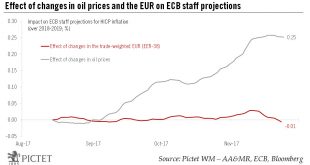

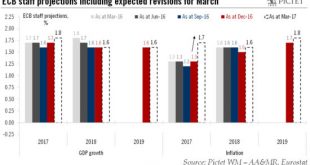

At the 14 December meeting, attention will be focused on the ECB staff forecasts and any changes in communication on plans for unwinding QEs. The main talking points ahead of the ECB’s last policy meeting this year on 14 December are the new staff projections for growth and inflation as well as forward guidance on asset purchases. We expect higher oil prices to push ECB staff forecasts for inflation higher, to 1.4% in 2018 and 1.6% in 2019. A lower...

Read More »Oil prices to push ECB staff projections for inflation slightly higher

We also expect the ECB staff to revise higher its GDP growth forecast for the euro area in 2018 and 2019.This week was all about stellar euro area PMIs and hawkish nuances in the accounts of the October ECB meeting. However, the arrival at another deadline went unnoticed – the cut-off date for ECB staff projections, which implies that financial inputs will be derived from market expectations as at 23 November. Using elasticities derived from OECD and ECB models, the chart below shows the...

Read More »In spite of broadening growth, ECB will remain prudent

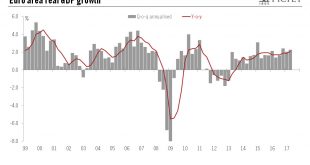

A growth spurt may push us to raise our euro area GDP forecast for this year and next, although we expect some slowdown in the pace of expansion and the ECB to continue to act cautiously.While the latest euro area GDP numbers were broadly in line with expectations, at 0.6% quarter-on-quarter in Q2, net revisions to past data pushed the GDP profile higher again.Once detailed estimates are published by Eurostat—and assuming there are no significant revisions to past data—we might revise our...

Read More »ECB preview: less reason to be dovish, but inflation battle not yet over

Next week, we expect the ECB to highlight that downside risks to the euro area outlook have diminished further, warranting upward revisions to staff forecasts and a more neutral monetary stance.The latest economic developments are consistent with the ECB turning somewhat more hawkish – or, more accurately, less dovish. Business surveys have improved, pointing to annualised GDP growth of around 2% in Q1. Headline inflation returned to the ECB’s 2% target in February, for the first time in...

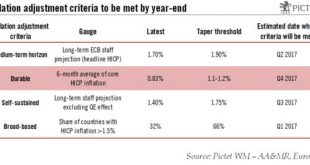

Read More »Inflation and the ECB (part 1): the four criteria

Euro area inflation was well above consensus in January. However, we believe that the ECB will look through this spike in (imported) inflation as underlying price pressures remain subdued.Although euro area headline inflation jumped to 1.8% in January, the closest it has been to ECB’s 2% target since Q1 2013, core inflation remained low at 0.9%. We continue to expect the ECB to wait until September before it announces a tapering of its asset purchases in 2018.A “sustained adjustment in...

Read More »Headline prices rise in the euro area, but core inflation still subdued

With the ECB still concerned about weak dynamics in core prices and wages, we believe a 6-month extension of QE will be announced in December, with asset purchases of EUR80 bn per month.Euro area flash HICP inflation rose from 0.4% year on year (y-o-y) in September to 0.5% in October, while core inflation remained stable at 0.8%. Both figures were in line with market expectations. However, the details behind the core inflation figure were slightly weaker than expected.Euro area inflation is...

Read More »ECB: tapering is no answer for bond scarcity

Tapering is not an immediate issue for the ECB, which we believe is much more likely to announce an extension of QE and measures to deal with the scarcity of bonds it can purchase. Spokespersons for the ECB have been anxious to beat back a Bloomberg story that the bank was attempting to “build a consensus” around the tapering of its bond purchases, saying the Governing Council (GC) had not even discussed this issue at its last policy meeting in September.The timing of the story is a...

Read More »ECB: reality check, no QE extension (yet)

The central bank’s growth and inflation forecasts were left largely unchanged on Sept. 8, but more intervention is in the offing. The ECB kept policy rates and QE unchanged at its 8 September meeting, in line with our expectations. ECB staff forecasts were broadly stable: the 2018 HICP projection, which was left at 1.6%, while the GDP growth was revised down slightly, from 1.7% to 1.6% in 2017 and 2018.The relative stability in the macroeconomic projections reflects, according to the ECB,...

Read More »ECB preview: getting the sequence right

Extension of quantitative easing (QE) along with changes to how QE works may be in the offing, but an announcement might wait until December. Ahead of its 8 September policy meeting, the European Central Bank (ECB) has expressed its “concerns” over the lack of upward momentum in core inflation. In our view, it is not a question of whether the ECB will ease (QE extension is a given, and more could be needed at some stage in the future), but more about getting the sequence right in order to...

Read More »ECB on hold, rendez-vous in September

Macroview Further policy stimulus and adjustments to its bond-buying programme remain on the agenda as the ECB strives to measure the impact of current uncertainties The ECB remained on hold at its 21 July policy meeting. The main conclusion to be drawn from the meeting was that more stimulus is on the table for September, when new staff forecasts will be available.The only unexpected bit of news was ECB chairman’s Mario Draghi’s apparent support for the idea of a public backstop for banks...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org