Der oft zitierte Einleitungssatz zu Leo Tolstois Anna Kerenina — „Alle glücklichen Familien gleichen einander, jede unglückliche Familie ist auf ihre eigene Weise unglücklich“ — gilt offenbar auch für die Bitcoin-Familie. Familie? Richtig. Der ursprüngliche Bitcoin (an den Börsen BTC) hat nämlich verschiedene Abkömmlinge gezeugt. Einer davon ist Bitcoin Cash (BCH), entstanden 2017 durch eine Gabelung (fork) in der Blockchain aufgrund einer Meinungsverschiedenheit der...

Read More »Der Geburtsfehler des Kryptogeldes

Urs Birchler Ist Kryptogeld das Geld der Zukunft? Wenn man mich fragt: Nein. Die Gründe habe ich dargelegt in der neuesten Ausgabe des Schweizer Monat.

Read More »Stablecoin nicht gedeckt

Urs Birchler Zu den sonderbarsten Erscheinungen am gehören jene Coins, die angeblich einen festen Wechselkurs zu einer staatlichen Währung wie US-Dollar oder Schweizer Franken haben. Einen Fixkurs kann nämlich nur jemand garantieren, der in beiden Währungen genügend Kapital hat. Ein „Stablecoin“, das einen Fixkurs in US-Dollar verspricht, müsste also stets zu 100 Prozent durch wertsichere und liquide Anlagen in Dollars gedeckt sein. Wie aber mit dem Halten gesicherter Dollarguthaben und...

Read More »Vernissage im Money Museum

Urs Birchler Das Money Museum hat gestern mit einer Vernissage neu eröffnet, unter anderem mit einer Ausstellung zum Thema „Der gerechte Preis“, das seit dem Mittelalter nichts an Aktualität eingebüsst hat. Dann verfügt das Museum über eine sensationelle Sammlung von aktuell 2095 Münzen, aus der im übrigen unsere täglich wechselnden Batzen (oben rechts) stammen. So ganz beiläufig erhielt ich gestern plötzlich eine sumerische Tontafel in Keilschrift in die Hand gelegt. Der Vater des...

Read More »Ohio: mit Bitcoin Steuern zahlen

Urs Birchler Wie das Wall Street Journal berichtet, hat Ohio als erster Bundesstaat der USA Bitcoin als Zahlungsmittel für Steuern, Verkehrsbussen, etc. zugelassen. Ohio tritt damit in die Fusstapfen der Stadt Zug, die 2016 als erste Bitcoin für gewisse Zahlungen gelten liess. In Zug ist mittlerweile eine gewisse Ernüchterung eingetreten (wie die NZZ schon im Februar berichtete). Das einst als gelobtes Land wahrgenommene Krypto-Valley wird mehr und mehr zum Klepto-Valley. (Kritische...

Read More »Sovereign Money Referendum: A Swiss Awakening to Fractional-Reserve Banking?

On Sunday 10 June 2018, Switzerland’s electorate voted on a referendum calling for the country’s commercial banks to be banned from creating money. In a country world-famous for its banking industry, this was quite an interesting turn of events. Known as the Sovereign Money Initiative or ‘Vollgeld’, the referendum was brought to the Swiss electorate in the form of a ‘Popular Initiative‘. The Sovereign Money referendum...

Read More »Chinese bitcoin mining giant sets up Swiss hub

One of the world’s largest bitcoin miners is setting up a hub for European operations in Switzerland, a person familiar with company has confirmed to swissinfo.ch. The Chinese firm Bitmain Technologies is setting up in Zug just as the Chinese authorities move to shut down cryptocurrency miners. Bitmain Technologies builds and supplies machines for bitcoin mining and runs its super-scale mine in China. The company set...

Read More »If Bitcoin Is A Bubble…

Our earlier articles on bitcoin discuss the crypto asset as a currency and a commodity. Both papers focused on the consequences of bitcoin’s defining feature: the asymptotic supply limit of 21 million coins. This gives it an unusual juxtaposition of demand uncertainty and supply certainty (as well as inelasticity). As a currency, it gives rise to a tension between its use as a store of value and as medium of exchange....

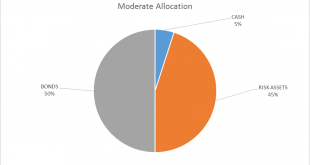

Read More »Global Asset Allocation Update

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. The extreme overbought condition of the US stock market persists so I will continue to hold a modest amount of cash. There are some minor changes within the portfolios but the overall allocation is unchanged. - Click to enlarge There have been two major developments since...

Read More »A Gold Guy’s View Of Crypto, Bitcoin, And Blockchain

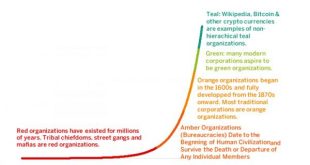

Bitcoin was on my radar far back as 2011, but for years, I didn’t think much of it. It was a curiosity. Nothing more. Sort of like the virtual money you use in World of Warcraft or something. In 2015, looking deeper, I slowly (not the sharpest tool in the shed) arrived at that “aha” inflection point that most advocates of honest money arrive at. I realized that a distributed public ledger has the power to change, well,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org