide a technical overview this week.) Rising price pressures, stronger and more persistent than generally expected, has been the main challenge for consumers, businesses, and policymakers. It will stay top of mind in the week ahead as both the world's two largest economies, the US and China, report July consumer and producer prices. During the Great Depression, the central governments discovered their balance sheets, and budget deficits...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org