The economic sickness is predictably spreading. While unexpected in most of the world which still, somehow, depends on central banking forecasts, it really has been almost inevitable. From the very start, just the utterance of the word “decoupling” was the kiss of death. What that meant in the context of globally synchronized growth, 2017’s repeatedly dominant narrative, wasn’t the end of synchronized as many tried to say but the end of growth. This was more than an economic factor. A fixed system leading into full, meaningful recovery was supposed to heal more than economy. Those political extremists who had multiplied and spread while waiting for it would be revealed as illegitimate, their complaints nothing more

Topics:

Jeffrey P. Snider considers the following as important: 5) Global Macro, Canada, China, currencies, economy, EuroDollar, Featured, Federal Reserve/Monetary Policy, globally synchronized downturn, globally synchronized growth, Korea, Markets, newsletter, popular discontent, Populism, Socialism, Sweden, The United States

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The economic sickness is predictably spreading. While unexpected in most of the world which still, somehow, depends on central banking forecasts, it really has been almost inevitable. From the very start, just the utterance of the word “decoupling” was the kiss of death. What that meant in the context of globally synchronized growth, 2017’s repeatedly dominant narrative, wasn’t the end of synchronized as many tried to say but the end of growth.

This was more than an economic factor. A fixed system leading into full, meaningful recovery was supposed to heal more than economy. Those political extremists who had multiplied and spread while waiting for it would be revealed as illegitimate, their complaints nothing more than some form of evil “ism.” The New York Times in January 2018 succinctly described its wider significance:

A decade after the world descended into a devastating economic crisis, a key marker of revival has finally been achieved. Every major economy on earth is expanding at once, a synchronous wave of growth that is creating jobs, lifting fortunes and tempering fears of popular discontent.

Well, purported significance anyway. If globally synchronized growth was “tempering fears of popular discontent”, the risks are pretty clear should there not be any. I wrote last September what wasn’t any sort of special insight:

The answer is here before us. Yesterday, the Bank of Canada throws in the towel on its end of the global economy. Last October, the Canadians were thinking how they had to get serious with their rate hikes. Now, officials admit in all likelihood there won’t be any more. Something sure changed. |

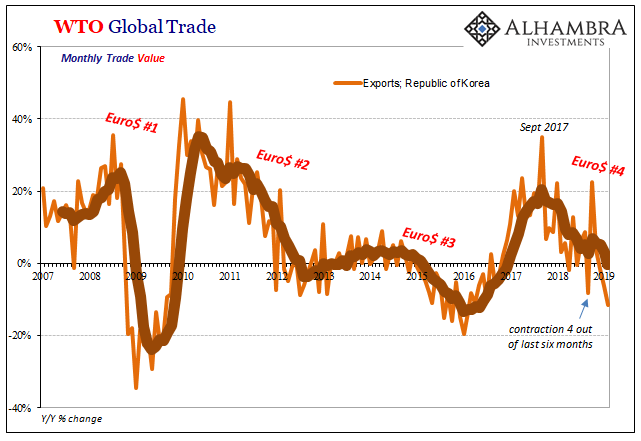

WTO Global Trade, Korea 2007-2019 |

| Today, Sweden. Sveriges Riksbank, that country’s central bank, follows the Canadian (or European) example. Rate hikes which were scheduled for later this year, perhaps as soon as July, are now forecast for early next year. Its version of QE has now been extended to likely December 2020. And that’s if this current interruption is “transitory” as each central bank currently figures.

What are the chances of that? Perhaps we should ask the people of the Republic of Korea.

If there are tensions in trade it has little or nothing to do with “trade tensions” as commonly described. About half of ROK’s GDP is derived from global trade. All of the major export bellwethers, South Korea included, are, say it with me, synchronized. Downturn synchronized. |

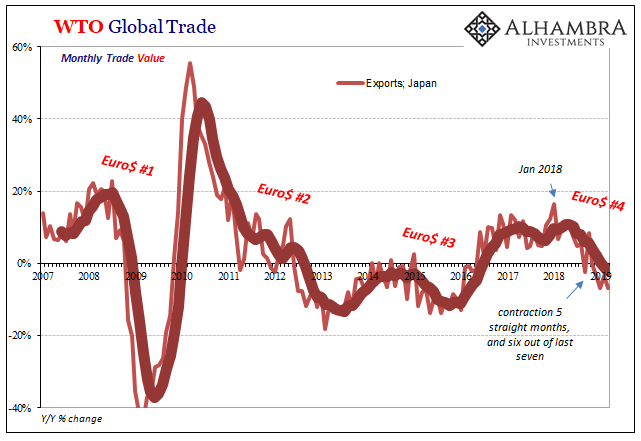

WTO Global Trade, Japan 2007-2019 |

| The more immediate issue is what sure looks like a fourth eurodollar downturn being forced on the global economy by a fourth eurodollar squeeze. International data, central bank action, and consistent market data and prices. Curves more than anything. As my offshore friend Emil has said, paraphrasing George Soros, we are not forecasting #4 we are witnessing it.

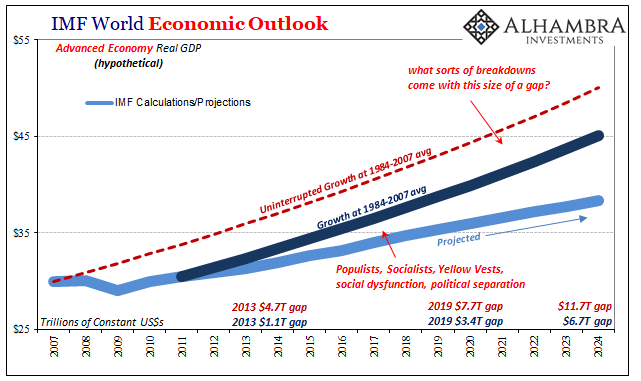

Thoughts now must turn to severity, including some detective work about variability across nations even regions, as well as duration. We’ll do that some other day. For now, though, there is also the big picture to consider beyond just eurodollars. The longer the public stays in the dark about shadow money, this is the best we will ever see. And that’s not good. It can only lead to more genuine if understandably misguided dissatisfaction with the way things are. Popular discontent, The New York Times blandly describes it. |

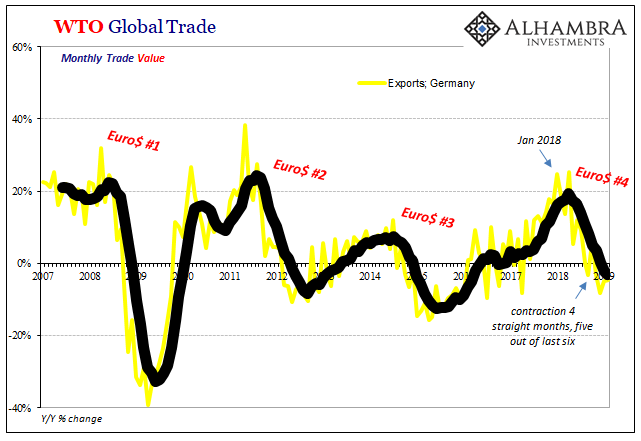

WTO Global Trade, Germany 2007-2019 |

| If Euro$ #3 brought out Trump, Bernie, Brexit, populism, AOC, socialism, European dissolution, etc., what does Euro$ #4 do? The Times was right about only the one thing. Had globally synchronized growth been as advertised it would’ve pushed the global trend back toward the center, reversing it away from the extremes.

Synchronized downturn instead, not only does “popular discontent” spread further, the temperature of those already discontented will surely rise. If they distrusted the status quo after 2016… People around the world have been incredibly patient. For the most part, officials were given ever chance, two, three, and four of them, to get it right. The immediate implication should be easy enough, but it won’t be heeded. Stop listening to central bankers. They really have no idea what they are doing. That’s really all renewed “dovishness” means, and proves. |

IMF World EconomicOutlook, 2007-2024 |

Tags: Canada,currencies,economy,EuroDollar,Featured,Federal Reserve/Monetary Policy,globally synchronized downturn,globally synchronized growth,Korea,Markets,newsletter,popular discontent,populism,Socialism,Sweden