Der New Yorker Geldmarkt ist der flüssigste von allen: Ausblick vom One World Trade Center. Foto: Lucas Jackson (Reuters) Als die Finanzkrise vor zehn Jahren ausbrach, prophezeiten viele den baldigen Abstieg New Yorks. Eine solche Pleite, lautete das Argument, würde den Ruf des Finanzplatzes nachhaltig schädigen. Ausserdem wusste man seit langem, dass die EU und China nur darauf warteten, eine bedeutendere Rolle zu spielen. Nun schien der Moment für eine Ablösung gekommen. Nichts von all...

Read More »New York – Phönix aus der Asche

Der New Yorker Geldmarkt ist der flüssigste von allen: Ausblick vom One World Trade Center. Foto: Lucas Jackson (Reuters) Als die Finanzkrise vor zehn Jahren ausbrach, prophezeiten viele den baldigen Abstieg New Yorks. Eine solche Pleite, lautete das Argument, würde den Ruf des Finanzplatzes nachhaltig schädigen. Ausserdem wusste man seit langem, dass die EU und China nur darauf warteten, eine bedeutendere Rolle zu spielen. Nun schien der Moment für eine Ablösung gekommen. Nichts von all...

Read More »Questions Persist About China Trade

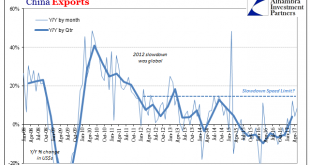

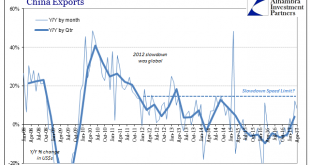

Chinese trade statistics were for May 2017 better than expected by economists, but on the export side questions remain as to their accuracy. Earlier this year discrepancies between estimates first published by the General Administration of Customs (GAC), those you find reported in the media, and what is captured by the National Bureau of Statistics (NBS), backed up by data from the Ministry of Commerce, became...

Read More »All About Inventory

Andy Hall has been called the God of Oil. As chief of Astenbeck Capital, he has proven at times that even gods can be mortal. In the “rising dollar” period, for example, after making money on the way down Mr. Hall went bullish. That was March 2015: We suspect their projection of current prices into the future will again be frustrated by the market. For that reason we have closed out all of our bearish bets (at a...

Read More »Bi-Weekly Economic Review: The Return of Economic Ennui

The economic reports released since the last of these updates was generally not all that bad but the reports considered more important were disappointing. And it should be noted that economic reports lately have generally been worse than expected which, if you believe the market to be fairly efficient, is what really matters. The disappointing employment report and the generally less than expected tone of the reports...

Read More »Not Do We Need One, But Do We Need A Different One

On March 24, 2009, then US President Barack Obama gave a prime time televised press conference whose subject was quite obviously the economy and markets. The US and global economy was at that moment trying to work through the worst conditions since the 1930’s and nobody really had any idea what that would mean. As President, Obama’s main task was not to deliver specifics about auto lending or the inner workings at...

Read More »Suddenly Impatient Sentiment

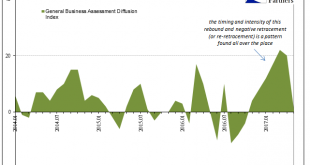

Two more manufacturing surveys suggest sharp deceleration in momentum, or, more specifically, the momentum of sentiment (if there is such a thing). The Federal Reserve’s 5th District Survey of Manufacturing (Richmond branch) dropped to barely positive, calculated to be just 1.0 in May following 20.0 in April and 22.0 in March. It follows an all-too-familiar pattern, where sentiment spiked to start this year after being...

Read More »Trying To Reconcile Accounts; China

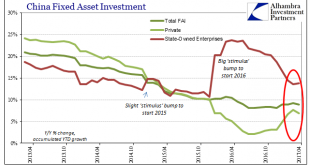

Chinese economic data for April 2017 has been uniformly disappointing. External trade numbers resembled too much commodity prices, leaving an emphasis on them rather than actual economic forces. The latest figures for the Big 3, Industrial Production, Retail Sales, and Fixed Asset Investment, unfortunately also remained true to the pattern. Industrial Production had seemingly accelerated in March, rising to a 7.6%...

Read More »Lackluster Trade, China April Edition

China’s trade statistics for April 2017 uniformly disappointed. They only did so, however, because expectations are being calibrated as if the current economy is actually different. It is instead merely swinging between bouts of contraction and low-grade growth, but so low-grade it really doesn’t qualify as growth. Positive numbers do get the mind racing, but since the end of 2011 there is almost a speed limit on how...

Read More »Lackluster Trade

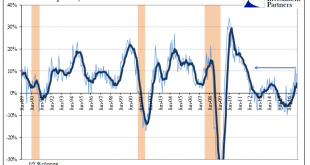

US imports rose 9% year-over-year (NSA) in March 2017, after being flat in February and up 12% in January. For the quarter overall, imports rose 7.3%, a rate that is slightly more than the 2013-14 comparison. The difference, however, is simply the price of oil. Removing petroleum, imports rose instead 6.3% in March and just 4% for the first quarter overall. The value of inbound crude oil expanded by more than 70% for...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org