Entre la fin de l’année 2016 et la fin du 3ème trimestre 2017 (chiffres disponibles), les dirigeants de la BNS ont accru le volume des devises détenues par l’établissement de 65 milliards de francs environ. En 9 mois seulement…. Selon eux, ces investissements se justifient par le franc suisse qui serait trop fort face à l’euro. Et pour l’affaiblir, il faut acheter de l’euro, mécanisme qui expliquerait la croissance du bilan. Vous allez voir qu’une fois de plus les chiffres, décidément...

Read More »Chinese Are Not Tightening, Though They Would Be Thrilled If You Thought That

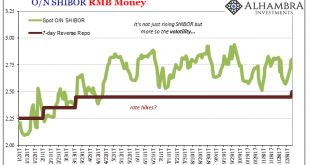

The PBOC has two seemingly competing objectives that in reality are one and the same. Overnight, China’s central bank raised two of its money rates. The rate it charges mostly the biggest banks for access to the Medium-term Lending Facility (MLF) was increased by 5 bps to 3.25%. In addition, its reverse repo interest settings were also moved up by 5 bps each at the various tenors (to 2.50% for the 7-day, 2.80% for the...

Read More »Three Years Ago QE, Last Year It Was China, Now It’s Taxes

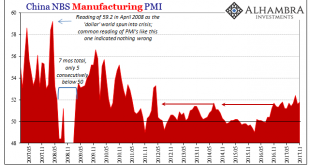

China’s National Bureau of Statistics reported last week that the official manufacturing PMI for that country rose from 51.6 in October to 51.8 in November. Since “analysts” were expecting 51.4 (Reuters poll of Economists) it was taken as a positive sign. The same was largely true for the official non-manufacturing PMI, rising like its counterpart here from 54.3 the month prior to 54.8 last month. China Manufacturing...

Read More »Maybe Hong Kong Matters To Someone In Particular

Hong Kong stock trading opened deep in the red last night, the Hang Seng share index falling by as much as 1.6% before rallying. We’ve seen this behavior before, notably in 2015 and early 2016. Hong Kong is supposed to be an island of stability amidst stalwart attempts near the city to mimic its results if not its methods. Thus, most kinds of turmoil are noticeable. Most. My own brief survey of this morning’s news from...

Read More »Bi-Weekly Economic Review: Yawn

When I wrote the update two weeks ago I said that we might be nearing the point of maximum optimism. Apparently, there is another gear for optimism in this market as stocks have just continued to slowly but surely reach for the sky. Which is fine I suppose since we own the devils (although not much in the way of the US variety) but I can’t help but wonder what happens when the spell breaks. Goldilocks may be in the...

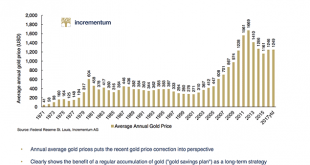

Read More »Key Charts: Gold is Cheap and US Recession May Be Closer Than Think

by Dominic Frisby of Money Week Every year, Ronald-Peter Stoeferle and Mark J Valek of investment and asset management company Incrementum put together the report In Gold We Trust – 160-plus pages of charts and thoughts, mostly gold-related, on the state of the world’s finances. There’s so much to look at and consider. It’s a sort of digital equivalent of a coffee-table book. Yesterday I got an email from them, containing a “best of” – a compendium of some of the best...

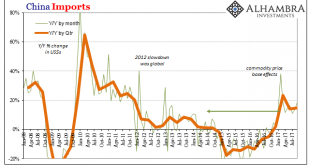

Read More »China Exports/Imports: Enforcing A Global Speed Limit

Chinese imports rose 18.7% in September 2017 year-over-year. That’s up from 13.5% growth in August. While near-20% expansion sounds good if not exhilarating, it isn’t materially different from 13.5% or 8% for that matter. In addition, Chinese trade statistics tend to vary month to month. What is becoming very clear is that China’s economy is behaving no differently than the global economy. Most of that increase for...

Read More »Covered Interest Parity

On Alphaville, Matthew Klein points out that covered interest parity (dollar vs. yen) is alive and kicking again. It wasn’t during much of 2016. The Reserve Bank of Australia exploited the arbitrage opportunity. Previous post on the topic, and another one.

Read More »Bi-Weekly Economic Review: Maximum Optimism?

The economic reports of the last two weeks were generally of a more positive tone. The majority of reports were better than expected although it must be noted that many of those reports were of the sentiment variety, reflecting optimism about the future that may or may not prove warranted. Markets have certainly responded to the dreams of tax reform dancing in investors’ heads with US stock markets providing a steady...

Read More »US: Reflation Check

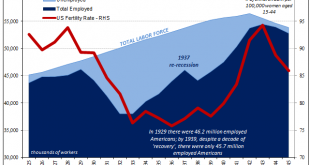

There is a difference between reflation and recovery. The terms are similar and relate to the same things, but in many ways the latter requires first the former. To get to recovery, the economy must reflate if in contraction it was beaten down in money as well as cyclical forces. In the Great Crash of 1929 and after, reflation was required because of the wholesale devastation of the money supply. By pumping up new...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org