The Swiss franc has hit an all-time high against the euro. Even though it trades at an unprecedented CHF0.95 to the euro, the strong franc no longer poses a threat to the Swiss economy. What has changed in the last ten years? More from this author On September 6, 2011, at 10am, the then president of the Swiss National Bank (SNB) Philipp Hildebrand made an important announcement to the media: “With immediate effect, the SNB will no longer tolerate a euro-franc exchange rate below CHF1.20.” If the franc trades at less than CHF1.20, it will be too strong and inflict tremendous long-term damage to the Swiss economy. Times have changed. For many years, the euro-franc exchange rate has been below that benchmark, and the last time we checked, it was as low as

Topics:

Swissinfo considers the following as important: 1) SNB and CHF, 3.) Swissinfo Business and Economy, Business, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The Swiss franc has hit an all-time high against the euro. Even though it trades at an unprecedented CHF0.95 to the euro, the strong franc no longer poses a threat to the Swiss economy. What has changed in the last ten years?

On September 6, 2011, at 10am, the then president of the Swiss National Bank (SNB) Philipp Hildebrand made an important announcement to the media: “With immediate effect, the SNB will no longer tolerate a euro-franc exchange rate below CHF1.20.” If the franc trades at less than CHF1.20, it will be too strong and inflict tremendous long-term damage to the Swiss economy.

Times have changed. For many years, the euro-franc exchange rate has been below that benchmark, and the last time we checked, it was as low as CHF0.95 to the euro. Economists no longer seem worried about the damage this could do to the Swiss economy. How come?

Strong appreciation against the euroLet’s look back at the early 2010s. While the SNB’s minimum exchange rate was in force, the euro usually hovered around CHF1.20 and did not go much beyond it. This meant that the cost for a holiday in other European countries remained more or less the same for the Swiss, while people in the Eurozone did not see a price increase for popular export items such as Swiss watches. This changed when the minimum exchange rate was abolished in January 2015 and the euro-franc rate dropped to below CHF1.10. The Swiss finally got a better deal and could enjoy their city trips to Barcelona at a cheaper price. By the same token, people in Berlin, for example, had to dig deeper to buy a Swiss watch. These were the effects of the appreciation of the Swiss franc. Since September 2011, the Swiss franc has appreciated against the euro by around 20%. At first glance, the franc seems to be strong, but all that glitters is not gold. |

|

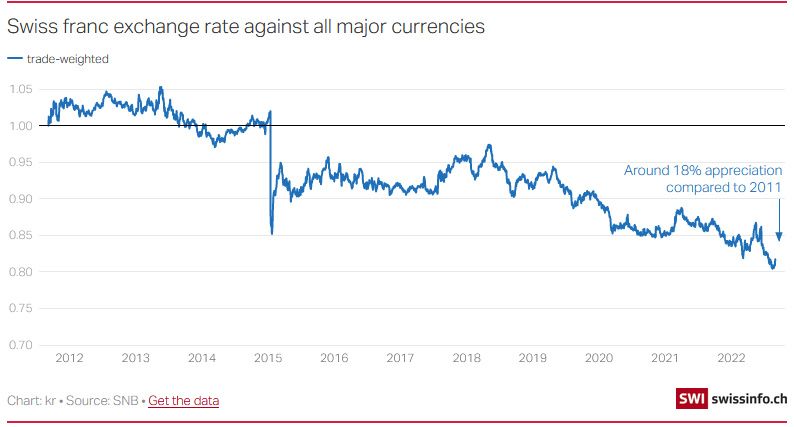

A basket of currenciesWe must bear in mind that Swiss watches are not just sold in the Eurozone, but all over the world. This means that the strength of the franc does not just depend on the euro-franc exchange rate but also on other currencies like the US dollar, for example. In the grand scheme of things, how strong is the franc when compared to all other important currencies? Economists can answer this question by calculating the so-called ‘trade-weighted’ rate. This is the rate we pay for a shopping basket that is not filled with the usual items such as spaghetti and eggs, but with various currencies such as the euro or the US dollar. In order to better understand the idea behind the trade-weighted exchange rate, let’s take the spaghetti and egg example a little further: if you want to cook spaghetti carbonara, it doesn’t matter how much you paid for the spaghetti and eggs individually. What matters is how much the dinner costs in total. The same logic applies to the trade-weighted rate. It does not matter to the Swiss economy whether the euro is weak or the US dollar is strong. What matters is how the rates of all foreign currencies develop which is exactly what the trade-weighted exchange rate measures. If you look at the development of the trade-weighted exchange rate, you will notice that the overall appreciation of the Swiss franc has been around 18% since September 2011. This is somewhat smaller than the franc’s appreciation against the euro but reinforces the myth that the Swiss currency is still going strong. |

|

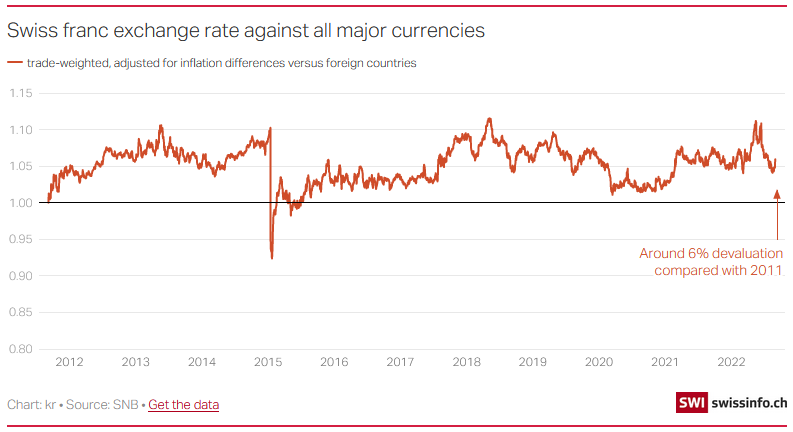

High inflation requires another correctionHowever, the story about the allegedly strong franc is not over yet. Apart from exchange rates, price levels abroad also determine how easy it is for Swiss companies to sell their products in other countries. At the best of times, prices abroad increase faster than in Switzerland, and this trend has been accelerated by the rising inflation rates in the Eurozone and the US which are several times as high as in Switzerland. This means that for Switzerland it does not really matter how high the trade-weighted exchange rate is. The high inflation rate abroad will make it increasingly easy for Switzerland to export its products. Economists can determine the effective value of the exchange rate by correcting the trade-weighted exchange rate for the difference in the inflation rates in Switzerland and abroad. This gives us a clear picture of how strong the franc really is, and the calculations show that overall, the franc is weaker than it was in 2011. So, it is not surprising that the debate around the strong Swiss franc has just about died down. Compared to before, it is rather weak and the story of the strong Swiss franc appears to be a myth. Fabio Canetg holds a PhD in monetary policy from the University of Bern and the Toulouse School of Economics. He is a MAS lecturer at the University of Bern. As a journalist, he works for SRF Arena, Republik Magazin and swissinfo.ch and hosts the monetary policy podcast “Geldcast”. |

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

Tags: Business,Featured,newsletter