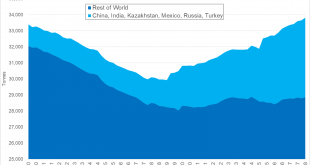

– There has been a recent change for the better in central bank attitudes to gold – There has been “net gold demand by central banks – approx. 500 tonnes per year – as a source of return, liquidity and diversification” – Policy shift to maintaining stable gold holdings reflects central bank concerns about financial markets and geopolitics – Little in the current global economic and political environment to support any...

Read More »Silver Is ‘Undervalued’ Relative to Stocks, Bonds, Gold – GoldCore

Silver is ‘undervalued’ relative to stocks, bonds and gold: GoldCore Silver at $14/oz is cheap relative to gold with gold-silver ratio over 85 Silver drops to 32-month lows prompting sellout of Silver Eagle coins at U.S. Mint U.S. Mint said “recent increased demand” prompted a “temporary sell out” of its American Silver Eagle bullion coins as investors see silver coins as a bargain “We believe that we are on the verge...

Read More »London House Prices Fall At Fastest Rate Since Height Of Financial Crisis

London house prices fall at the fastest annual rate since height of the financial crisis London house prices fall in 5th month in row, worst falls since 2009 London rents dropped at the fastest rate in eight years – ONS Brexit, London property slump put brake on UK house price growth Consumer spending declined in July as inflation increased UK house price growth slowed in June to the lowest annual rate in five years...

Read More »Jim Rogers – Making China Great Again! (Video)

We are delighted to announce a very special guest for our next episode of the Goldnomics Podcast, due for release later this week. We recently had the opportunity to speak with the legendary investor and adventure capitalist Jim Rogers. Jim is an American businessman, investor, traveler, financial commentator and author. He is the Chairman of Rogers Holdings and Beeland Interests, Inc. He was the co-founder of the...

Read More »Jim Rogers and the World’s New Reserve Currency

Today we’re bringing you another clip from our upcoming Episode of the Goldnomics Podcast with the legendary investor and “Adventure Capitalist”, Jim Rogers. In this clip Jim tells us what he thinks about the long-term safe-haven status of the US dollar and what he sees as the future for the Euro currency. Jim also give us his opinion on what he suspects might be the currency to emerge as the only viable but necessary...

Read More »The Stock Market is Stretched to Double Tech-Bubble Extremes

By Joe Ciolli – BusinessInsider.com Leuthold Group has sounded the alarm on a valuation metric that shows the S&P 500 is twice as expensive as it was at the peak of the tech bubble. This development could have large implications for stock investors of all types, particularly value traders who make their living by finding discounts in the market. With the stock market within shouting distance of an all-time high,...

Read More »Gold—Even at its Lowest Levels in 2018—is Behaving Just as Prescribed

By: Rachel Koning Beals – News Editor Marketwatch Gold’s sharp decline over the past month serves as little surprise to the investors who want the asset to perform in just this fashion—that is, as an alternative to assets perceived as risky, like stocks. They’re betting that the opposite will be true as well, that gold will resume its role as protector and diversifier, even inflation hedge, when what they see as bloated...

Read More »Gold to Enter New Bull Market – Charles Nenner

Gold to Enter New Bull Market – Charles Nenner “Gold is going to enter a new bull market” “The first cycle will bottom after the summer” “$1,212 per ounce is our downside target” “It’s going to top $2,500 per ounce . . . in about two years or so” “Gold is in a bull market even though it came down from $1,900 per ounce” In our featured video today, Greg Hunter interviews Charles Nenner, President of The Charles Nenner...

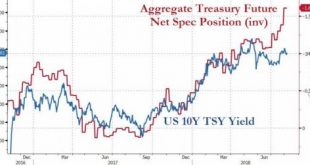

Read More »Russia Sells 80 percent Of Its US Treasuries

Description: In just over 2 months Russia has sold-off over 85% of its holdings of U.S. Treasuries, should the U.S. be concerned? – Russia has liquidated 85% of its US Treasury holdings in just two months – Russia dumps over $90 billion of Treasuries in April and May as holdings collapse from near $100 billion to just $9 billion – Deepening geo-political tensions between Russia and U.S. and Russian concerns about the...

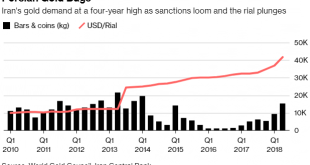

Read More »Physical Gold Is The “Best Defence” Against “Escalating Currency Wars”

Physical Gold Is The “Best Defence” Against “Escalating Currency Wars” As governments around the world debase their currencies, you need an asset that can ride out the hard times. And nothing fits the bill like gold writes John Stepek of Money Week We’ve always said that you should have a bit of physical gold in your portfolio (about 5%-10%, depending). And note that, by gold, we do mean gold, not gold miners. If you...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org