A boost to investment and net exports from the tailwind of strong external demand, together with faster expansion of household spending owing to rising employment, are forecast to lift GDP growth to around 2¼ percent in 2018, said the IMF in a statement referring to Switzerland issued on 26 March 2018. © Tibor Ritter | Dreamstime.com - Click to enlarge On the downside the IMF said: rising international trade tensions...

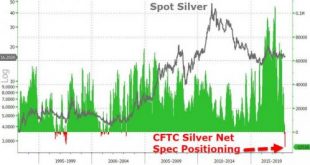

Read More »Silver Futures Report and JP Morgan Record Silver Bullion Holding Is Extremely Bullish

– Silver Futures Report, JP Morgan Record Silver Bullion Holding Is Extremely Bullish– JP Morgan Continues Adding To Massive Silver Bullion Holdings (see chart)– Silver Speculators Go Short – Which Is Extremely Bullish– Stunning Silver COT Report: One For the Ages (see chart) The silver futures Commitment of Traders (COT) report released last Friday was extremely positive and has most silver analysts calling for higher...

Read More »Slaves to Government Debt Paper

Seeing Things for What They Are Picture, if you will, a group of slaves owned by a cruel man. Most of them are content, but one says to the others, “I will defy the Master”. While his statement would superficially appear to yearn towards freedom, it does not. It betrays that this slave, just like the others, thinks of the man who beats them as their “Master” (note the capital M). This slave does not seek freedom, but...

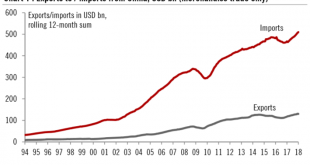

Read More »Impact of recent tariffs on US and China’s GDP should be limited for now

The Trump Administration last week announced tariffs of 25% on USD 60bn worth of imports from China (out of USD506bn of total Chinese merchandise imports). The list of products targeted, still has to be thrashed out. The official aim is to sanction China for alleged theft of US firms’ intellectual property; the US Trade Representative (USTR) estimates the damage amounts to USD 50bn. But President Trump also sees the...

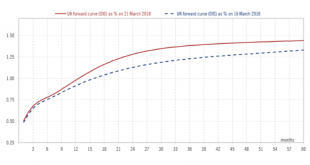

Read More »British pound – Smoother transition, stronger sterling

Recent positive developments in the United Kingdom (UK), namely the transitional deal reached between the UK and the European Union (EU) on 20 March and the strong job market report on 21 March, call for a more positive short-term outlook for the sterling than previously thought. We therefore revise our projections upward for the sterling on the entire time horizon. Our new projection for the GBP/USD rate in the next 12...

Read More »FX Daily, March 28: Three Developments Shaping Month-End

Swiss Franc The Euro has risen by 0.34% to 1.1779 CHF. EUR/CHF and USD/CHF, March 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Today may be the last day of full liquidity until next Tuesday, after the Easter holidays. We identify three developments that are characterizing the end of the month, quarter, and for some countries and companies, the fiscal year. Equity...

Read More »Bi-Weekly Economic Review: Embrace The Uncertainty

There’s something happening here What it is ain’t exactly clear There’s a man with a gun over there Telling me I got to beware I think it’s time we stop, children, what’s that sound Everybody look what’s going down There’s battle lines being drawn Nobody’s right if everybody’s wrong Young people speaking their minds Getting so much resistance from behind It’s time we stop, hey, what’s that sound Everybody look what’s...

Read More »Maker of the Sniper’s Choice, makes the news – but what is the Swiss company RUAG?

The Swiss company RUAG made the news last week when investigators were called in to look at information relating to the sale of ammunition. But what is this company? RUAG Ammotec stand at Berlin Airshow 2016 © Sergey Kohl _ Dreamstime.com - Click to enlarge According to RTS, the investigation revealed contracts for the sale of ammunition to Russia that had not been properly declared, RUAG triggered the investigation...

Read More »Swiss electricity getting cleaner, says energy report

A traquil view of the Loentsch power plant on Lake Kloentaler in canton Glarus. (Keystone/Roland Schuler) - Click to enlarge The electricity consumed in Switzerland is ever greener, according to government statistics: some 62% comes from renewable sources, while nuclear has fallen to 17%. The figures (in French/German)external link were released on Monday by the Federal Office of Energy, which gathers each...

Read More »London House Prices Falling Sharply – UK’s Much Needed Wake-Up Call

– London house prices falling at fastest pace since 2009 – Values fell by 2.6% in year through January – London house prices likely to be weakest in UK over next five years – Inflated prices make London property more exposed to economic and political shocks – Worries over house prices are having a knock-on effect in wider economy– Physical gold to act as much needed hedge against falling property prices A new study by...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org