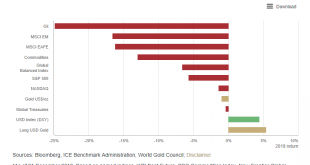

Gold Outlook 2019 – World Gold Council As we look ahead, we expect that the interplay between market risk and economic growth in 2019 will drive gold demand. And we explore three key trends that we expect will influence its price performance: financial market instability monetary policy and the US dollar structural economic reforms. Against this backdrop, we believe that gold has an increasingly relevant role to...

Read More »Blackrock Say Gold Will Be A “Valuable Portfolio Hedge” In 2019

“We’re experiencing a slowdown,” says Blackrock fund manager Global Allocation Fund adding to gold exposure through ETFs Gold “has had a very consistent record of helping mitigate equity risk when volatility is rising” Gold bullion has been a “store of value for a very long time” by Bloomberg News Gold may extend gains as global growth slows, equity market volatility remains elevated and the Federal Reserve is expected...

Read More »China Adds 320,000 Ounces To Gold Reserves – First PBOC Purchase Since October 2016

China increases gold holdings by large 320,000 ounces Gold bullion remains a tiny component of the People’s Bank of China massive foreign exchange (FX) reserves which rose to $3.073 trillion China’s gold reserves rose for first time since October 2016 to 59.56 million ounces by the end of December (1,853 metric tons) from 59.24 million ounces Gold climbed 5% in December on equity rout, growth concerns by Bloomberg:...

Read More »Gold Prices Likely To Go Higher In 2019 After 4 percent Gain So Far In Q4

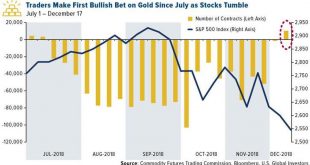

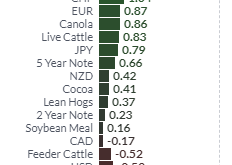

Gold traders appear excited about gold again as stocks are on pace for their worst year since 2008, and their worst December since 1931. Bullish bets on the yellow metal outnumbered bearish ones for the week ended December 11, resulting in the first instance of net positive contracts since July, according to Commodity Futures Trading Commission (CFTC) data. As many of you know, December has historically been a strong...

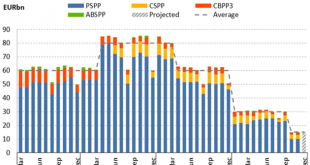

Read More »EU Recession Imminent – Euro Disunion as Brexit, Italy and End of QE Loom

Someone asked recently how many times I had “crossed the pond” to Europe. I really don’t know. Certainly dozens of times. It’s been several times a year for as long as I remember. That makes me an extremely unusual American. Most of us never visit Europe, except maybe for a rare dream vacation. And that’s okay because our own country is wonderful and has a lifetime of sights to see. But it does affect our perspective on...

Read More »Gold and Silver Gained 2 percents and 3 percents Last Week While Stocks Dropped Nearly 5 percents

Close Gain/Loss On Week Gold $1248.40 +$10.10 +2.19% Silver $14.63 +$0.25 +3.25% XAU 67.94 +2.40% +5.40% HUI 153.93 +2.58% +6.13% GDM 560.05 +2.34% +5.32% JSE Gold 1201.13 -0.09 +9.31% USD 96.60 -0.14 -0.61% Euro 114.10 +0.24 +0.80% Yen 88.80 +0.01 +0.67% Oil $52.61 +$1.12 +3.30% 10-Year 2.856% -0.031 -4.86% Bond 143.90625 +0.34375 +2.27% Dow 24388.95 -2.24% -4.50% Nasdaq 6969.25 -3.05% -4.93% S&P 2633.08 -2.33%...

Read More »Pound Falls 2.5 percent Against Gold as UK Government in Turmoil Over Brexit

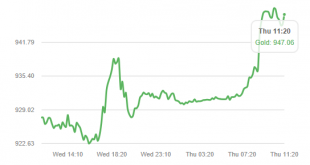

The pound plunged against the euro, the dollar, gold and all leading currencies today as Theresa May’s UK government appeared vulnerable to collapsing and political turmoil risked creating a hard Brexit. The pound has fallen 2.6% against gold in less than twenty four hours seeing gold rise from £923 to £947 per ounce in sterling terms. The pound slumped the most in more than 17 months as several U.K. ministers resigned...

Read More »Gold ETFs See Strong Demand In Volatile October After Robust Global Gold Demand In Q3

Gold ETFs saw inflows in volatile October as investors again hedged risk Gold ETFs see demand of 16.5 tonnes(t) in October to total of 2,346t, the equivalent of US$1B in inflows Global gold demand was robust in Q3 – demand of 964.3 tonnes – plus 6.2t yoy Strong central bank and store of value coin and bar demand offset the gold ETF outflows in Q3 Central bank gold reserves grew 148.4t in Q3, up 22% yoy Gold coin and...

Read More »Gold Analysts At LBMA See 25percent Return To $1,532/oz In 12 months

(by Reuters from BOSTON, LBMA) The price of gold is expected to rise to $1,532 an ounce by October next year, delegates to the London Bullion Market Association’s (LBMA) annual gathering predicted on Tuesday. A poll of delegates at the LBMA conference in Boston also predicted higher prices in a year’s time for silver, platinum and palladium. Spot gold has had a difficult few months, falling from a high of $1,366.07 in...

Read More »Perth Mint’s Gold and Silver Bullion Coin Sales Soar In September

Sales of gold products by the Perth Mint surged in September to their highest since January 2017, while silver sales more than doubled from August to mark an over two-year peak, boosted by lower bullion prices, the mint said on Wednesday. Sales of gold coins and minted bars surged 61 percent from August to 62,552 ounces last month, the mint said in a blog post. Gold sales in September rose about 35 percent from a...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org