One in four Swiss Airline flights were delayed by about 15 minutes over the summer months. (Keystone) The Swiss International Airlines is among the worst victims of a shortage of air traffic controllers in Europe. About 34% of all Swiss flights are delayed because of issues with air navigation safety or at the airport, the SonntagsZeitung newspaper reports quoting data from Eurocontrol.external link Only two other...

Read More »FX Weekly Preview: Forces of Movement

There are three broad forces of movement in the week ahead: the equity market performance, political developments, and economic data. United States It was a tumultuous week for equities, and there was not clear or obvious trigger. With US bond yields and equities trending higher this year, there does not seem to a reason why it ended last week. Similarly, the recovery before the weekend, which lifted the S&P 500...

Read More »How Many Households Qualify as Middle Class?

By the standards of previous generations, the middle class has been stripmined of income, assets and purchasing power. What does it take to be middle class nowadays? Defining the middle class is a parlor game, with most of the punditry referring to income brackets as the defining factor. People tend to self-report that they belong to the middle class based on income, but income is not the key metric: 12 other factors...

Read More »Special Edition: Markets Under Pressure (VIDEO)

[embedded content] What does Alhambra Investments think about the 1300 point drop in the Dow Jones Average this week? Alhambra CEO Joe Calhoun has some thoughts. Related posts: Cool Video: Bloomberg Clip from Discussion on Emerging Markets Cool Video: Emerging Markets Continue to Sell-Off FX Daily, August 13: Turkey Drives Risk-Off, but Pressure...

Read More »Over 27percent of Swiss workers are stressed

When it comes to stress, gender plays less of a role than the number of working hours, found the Job Stress Index. (racorn / 123rf.com) Workplace stress in Switzerland is on the rise, particularly among younger workers – who often show up feeling unwell. The consequences are costly. The “Job Stress Index” – published by Health Promotion Switzerlandexternal link on the eve of World Mental Health Dayexternal link – has...

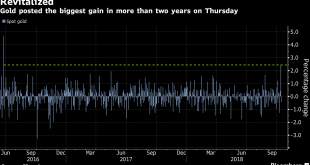

Read More »Gold’s Best Day In 2 Years Sees 2.5 Percent Gain As Global Stocks Sell Off – This Week’s Golden Nuggets

Gold’s Best Day In 2 Years Sees 2.5 Percent Gain As Global Stocks Sell Off – This Week’s Golden Nuggets News, Commentary, Charts and Videos You May Have Missed Here is our Friday digest of the important news, commentary, charts and videos we were informed by this week. Market jitters and volatility have returned this week and the sell-off in US government bonds led to sharp falls on Wall Street centered on the very...

Read More »Swiss Public Broadcaster to Shed Fewer Jobs than Expected

The Zurich studios and headquarters of German-language public television, which radio journalists will also move into. (swissinfo.ch) The Swiss Broadcasting Corporation (SBC) will shed fewer jobs than initially stated as it embarks on a four-year CHF100 million ($100 million) cost-cutting programme. Some 200 jobs are slated to go instead of the 250 announced in June. The new figure was announced following a period of...

Read More »The Gold Standard: Protector of Individual Liberty and Economic Prosperity

A Piece of Paper Alone Cannot Secure Liberty The idea of a constitution and/or written legislation to secure individual rights so beloved by conservatives and among many libertarians has proven to be a myth. The US Constitution and all those that have been written and ratified in its wake throughout the world have done little to protect individual liberties or keep a check on State largesse. Sound money vs. a piece of...

Read More »FX Daily, October 12: Market Fever is Burning Itself Out Ahead of the Weekend

Swiss Franc The Euro has fallen by 0.16% at 1.145 EUR/CHF and USD/CHF, October 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Equity markets are stabilizing today as Asian and European markets shrug off the failure to get traction in the US yesterday. As everything and nothing was behind the dramatic sell-off in recent days, the same could be said about today’s...

Read More »Swiss Divorce Rates Continue to Climb

By 2017, 40.5% of those married in 1987 were divorced, compared to 33.2% of those married in 1977 and 24.7% of those married in 1967. ©-Bacho12345-_-Dreamstime.com_ - Click to enlarge Divorce in Switzerland starts early. 9.4% of those married in 1987 were divorced after five years, as were 8.1% of those married in 1977 and 4.8% of those who tied the knot in 1967. However, rates of divorce among the more recently...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org