Dixit Joshi ‘loves solving big, complex financial problems’, according to one acquaintance CS As daunting first weeks go, Dixit Joshi’s takes some beating. After a weekend of damaging speculation on social media about the impending collapse of Credit Suisse, Joshi started as the bank’s chief financial officer last Monday with its share price plumbing new lows and a gauge of default risk spiralling higher. The British-South Africa banker turned up to his first...

Read More »Fiat-Geld und die Corona- und Klima-Politik: Die real existierende Postmoderne

Was haben das unbegrenzte Gelddrucken und das Corona- und Klima-Regime gemeinsam? Offensichtlich ist Ersteres die Voraussetzung für Letztere: Ohne die Möglichkeit für Regierungen, willkürlich Geld aus dem Nichts zu schaffen, könnte es weder die Corona-Lockdowns noch die Wende hin zu ineffizienten und unzuverlässigen Energiequellen geben, weil dann die Menschen die wirtschaftlichen Folgen dieser Politik direkt im Portemonnaie spüren würden. Aber die Parallele geht...

Read More »Allen Mendenhall: Putting Humanness and Ethics Back Into Business Economics

We are living through a particularly bad moment in history for free markets and capitalism. Government, not business, is promoted as the solution to all problems. Young people have never known any other environment, and one of the consequences is the skepticism about capitalism that they learn in school, college, and university. One solution to this problem lies in better business education — shaping how young minds think about business by shedding light on the...

Read More »It’s Time to Tackle the Year-End Financial Checklist

Here we are again in the final quarter of the year when thoughts turn to Thanksgiving and Christmas and… reviewing your financial house. Oh, that’s not on your list? Well, let’s put it there because financial issues cannot be on automatic pilot. Things change and you need to keep current. Here are 16 items you need to review before the end of the year. Tax Loss Harvesting No one wants to pay more taxes than necessary (at least no one I know) and harvesting capital...

Read More »SNB’s Jordan: Central Bank Independence is crucial to fight inflation effectively

SNB Jordan is on the wires speaks in general terms: Central bank independence is crucial to fight inflation effectively central banks could face political pressures to slow down or postpone interest rate hikes to tackle inflation central banks more politically vulnerable as inflation rises Comments outline reasons why central banks in general need to remain independent. Will be on alert for any comments on monetary policy. [embedded content]...

Read More »Ethereum bis Dezember auf 2.000 US-Dollar prognostiziert

Das Jahr lief generell nicht gut für den Markt, doch besonders Ethereum ließ kräftig Federn. Fast drei Viertel seines Wertes hat der ETH in diesem Jahr verloren. Laut Analysten wird es jedoch zum Jahresende wieder nach oben gehen – 2.000 US-Dollar ist die konkrete Prognose für den Kurs. Ethereum News: Ethereum bis Dezember auf 2.000 US-Dollar prognostiziertDie Analysten gehen nicht nur von einem Dezember-Kurs bis auf 2.000 US-Dollar aus, sondern sprechen auch von...

Read More »Inflation, High Inflation, Hyperinflation

The word “inflation” is heard and read everywhere these days. However, since different people sometimes have very different understandings of inflation, here is a definition: Inflation is the sustained rise in the prices of goods across the board. This definition conveys that inflation means that the increase in prices of goods is not just a one-off but permanently; and that not just some goods prices go up, but all. How does inflation arise? The economists have two...

Read More »Bank of England Steps in to Buy Inflation-Linked Bonds for the First Time

Overview: The dollar continues to ride high. It reached its highest level against the yen since the recent intervention. The Canadian dollar has fallen to its lowest level in two-and-a-half years and the New Zealand dollar is approaching the 2020 extreme. The greenback is firmer against all the major currencies but the Swiss franc, and against nearly all the emerging market currencies today. Equities have been sold. Japan, South Korea, and Taiwan re-opened after...

Read More »Switzerland shares bank details with Nigeria for first time

Five additional countries, including Nigeria, now benefit from an automatic exchange of banking information with Switzerland, taking the total to over 100 for the first time. On Monday, the Swiss Federal Tax Administration revealed that it had provided details of around 3.4 million bank accounts held by foreigners (or those with a fiscal residence abroad) to their countries of origin or residence this year. In return, it had received information on banking...

Read More »Crypto and the Environment

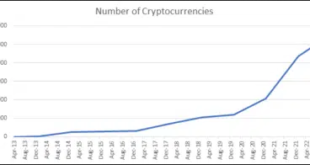

An intrusive intervention into the crypto market similar to what the EU has recently provided is not a sure promise of a Pareto efficient result. The cryptocurrency market has evolved at a rapid pace over the course of its short lifespan. With its community and users growing steadily. They offer the potential for new choices to be made in a field long dominated by government monopolies. They are a real financial alternative and might provide intense competition...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org