Online trading platform Swissquote has launched a cryptocurrency exchange called SQX that aims to provide a more competitive and secure trading environment. Unlike other crypto exchanges, SQX says that it prides itself on being a centralised trading platform as it believes that currency markets function on the back of long-standing bilateral relationships. As such, Swissquote added that SQX’s new central order book, which sources and aggregates liquidity from...

Read More »Credit Suisse reassures investors over bank’s financial strength

Senior Credit Suisse executives spent the weekend reassuring large clients, counterparties and investors about the Swiss bank’s liquidity and capital position in response to concerns raised about its financial strength. Executives hit the phones after spreads on the bank’s credit default swaps, which offer protection against a company defaulting, rose sharply on Friday, indicating investor worries over its financial health. “The teams are actively engaging with...

Read More »University of Zurich and ETH Zurich Among World’s Best Universities for Blockchain Education

The University of Zurich and ETH Zurich ranked third and 27th respectively on CoinDesk’s latest annual best universities for blockchain rankings. The rankings were made from a shortlist of 240 institutions around the world, calculated based on their scholarly, industrial and pedagogical impact on blockchain. Metrics that were taken into account included the institutions’ blockchain research publications, courses, degrees, conferences, clubs and industry partnerships...

Read More »What Drove the Industrian Revolution in Britain? It Wasn’t Slavery

The link between the transatlantic slave trade and industrial growth in Britain is a recurring theme in public discussions. There is a widespread assumption that the profitability of the slave trade requires Britain to compensate the descendants of Africans, since slavery helped to enrich some institutions. It is true that the slave trade made profits, but its contribution to the economy was marginal. Technological change rather than the slave trade was the force...

Read More »Devil’s Advocates are Investors’ Best Friends

If those on the opposite side of the trade are viewed as threats rather than friends, it’s time to revise the analysis. Of the many self-generated dangers investors face, few are more dangerous than confirmation bias, the comfort we experience seeking out views that confirm our own positions and our resistance to studying opposing views. Confirmation bias is both self-evident and complex. We all understand the psychologically soothing feeling when others heartily...

Read More »Swiss electricity savings drive slow out of the blocks

Electricity consumption in Switzerland remained at normal levels last month despite a government appeal for households and industry to make savings. On August 31, ministers urged the population to voluntarily reduce consumption ahead of anticipated shortages this winter. Recommended measures included turning heating down and switching off lights. Both the Tages Anzeiger and Neue Zürcher Zeitung showed figures on Saturday that suggests this plea has so far fallen...

Read More »Weekly Market Pulse (VIDEO)

Are investors at the point of maximum pessimism? Alhambra CEO Joe Calhoun talks about a horrible 3rd quarter, sentiment, and where investors can look right now. [embedded content] [embedded content] Tags: Alhambra Research,Bonds,commodities,currencies,economy,Featured,Federal Reserve/Monetary Policy,Markets,newsletter,Real Estate,stocks

Read More »Weekly Market Pulse: Peak Pessimism?

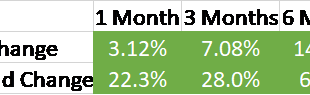

Goodbye and good riddance to the third quarter of 2022. That was one of the wildest 3 months I’ve experienced in my 40 years of trading and investing. The quarter started off great with the S&P 500 rising 14% from July 1 to August 16 but ended with a 17% swan dive into the end of the quarter. And we closed on the low of the year. The 10-year Treasury yield rose from 2.97% to 4% just a few days before the end of the quarter. The 3-7 year Treasury index – our...

Read More »Monday Blues

Overview: The markets begin October with some trepidation. Rumors continue to circulate about the health of a large European bank, cross currency swaps are elevated, suggest dollars are more difficult to access. The S&P 500 settled on new lows for the year at the end of last week. China and South Korea on closed for national holidays. Chinese market will not open until next week, and Hong Kong markets are closed tomorrow. While the Nikkei advanced, the other...

Read More »The strong Swiss franc – truth or myth?

The Swiss franc has hit an all-time high against the euro. Even though it trades at an unprecedented CHF0.95 to the euro, the strong franc no longer poses a threat to the Swiss economy. What has changed in the last ten years? More from this author On September 6, 2011, at 10am, the then president of the Swiss National Bank (SNB) Philipp Hildebrand made an important announcement to the media: “With immediate effect, the SNB will no longer tolerate a...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org