A “Typical” Correction? A Narrative Fail May Be in Store Obviously, assorted crash analogs have by now gone out of the window – we already noted that the market was late if it was to continue to mimic them, as the decline would have had to accelerate in the last week of March to remain in compliance with the “official time table”. Of course crashes are always very low probability events – but there are occasions when...

Read More »Weakening franc approaches symbolic mark

The SNB conducts a difficult balancing act to stabilise the national economy. (Keystone) - Click to enlarge As the Swiss franc weakens towards the threshold CHF1.20 exchange rate, the likelihood remains slim that Switzerland’s central bank will alter monetary policy any time soon. On Thursday morning a euro cost CHF1.198 francs. In February, the price of a single euro fell to under CHF1.150. The greater the...

Read More »Europe’s most expensive hotels in Geneva, Paris and Zurich

Across the road from Lake Geneva, sits Geneva’s and the world’s most expensive hotel suite. The Hotel President Wilson’s Royal Penthouse Suite is reported to cost $83,500 per night – the price is not listed on the hotel’s website but costs this much according to CNN. © Tacettin Ulas | Dreamstime.com - Click to enlarge For most of those planning to visit Geneva, this price is, thankfully, an outlier. According to a...

Read More »FX Daily, April 20: The Greenback is Alive

Swiss Franc The Euro has fallen by 0.24% to 1.1961 CHF. EUR/CHF and USD/CHF, April 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is set to finish the week on a firm note. It reflects rising US yields, where the 10-year is above 2.90% for the first time since February and the widening two-year different between the US and Germany, which is holding just...

Read More »Volatile Week Sees Oil and Palladium Surge Over 8%, Gold and Silver Marginally Higher and Stocks Gain

– Gold & silver eke out small gains; palladium surges 8% and platinum 2% – Oil (WTI) surges over 8% to over $66.90/bbl; supply disruption risk – U.S. dollar and Treasuries fall; geopolitical, trade war and fiscal concerns– Stocks rally and shrug off trade war, macro and geo-political risks – Bitcoin, major cryptos (Ethereum, Ripple etc) rise sharply– Russia-US tensions high: Trump warns attack ‘could be very soon or...

Read More »Bi-Weekly Economic Review

[embedded content] Related posts: Global Asset Allocation Update: The Certainty of Uncertainty Why Trade Wars Ignite and Why They’re Spreading The Genie’s Out of the Bottle: Eight Defining Trends Are Reversing Bi-Weekly Economic Review: Investing Is Not A Game of Perfect US-China Trade War Escalates As Further Measures Are Taken Less Retail Jobs,...

Read More »Sika stand-off with family heirs continues unabated

Urs Burkard, representing the family heirs, appeals to the AGM during an address. (Keystone) - Click to enlarge During another stormy annual general meeting, the majority stakeholders of Swiss chemical manufacturer Sika were once again controversially denied the chance to vote in a new chairman who would support their plans to sell the company to a French rival. At Tuesday’s AGM, the family heirs of Sika’s...

Read More »FX Daily, April 19: Markets Calm But Lack Immediate Focus

Swiss Franc The Euro has fallen by 0.11% to 1.1968 CHF. EUR/CHF and USD/CHF, April 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates A light news stream and less trade rhetoric lend the equity markets a positive impulse amid a strong US earnings season while leaving the dollar narrowly mixed. The MSCI Asia Pacific Index rose 0.5% and is up 1% for the week with one...

Read More »Flight of the Bricks – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. The Lighthouse Moves Picture, if you will, a brick slowly falling off a cliff. The brick is printed with green ink, and engraved on it are the words “Federal Reserve Note” (FRN). A camera is mounted to the brick. The camera shows lots of things moving up. The cliff face is whizzing upwards at a blur. A black painted brick...

Read More »China’s Exports Are Interesting, But It’s Their Imports Where Reflation Lives or Dies

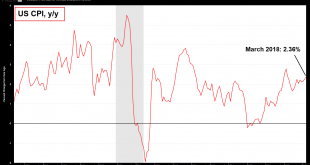

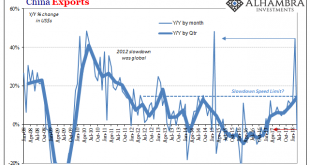

Last month Chinese trade statistics left us with several key questions. Export growth was a clear outlier, with outbound trade rising nearly 45% year-over-year in February 2018. There were the usual Golden Week distortions to consider, made more disruptive by the timing of it this year as different from last year. And then we have to consider possible effects of tariffs and restrictions at the start of what is called a...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org