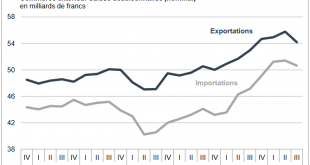

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade...

Read More »Builders strike in Ticino over worsening work conditions

Construction workers meeting before a rally in Bellinzona, canton Ticino. Some 3,000 construction workers staged a strike in southern Switzerland on Monday to protest changes in the industry, including disputes around the retirement age of 60. Further action is planned in Geneva on Tuesday. The strikes in canton Ticino were jointly called by the Unia, Syna, and OCST trade unions, who claimed that business leaders were...

Read More »Brexit: Five FAQs

Q. The UK voted in s referendum to leave the EU in June 2016. It will happen at the end of March 2019. What is the status of the negotiations? A: It had been hoped that the two sides would be close enough to allow a special summit to be called next month to finalize an agreement. This seems a bit premature, but an agreement still seems likely shortly. There are two stumbling blocks. The first is the Irish border. The...

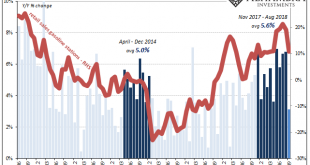

Read More »Just The One More Boom Month For IP

The calendar last month hadn’t yet run out on US Industrial Production as it had for US Retail Sales. The hurricane interruption of 2017 for industry unlike consumer spending extended into last September. Therefore, the base comparison for 2018 is against that artificial low. As such, US IP rose by 5.1% year-over-year last month. That’s the largest gain since 2010. While that may be, over the last five months American...

Read More »In surprise move, Central Bank of Hungary announces 10-fold jump in its gold reserves

In one of the most profound developments in the central bank gold market for a long time, the Hungarian National Bank, Hungary’s central bank, has just announced a 10 fold jump in its monetary gold holdings. The central bank, known as Magyar Nemzeti Bank (MNB) in Hungarian, made the announcement in Budapest, Hungary’s capital. The details of Hungary’s dramatic new gold purchase are as follows: Before this month,...

Read More »FX Daily, October 17: Greenback is Little Changed While Stocks Recover

Swiss Franc The Euro has fallen by 0.13% at 1.1449 EUR/CHF and USD/CHF, October 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Led by a dramatic recovery in US stocks, global equities are moving higher today. Before last week, decline, the US stock market lacked breadth, but not only did the S&P 500 and NASDAQ post their biggest advance in several...

Read More »Business group pushes for more streamlined farming sector

The plans foresee continued government subsidies to ensure animals’ well-being. The main Swiss business federation has released its recommendations for the government’s sensitive reforms of the agriculture sector. Farmers’ groups reacted with cautious approval. Economiesuisseexternal link gave its appraisal of the government’s 2022 agricultural reform plans on Monday, an appraisal that mostly centred around the...

Read More »Great Graphic: What is Happening to Global Equities?

The decline in the global equity market is the most serious since the February and March spill. In this Great Graphic, the white line is the S&P 500. With the setback, it is up a little more than 8% for the year. It managed to recover fully from the sell-off earlier in the year. The fuchsia line is the MSCI World Index of developed countries. It is up 1.25% year-to-date, and it never managed to take out the high set...

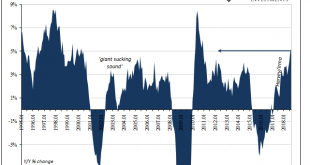

Read More »Now Back To Our Regularly Scheduled Economy

The clock really was ticking on this so-called economic boom. A product in many economic accounts of Keynesian-type fantasy, the destructive effects of last year’s hurricanes in sharp contrast to this year’s (which haven’t yet registered a direct hit on a major metropolitan area or areas, as was the case with Harvey and Irma) meant both a temporary rebound birthed by rebuilding as well as an expiration date for those...

Read More »Is the Canary in the Gold Mine Coming to Life Again?

A Chirp from the Deep Level Mines Back in late 2015 and early 2016, we wrote about a leading indicator for gold stocks, namely the sub-sector of marginal – and hence highly leveraged to the gold price – South African gold stocks. Our example du jour at the time was Harmony Gold (HMY) (see “Marginal Producer Takes Off” and “The Canary in the Gold Mine” for the details). Mining engineer equipped with bio-sensor ...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org