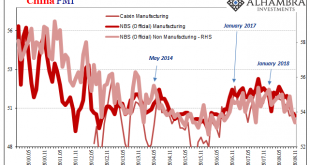

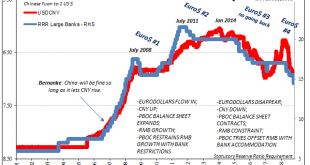

By the time things got really bad, China’s economy had already been slowing for a long time. The currency spun out of control in August 2015, and then by November the Chinese central bank was in desperation mode. The PBOC had begun to peg SHIBOR because despite so much monetary “stimulus” in rate cuts and a lower RRR banks were hoarding RMB liquidity. Late 2015 was not a fun time in China. The idea of economic...

Read More »Monthly Macro Monitor – November 2018

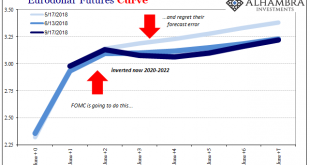

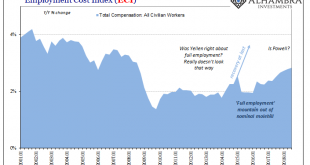

Is the Fed’s monetary tightening about over? Maybe, maybe not but there does seem to be some disagreement between Jerome Powell and his Vice Chair, Richard Clarida. Powell said just a little over a month ago that the Fed Funds rate was still “a long way from neutral” and that the Fed may ultimately need to go past neutral. Clarida last week said the FF rate was close to neutral and that future hikes should be “data...

Read More »The Direction Is (Globally) Clear

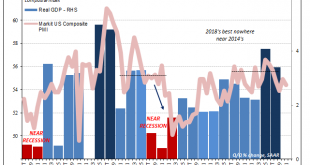

It is definitely one period that they got wrong. Still, IHS Markit’s Composite PMI for the US economy has been one of the better forward-looking indicators around. Tying to real GDP, this blend of manufacturing and services sentiment has predicted the general economic trend in the United States pretty closely. The latter half of 2015 was the big exception. For November 2015, the composite index jumped to 56.1 from 55.0...

Read More »Eurodollar Futures: Powell May Figure It Out Sooner, He Won’t Have Any Other Choice

For Janet Yellen, during her somewhat brief single term she never made the same kind of effort as Ben Bernanke had. Her immediate predecessor, Bernanke, wanted to make the Federal Reserve into what he saw as the 21st century central bank icon. Monetary policy wouldn’t operate on the basis of secrecy and ambiguity. Transparency became far more than a buzzword. Way back in 2012, under Bernanke’s direction officials would...

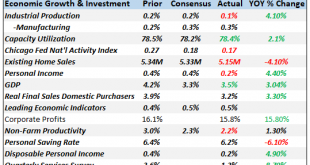

Read More »Retail Sales Marked By Revisions

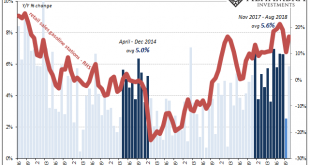

Retail sales rebounded 0.8% in October 2018 from September 2018, but it’s the downward revisions to the prior months that are cause for attention. The estimates for particularly September were moved sharply lower. Total retail sales two months ago had been figured last month at $485.8 billion (unadjusted) originally, but are now believed to have been just $483.0 billion. The difference takes the growth rate underneath...

Read More »China’s Pooh Lesson

It’s one of those “nothing to see here” moments for Economists trying not to appreciate what’s really going on in China therefore the global economy. The slump in China’s automotive sector dragged on through October, with year-over-year sales down for the fourth straight month.Auto sales last month were off 12% from a year earlier to 2.38 million, the government-backed China Association of Automobile Manufacturers said...

Read More »Harmful Modern Myths And Legends

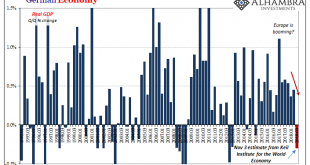

Loreley Rock near Sankt Goarshausen sits at a narrow curve on the Rhine River in Germany. The shape of the bluff produces a faint echo in the wind, supposedly the last whispers of a beautiful maiden who threw herself from it in despair once spurned by her paramour. She was transformed into a siren, legend says, a tantalizing wail which cries out and lures fishermen and tradesmen on the great river to their death. While...

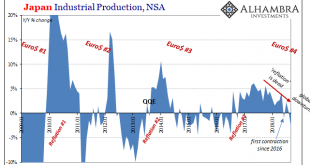

Read More »China Now Japan; China and Japan

Trade war stuff didn’t really hit the tape until several months into 2018. There were some noises about it back in January, but there was also a prominent liquidation in global markets in the same month. If the world’s economy hit a wall in that particular month, which is the more likely candidate for blame? We see it register in so many places. Canada, Europe, Brazil, etc. It does seem as if someone flipped a switch...

Read More »Bloomberg Interview with Jeffrey Snider

Why Eurodollars Might Be Key to the Market Sell-Off (Podcast) There’s a huge market out there that doesn’t get much attention: Eurodollars. These have nothing to do with the euro-dollar exchange rate. Instead, eurodollars are U.S. dollar-denominated deposits at foreign banks and overseas branches of American banks. They’re effectively a source of dollars that operates outside the control of the U.S., and have at...

Read More »Another ‘Highest In Ten Years’

Upon the precipice of the Great “Recession”, US workers were cushioned to some extent by what economists call sticky wages. Before the Great Depression, as well as during it, companies would attempt to deal with looming economic contraction by cutting pay rates before workers. Nowadays, the intent is reversed; businesses will try to keep core workers by keeping pay rates as steady as possible while instead shedding...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org