The U.S. Department of Treasury has just published its semi-annual report on International Economic and Exchange Rate Policies. It comes at a time when the US Administration remains deeply concerned by the significant trade imbalances in the global economy. The report only focuses on the US’s 12 largest trading partners, which collectively account for more than 70% of the US’s trade in goods. Although Switzerland is currently only the United States’ 15th largest trading partner (it used to be among the 12 largest), it still appears on the US Treasury semi-annual report. The main news was the inclusion of India on the department’s monitoring list, together with five other countries (China, Japan, Korea, and Germany,

Topics:

Nadia Gharbi considers the following as important: 2) Swiss and European Macro, Featured, Macroview, newslettersent

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

The U.S. Department of Treasury has just published its semi-annual report on International Economic and Exchange Rate Policies. It comes at a time when the US Administration remains deeply concerned by the significant trade imbalances in the global economy. The report only focuses on the US’s 12 largest trading partners, which collectively account for more than 70% of the US’s trade in goods. Although Switzerland is currently only the United States’ 15th largest trading partner (it used to be among the 12 largest), it still appears on the US Treasury semi-annual report. The main news was the inclusion of India on the department’s monitoring list, together with five other countries (China, Japan, Korea, and Germany, as well as Switzerland).

| The Treasury has established three criteria for a country to be deemed a currency manipulator, namely: (1) a bilateral trade surplus of over USD 20 billion with the US; (2) a current account surplus larger than 3.0% of GDP; and (3) persistent, one-sided intervention including net purchases of foreign currency, conducted repeatedly, totalling in excess of 2% of an economy’s GDP over a 12-month period. Among the countries on the latest monitoring list, no country met all three criteria during the reporting period.

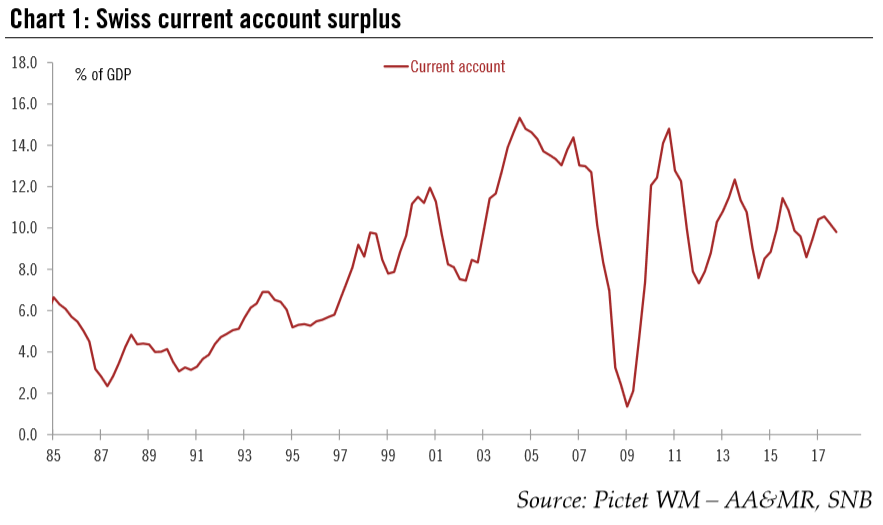

Switzerland meets two of the three conditions established by the US Treasury. The country has a current account larger than 3.0% of GDP (see Chart 1) and interventions in the foreign exchange market exceed 2% of GDP over a 12-month period. As we mentioned in our previous Flash Note, persistent current account surpluses in Switzerland are nothing new; the country has been running a surplus since the 1980s. |

Swiss Current Account Surplus, 1985 - 2018 |

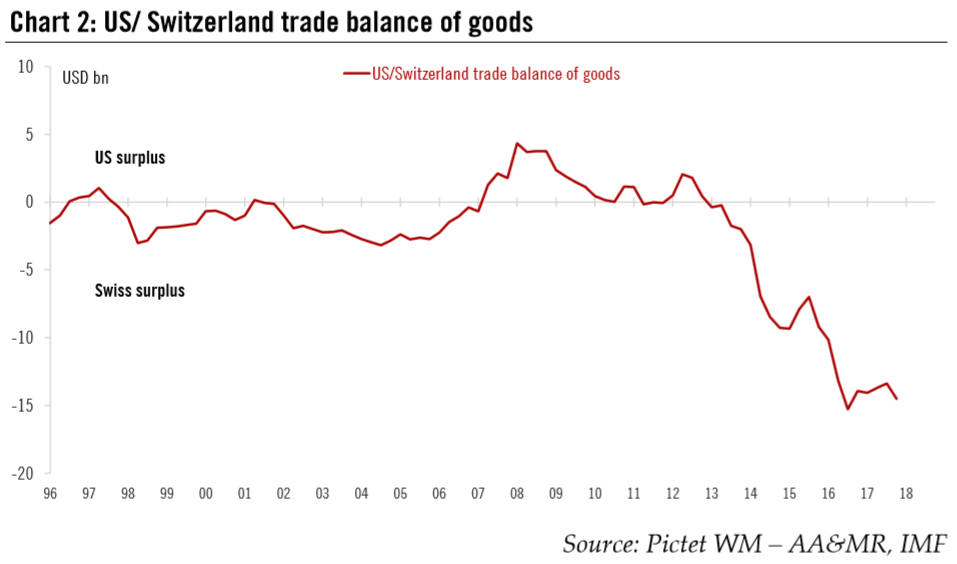

| Switzerland does not meet the third criterion to be deemed a currency manipulator, ie. a large trade surplus with the US. Switzerland has an USD14.5 billion trade surplus with the US (according to the latest data). The Swiss trade surplus with the US has been growing significantly since 2014 (see Chart 2). The growth in the surplus might appear surprising when one thinks that during the same period the Swiss franc has appreciated against the dollar. One explanation can be found in what is traded. In particular, Switzerland’s chemical and pharmaceutical exports have proved relatively insensitive to currency fluctuations. |

US/Switzerland Trade Balance of Goods, 1986 - 2018 |

Conciliatory view on Switzerland

In the semi-annual report, the US Treasury encouraged Switzerland to “adjust macroeconomic policies to more forcefully support domestic economy given that economic activity remains subdued and both trade and current account surpluses are very large”. The Treasury also encourages the “Swiss monetary authorities to publish all intervention data on a higher frequency basis”. In this regard, it is worth noting that after its massive interventions in the FX market in previous years, the Swiss National Bank (SNB) seems not to have intervened in the FX market so far this year based on the weekly variation of deposits. If this trend continues, the US Treasury’s third criteria to be deemed a currency manipulator (“a persistent, one-sided intervention including net purchases of foreign currency, conducted repeatedly, totalling in excess of 2% of an economy’s GDP over a 12-month period”) might not be fulfilled by Switzerland when the next report comes out in October.

Overall, while Switzerland fulfils two of the three criteria for being considered a currency manipulator, the US Treasury seems again to have a relatively conciliatory view of Switzerland. In any case, given the small size of Switzerland’s economy, its trade and current account surplus is relatively insignificant compared to those of China and Germany. Switzerland is unlikely to become the main target of US Trump administration trade manoeuvres.

Tags: Featured,Macroview,newslettersent