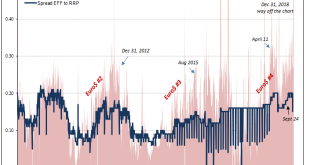

It was only near the quarter end, that’s what made it so unnerving. We may have become used to these calendar bottlenecks over the years, but they still remind us what they are. Late October 2012 was a little different, though. On October 29, the GC repo rate for UST collateral (DTCC) surged to 52.6 bps. The money market floor, so to speak, was zero at the time and IOER (the joke) 25 bps. We also have to keep in mind...

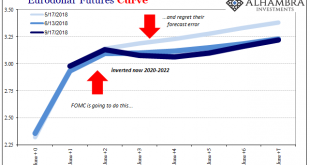

Read More »Eurodollar Futures: Powell May Figure It Out Sooner, He Won’t Have Any Other Choice

For Janet Yellen, during her somewhat brief single term she never made the same kind of effort as Ben Bernanke had. Her immediate predecessor, Bernanke, wanted to make the Federal Reserve into what he saw as the 21st century central bank icon. Monetary policy wouldn’t operate on the basis of secrecy and ambiguity. Transparency became far more than a buzzword. Way back in 2012, under Bernanke’s direction officials would...

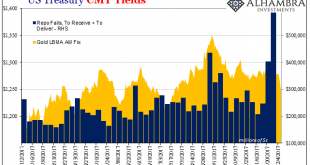

Read More »Chart of the Week: Collateral

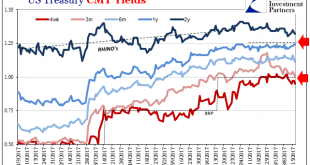

It’s been a week of quite righteous focus on collateral. The 4-week bill equivalent yield closes it at just 114 bps, with only three days left before the RRP “floor” is moved up by the FOMC to 125 bps. That’s too much premium in price, though we know why given what FRBNY reported for repo fails last week. With all that, there’s really nothing much to say about what’s below. OK, there is, but I’ll save that for next...

Read More »It Was Collateral, Not That We Needed Any More Proof

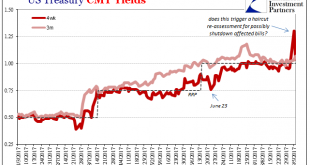

Eleven days ago, we asked a question about Treasury bills and haircuts. Specifically, we wanted to know if the spike in the 4-week bill’s equivalent yield was enough to trigger haircut adjustments, and therefore disrupt the collateral chain downstream. US Treasury, Jan - Sep 2017(see more posts on U.S. Treasuries, ) - Click to enlarge Within two days of that move in bills, the GC market for UST 10s had gone...

Read More »Moscow Rules (for ‘dollars’)

In Ian Fleming’s 1959 spy novel Goldfinger, he makes mention of the Moscow Rules. These were rules-of-thumb for clandestine agents working during the Cold War in the Soviet capital, a notoriously difficult assignment. Among the quips included in the catalog were, “everyone is potentially under opposition control” and “do not harass the opposition.” Fleming’s book added another, “Once is an accident. Twice is...

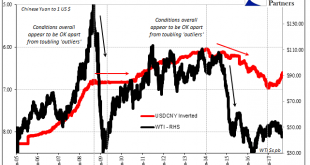

Read More »United States: The Fed Tries To Tighten By Rates, But The System Instead Tightens By Repo

The Fed voted for the first federal funds increase in almost a decade on December 15, 2015. It was the official end of ZIRP, and though taking so many additional years to happen, to many it marked the start of recovery. The yield on the 2-year Treasury Note was 98 bps that day. A lot has happened between now and then, including three additional “rate hikes” dating back to December 2016, the last in June 2017. The yield...

Read More »ECB Collateral Framework

In an ECB occasional paper, Ulrich Bindseil, Marco Corsi, Benjamin Sahel, and Ad Visser review the European Central Banks’s collateral framework. From the executive summary, on misconceptions: … differences e.g. with interbank repo markets: first, central banks are not subject to liquidity risk in the way “normal” market participants are, and can therefore accept less liquid collateral. Second, as the central bank has a zero default probability in its domestic market operations,...

Read More »Deposit Insurance in Switzerland

The Federal Council aims at strengthening the deposit insurance system and has asked the ministry of finance to work out new rules. Banks will have to pledge securities as collateral, rather than solely contribute cash ex post. The council rejects the proposal to prefund a deposit fund.

Read More »Collateral Values in ECB Operations

In the NZZ, Kjell Nyborg questions whether the collateral values of the securities the ECB accepts in monetary policy operations reflect market values. He argues that the valuation is discretionary and politicized. Meine Analyse macht deutlich, dass der Besicherungsrahmen in der Euro-Zone in unterschiedlicher Ausprägung unter all diesen Problemen leidet. Das öffentliche Verzeichnis der zulässigen notenbankfähigen Sicherheiten enthält 30 000 bis 40 000 verschiedene Wertpapiere, von...

Read More »Pawn Shops, Information Insensitivity, and Debt-on-Debt

In a BIS working paper (January 2015), Bengt Holmstrom summarizes some of the implications of the research on information insensitive debt. He cautions against moves to increase transparency in debt markets and defends the shadow banking system. He explains why opacity and information insensitivity are valuable and argues that debt-on-debt arrangements are (privately) optimal. It all started with pawn shops: The beauty lies in the fact that collateralised lending obviates the need to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org