I do get a big kick out of the way Communists over in China announce how they are dealing with their enormous problems especially as they may be getting worse. Each month, for example, the country’s National Bureau of Statistics (NBS) will publish figures on retail sales or industrial production at record lows but in the opening paragraphs the text will be full of praise for how the economy is being handled. If you thought the Western media was liberal with the...

Read More »Seriously, Good Luck Dethroning the (euro)Dollar

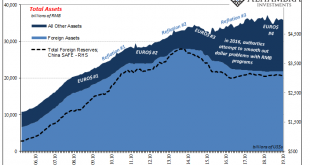

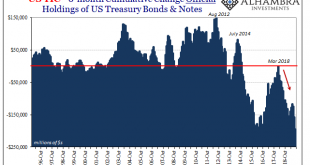

Scarcely a week will go by without some grand prediction of the dollar being dethroned. Set aside how if anything is to be deposed it would have to be the eurodollar, these stories typically follow the same formulaic approach: Country X is moving away from dollar reserves, “diversifying” its holdings because of the geopolitics of Y. Usually, it is the Chinese who are set to play the role of upstart. It makes sense. As the world’s second largest national economy...

Read More »More (Badly Needed) Curve Comparisons

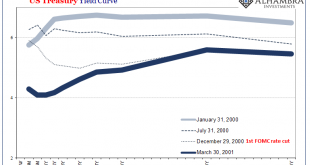

Even though it was a stunning turn of events, the move was widely celebrated. The Federal Reserve’s Open Market Committee, the FOMC, hadn’t been scheduled to meet until the end of that month. And yet, Alan Greenspan didn’t want to wait. The “maestro”, still at the height of his reputation, was being pressured to live up to it. The Fed had begun to cut rates. In Austin, Texas, where President-elect Bush and many prominent business leaders were gathered, the news...

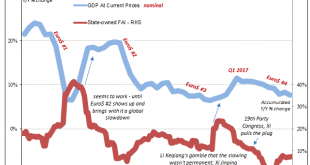

Read More »More Synchronized, More Downturn, Still Global

China was the world economy’s best hope in 2017. Like it was the only realistic chance to push out of the post-2008 doldrums, a malaise that has grown increasingly spasmatic and dangerous the longer it goes on. Communist authorities, some of them, anyway, reacted to Euro$ #3’s fallout early on in 2016 by dusting off their Keynes. A stimulus panic that turned out to be more panic than stimulus. China GDP, 2007-2019(see more posts on China Gross Domestic Product, )...

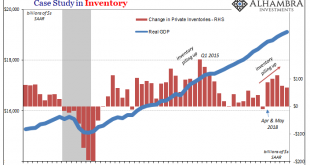

Read More »The Inventory Context For Rate Cuts and Their Real Nature/Purpose

What typically distinguishes recessions from downturns is the inventory cycle. Even in 2008, that was the basis for the Great “Recession.” It was distinguished most prominently by the financial conditions and global-reaching panic, true, but the effects of the monetary crash registered heaviest in the various parts of that inventory process. An economy for whatever reasons slows down. That leads to inventory piling up across the various levels of the supply chain....

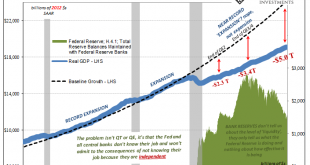

Read More »Three (Rate Cuts) And GDP, Where (How) Does It End?

The Federal Reserve has indicated that it will now pause – for a second time, supposedly. Remember the first: after raising its benchmark rates apparatus in December while still talking about an inflationary growth acceleration requiring even more hikes throughout 2019, in a matter of weeks that was transformed into a temporary suspension of them. Expecting the easy disappearance of “transitory” factors, that Fed pause was to be followed by the second half rebound...

Read More »The Inventory Context For Rate Cuts And Their Real Nature/Purpose

What typically distinguishes recessions from downturns is the inventory cycle. Even in 2008, that was the basis for the Great “Recession.” It was distinguished most prominently by the financial conditions and global-reaching panic, true, but the effects of the monetary crash registered heaviest in the various parts of that inventory process. An economy for whatever reasons slows down. That leads to inventory piling up across the various levels of the supply chain....

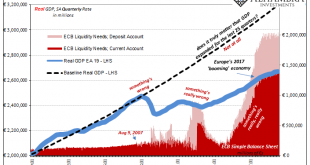

Read More »The Big Risks Left (and Right) In Europe

Another local election in Germany, another stunning defeat for the ruling center. How many more of these does anyone need before they realize the electorate is going to keep migrating toward the poles? And it all stems from the one reason; there is no and has been no economic growth. But because the so-called establishment has insisted the economy is booming, or it was, people are doing what people always do. They look for someone, anyone who can give them a...

Read More »Monthly Macro Monitor: Market Indicators Review

Is the recession scare over? Can we all come out from under our desks now? The market based economic indicators I follow have improved since my last update two months ago. The 10 year Treasury rate has moved 40 basis points off its low. Real interest rates have moved up as well but not quite as much. The difference is reflected in slightly higher inflation expectations. The yield curve has also steepened as the 10 year Treasury yield rose faster than the 2 year. This...

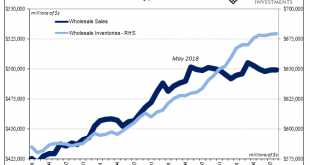

Read More »More Points For, And Pointing To, The Midpoint

It’s not surprising that the Census Bureau would report another weird sideways trend in wholesale sales. After all, the agency has already produced that kind of pattern in the related data for durable goods. For reasons that aren’t going to be explained, economic activity across the supply chain from producers to consumers has been curtailed. That hasn’t mean outright shrinking in seasonally adjusted forms, but it also doesn’t mean growth, either. I’m guessing there...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org