Many people understand politics and economics to be two different disciplines. I remember in graduate school more than two decades ago, many colleagues and professors operationally defined political economy as how politics, by which they meant the state, screws up economics. I spoke at the Fixed Income Leaders Summit earlier this week and teased that many seemed to think that politics comes from the ancient Greek “poly”...

Read More »With Daily Record Lows: Chart of German Bund Yields Since 1977

The German Bund chart is very important for us, because the Swiss franc is negatively correlated to German government bond yields. The lower Bund yields, the stronger the Swiss Franc. When European governments and the ECB are ready to pay higher interest rates, then CHF depreciates. 10-year Gilt yield, Close on 06/12 Whether it is due to rising, or receding, fears of Brexit, earlier today UK Gilts joined the global...

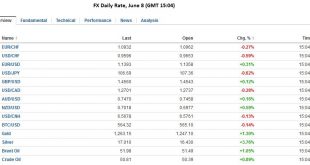

Read More »FX Daily, June 9: Greenback is Mostly Firmer, but Yen is Firmer Still

Swiss Franc The euro continues to weaken against the franc at 1.0922. But the speed of the descent has slowed. The dollar is stronger, in particular against EUR, CHF and AUD. The ECB bond buying program has finally started. For us the main reason of the weaker Euro was, however, the bad US jobs report, that will delay also a normalization of rates in the euro zone. via Dukascopy FX Rates The US dollar is posting...

Read More »Wealth Management Products: What Could Possibly Go Wrong?

A Convocation Of Gamblers The Wall Street Journal and BloombergView have just run articles on the shadow banking system in China. This has put me in a nostalgic mood. About 35 years ago when I was living in Japan, I made a side trip to Hong Kong. I took the hydrofoil to Macau one afternoon and the same service back early the next morning. On the morning trip, I am sure that I saw many of the same faces that I saw...

Read More »The Trump Risk: Will President Trump Trigger a Recession?

Home of the Brave? BALTIMORE – It is a bright summer day outside. A dry breeze sweeps down Cathedral Street and blows away the hot, humid air. It is hard for us to imagine that anything bad could happen today. But bad things do happen – even on nice days. The weather was fine when General Custer rode out to the Little Bighorn, too. Over the weekend, we worked at putting up a board fence – with half-round treated...

Read More »Need Safe havens: CHF or Gold?

A warped manifestation of the fear and greed trade-off that used to characterize investor behavior has developed, according to Bloomberg’s Richard Breslow. Asset managers are exhibiting the manic depressive drive to simultaneously throw caution to the wind, ignoring all risk metrics while plaintively bemoaning the lack of safe havens. S&P 500, 2016 EPS Expectations Fear and greed was a continuum, allowing for an...

Read More »Global Peace Index: Only 10 countries not at war (among them Switzerland)

Authored by Adam Withnall, originally posted at The Independent, The world is becoming a more dangerous place and there are now just 10 countries which can be considered completely free from conflict, according to authors of the 10th annual Global Peace Index. The worsening conflict in the Middle East, the lack of a solution to the refugee crisis and an increase in deaths from major terrorist incidents have all...

Read More »Greenback is Mostly Firmer, but Yen is Firmer Still

The US dollar is posting modest upticks against most of the European currencies and the Canadian and Australian dollars.However, it has fallen against the yen and taken out the recent low, leaving little between it and the May 3 low near JPY105.50. The New Zealand dollar though is the strongest of the major currencies; gaining 1.5% following the RBNZ’s decision to leave rates on hold, and signal of little urgency to...

Read More »FX Daily, June 8: Currencies Broadly Stable, but Greenback is Vulnerable

On Swiss Franc Once again the Swiss Franc appreciates both against EUR and USD.The euro topped at 1.1095 shortly before the US payroll data and has fallen to 1.0932. The dollar has fallen from 0.9947 to 0.9596. New CHF trade recommendation by Dennis Gartman: We wish to sell the EUR and to buy the Swiss franc this morning upon receipt of this commentary. As we write, the cross is trading 1.0972:1 and we shall risk...

Read More »Cool Video: Bloomberg Television–All about the Periphery

Click to see the video. I am in Boston to attend the Fixed Income Leaders Summit and was invited to join Alix Steel, Joe Weisenthal, and Scarlet Fu on Bloomberg TV. We talked about the peripheral in Europe, especially Portugal, Italy and Spain. Each has a pressing issue. In Portugal, yields have not fallen as much as in other peripheral countries. In Italy, they are belatedly addressing the recapitalization of...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org