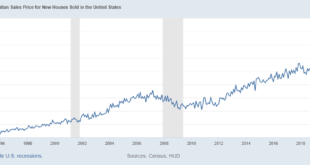

New home sales were reported for July as down nearly 13% to 511K, a number that is just about the average since 2010 (543k). But that doesn’t tell the whole story obviously. New home sales have fallen sharply since December of last year, down 39%. The drop from the peak in August 2020 is even more dramatic, down nearly 51%. Obviously, the fall this year is related to rising mortgage rates but that can’t be the reason sales have been falling for nearly two years....

Read More »Germany’s Nuclear Choice: Russian Energy Crisis Forces a Reckoning

“We are the makers of our own fate,” said Christian Lindner (FDP, Free Democratic Party), German federal minister of finance, in a TV interview not too long ago. This statement was made in the context of being asked if Vladimir Putin had had a hold over Germany, considering its rather dire energy situation, now, but especially going into winter. Torn between a decade-long reliance on cheap Russian gas on the one side and a sudden desperation to be energy independent...

Read More »Ep 39 – Tavi Costa: Breaking Down the Pressures on the Market

Tavi Costa of Crescat Capital joins Keith and Dickson on the Gold Exchange Podcast to talk about the current state of the market, investing in good times and bad, and what future indicators to watch. Connect with Tavi on Twitter: @TaviCosta Connect with Keith Weiner and Monetary Metals on Twitter: @RealKeithWeiner@Monetary_Metals [embedded content] Additional Resources Fed Zugzwang Germany Announcement Jerome Powell Nose Tweet Bloomberg Misery Index Zombie Company...

Read More »America’s Perpetual Foreign-Policy Crises

Ever since the federal government was converted from a limited-government republic to a national-security state after World War II, America has lived under a system of ongoing, never-ending, perpetual foreign-policy crises. That’s not a coincidence. The national-security establishment — i.e. the Pentagon, the CIA, and the NSA — need such crises to justify their continued existence and their ever-growing taxpayer-funded largess. An interesting aspect of this...

Read More »New Recession Worry Stalls Dollar Express but Doesn’t Derail It

Overview: A simply dreadful flash US PMI stopped the dollar’s four-day rally in its tracks. It followed news that the eurozone, Japan, and Australia’s composite PMIs are below the 50 boom/bust level. However, the dollar recovered, even if not fully as the market seemed unconvinced that the data could change Fed Chair Powell’s message at Jackson Hole on Friday. A consolidative tone is evident today. Asia Pacific equities were mixed. China and Hong Kong fell more than...

Read More »Concerns raised over looming energy shortage

Streetlights in Zurich © Keystone / Gaetan Bally Leading voices from business and politics have called on the Swiss government – and in particular economy minister Guy Parmelin – to do more about possible energy and gas shortages over the winter. The energy shortage is “imminent”, Roger Nordmann from the left-wing Social Democratic party told the SonntagsBlick. “The war in Ukraine is causing acute gas shortages. Half of the nuclear power plants in France are at a...

Read More »Swiss minister urges calm over energy shortage fears

Parmelin says every effort must be made to avoid imposing energy restrictions. ©keystone/peter Schneider The threat of energy shortages in Switzerland this winter should not be over-dramatised, Economics Minister Guy Parmelin has said in response to growing calls at the weekend for government action. A number of business groups and left-leaning political groups voiced concerns in last weekend’s newspapers, with some taking aim at the government for a perceived lack...

Read More »The Knockout Blow to Crypto

A New Type of Fighter Bonus The UFC has started paying fan bonuses to its fighters in Bitcoin. The UFC buys crypto at a fixed dollar amount and pays their fighters a bonus in cryptocurrency. As someone who loves the UFC and monetary economics, I wanted to offer an alternative solution to the UFC and its athletes. The Problems with Crypto This takedown of crypto will focus on the speculative aspect of cryptocurrencies. Crypto’s greatest draw is also its fatal flaw....

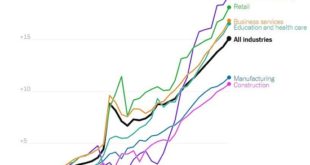

Read More »The Fed Can’t Stop Supply-Side Inflation

The Fed and other central banks have zero control of supply-driven inflation, period. America’s financial punditry is bewitched by four fatal fantasies: 1. Inflation is demand-driven. If the Federal Reserve (or other central banks) reduce demand with monetary tools like raising interest rates, inflation will cool. 2. Substitution of high-cost goods with lower-cost goods reduces inflation, and substitution is infinite: there’s always cheaper chicken if beef gets too...

Read More »Crypto-Mining-Farmen im Iran beschlagnahmt

Im Iran wurde in den letzten Tagen Equipment der Mining-Farmen beschlagnahmt. Offiziell heißt es, dass die iranische Regierung damit Blackouts verhindern wolle, die durch Strommangel verursacht werden. Crypto News: Crypto-Mining-Farmen im Iran beschlagnahmtInsgesamt berichtet die Regierung von 9.404 beschlagnahmten Mining-Geräten. Bei den Farmen handelt es sich jedoch vor allem um illegale Einrichtungen, die nicht offiziell gemeldet sind.Schon im letzten Jahr kam es...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org