See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Don’t be a Spruiker On 18 September we said, “the market is in the grips of a mini silver mania (we would not dare say bubble, at least not without trigger warnings).” Since then, we have warned every week that the fundamentals of silver were lousy. Last week we said, “Buying silver right now—at least if you’re buying it...

Read More »USA 2017-2020: An Ungovernable Nation?

The only way to govern successfully is to actually solve the underlying systemic problems, but doing that requires overthrowing a corrupt, self-serving elite. Regardless of who wins the presidency, a much larger question looms: will the U.S. be ungovernable 2017-2020? There are multiple sources of the question. One is of course the remarkable unpopularity of the two candidates for the presidency. For all the reasons...

Read More »Swiss real and minimum wages increase by 0.4% and 0.7% respectively

Swiss social partners signing the collective labour agreements (CLA) have agreed a nominal rise in real wages estimated at 0.4% for 2016, of which 0.2% is to be awarded collectively and 0.2% at individual level. Minimum wages were increased by 0.7%. The graph shows nominal wages since 1993. Changes in Swiss Nominal and Minimum WagesChanges in Swiss Nominal and Minimum Wages - Click to enlarge Download this press...

Read More »Emerging Markets: Week Ahead Preview

Stock Markets Despite the weaker than expected US jobs report, the dollar remains firm and EM is ending the week on a soft note. The main culprit was higher US rates, with the 2-year yield moving up to 0.85% and is the highest since early June. Concerns about Brexit impact and as well the health of European banks remain ongoing and could weigh on risk sentiment this coming week. Lastly, oil may come under more...

Read More »FX Weekly Preview: The Week Ahead: It’s Not about the Data

High frequency economic reports will be not be among the key drivers of the capital markets in the week ahead. The light schedule, consisting mostly of industrial production in Europe, inflation for Scandinavia, and US retail sales, will have minimal impact on rate expectations. A November rate Fed move was never very likely. The September employment report needed to be amazingly strong to boost the chances, and it was...

Read More »Great Graphic: US-German 2-Yr Differential and the Euro

Summary: The US premium over Germany is at its widest since 2006. This is despite a small reduction in odds of a hike in December. There are many forces are work, but over time, the widening differential will likely give the dollar better traction. This Great Graphic from Bloomberg shows two time series. The white line is the spread between the German two-year interest rate and the US two-year yield. The...

Read More »Do our money managers really believe this will end well?

Central banks are currently creating the mother of all bubbles. To my view it was caused by masses of cheap labor in China that entered the global economy in the early 1990s.This reduced inflation and interest rates, while Chinese productivity continously improved, in particular when rural workers came into the cities.The mother of all bubbles will pop at the latest, when Chinese wages approach Western levels....

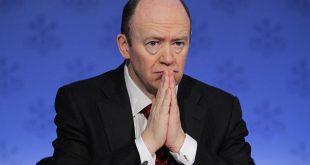

Read More »Deutsche Bank CEO Returns Home Empty-Handed After Failing To Reach ‘Deal’ With DOJ: Bild

Following the seemingly endless procession of short-squeeze-fueling trial balloons last week – from settlement rumors to German blue-chip bailouts to Qatari investors – Germany’s Bild newspaper confirms the rumors that sparked weakness on Friday: Deutsche bank CEO John Cryan has failed to reach an agreement with the US Justice Department. John Cryan - Click to enlarge Having soared over 25% off the briefly...

Read More »Swiss Franc Net Shorts Getting Reduced

Swiss Franc Last week SNB Q3 window cleaning that led to a big CHF net short position. This week this changed again. Both longs and shorts on CHF increased, but the net short position fell. During the CFTC’s Commitment of Traders week ending October 4, speculators took on risk. Of the sixteen gross currency positions we track, speculators added to their exposure in all but five. Bulls and bears saw...

Read More »Emerging Markets: What has Changed

Summary China reported lower than expected September reserve figures. Polish central bank Governor Glapinski adjusted the forward guidance. Brazil will open up development of its so-called pre-salt oil fields to foreign companies. Colombia’s referendum on the FARC peace agreement failed by a razor-thin 50.2% to 49.8% margin. In the EM equity space as measured by MSCI, Brazil (+5.3%), Czech Republic (+4.4%), and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org