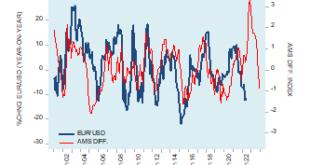

Overview: The poor eurozone PMI underscores likely recession and weighs on the single currency, which was sold to a new 20-year low. Rather than a "Turn Around Tuesday" a broadly consolidative session is unfolding. Asian and European equities are weaker, while US futures are positive but little changed. Benchmark 10-year bond yields are mostly firmer and the premium offered by Europe's periphery is edging higher. The US 10-year is little changed near 3.02%....

Read More »Developer invests CH170 million in new Swiss tourist resort

The region offers skiing in winter and mountain hiking in summer. © Keystone / Urs Flueeler The Andermatt Swiss Alps (ASA) company, majority owned by Egyptian financier Samih Sawiris, is to build a new 1,800-bed Alpine resort in the Sedrun region in southeast Switzerland. The complex in an undeveloped area of Dieni village will include 13 buildings, including several hotels, residential buildings, shops, restaurants and leisure facilities, the company said on Friday....

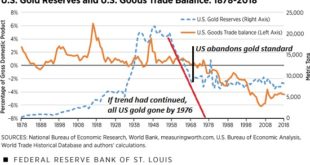

Read More »The Real Story of America Abandoning the Gold Standard

Even currencies maintaining convertibility to gold are still subject to bond yields, interest rates, trade and capital flows. It’s widely held that all of our financial woes are the result of abandoning the discipline of the gold standard in 1971. The premise here is that if the U.S. had maintained the gold standard, the excesses of the fiat currencies regime could not have arisen. The real story is the U.S. was hemorrhaging gold in the 1960s at such a rate that...

Read More »The Sphere of Economic Calculation

1. The Character of Monetary Entries Economic calculation can comprehend everything that is exchanged against money. The prices of goods and services are either historical data describing past events or anticipations of probable future events. Information about a past price conveys the knowledge that one or several acts of interpersonal exchange were effected according to this ratio. It does not convey directly any knowledge about future prices. We may often assume...

Read More »EUR/CHF forecast to 0.93 (Swiss National Bank to hike rates in September and December)

This via the folks at eFX. Danske forecast via eFX: “We expect the SNB to hike by 50bp again in September and December to curtail underlying inflation pressures bringing the policy rate to 0.75%. With the SNB broadly following the ECB, we see relative rates as an inferior driver for the cross,” Danske notes. “We continue to forecast the cross to move lower on the back of fundamentals and a tighter global investment environment. We thus lower our overall forecast...

Read More »Why we couldn’t be happier that gold is boring

We’re the first to admit that investing in gold can be pretty boring. Don’t get us wrong, when you first decide to buy gold then the newness of it is exciting, as you choose which gold bullion dealer to use then it is interesting and when you actually see the gold bars or coins appear in your account then it’s really exciting. But then what? There aren’t any major price moves, it’s not like you see any huge crashes or major leaps to keep you on your toes, not like...

Read More »Will the US Dollar Weaken against Other Currencies?

In the July 26 Financial Times article entitled “Is the Dollar about to Take a Turn?,” Barry Eichengreen writes that the US dollar has had a spectacular run, having risen more than 10 percent against other major currencies since the start of the year. According to Eichengreen, the key reason behind the spectacular strengthening in the US Dollar is that the Federal Reserve has been raising interest rates faster than other big central banks, drawing capital flows...

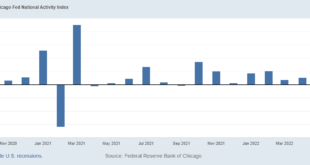

Read More »The Economy Improved In July

The Chicago Fed National Activity Index rose to 0.27 in July with all four categories of indicators rising. The 3 month average was unchanged at -0.09. That indicates growth is slightly below trend and is far from the recession threshold of -0.7. The index had been down for two consecutive months and both May and June were revised slightly lower. The data in August so far has been positive as well, particularly the production data with IP last week surprising to...

Read More »No Relief for the Euro or Sterling

Overview: The euro traded below parity for the second time this year and sterling extended last week’s 2.5% slide. While the dollar is higher against nearly all the emerging market currencies, it is more mixed against the majors. The European currencies have suffered the most, except the Norwegian krone. The dollar-bloc and yen are also slightly firmer. The week has begun off with a risk-off bias. Nearly all the large Asia Pacific equity markets were sold. Chinese...

Read More »Weekly Market Pulse: Same As It Ever Was

History never repeats itself. Man always does. Voltaire Mark Twain is credited with a similar saying, that history doesn’t repeat but it rhymes. Of course, there is scant evidence that Clemens said anything of the sort just as Voltaire may or may not have penned the quote above. But both men were much wittier than I – than most – so I’ll take them both as being representative if not genuine. I have been a professional investor for now over 30 years and I have seen...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org