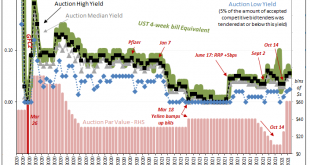

Treasury Secretary Janet Yellen hasn’t just been busy hawking cash management bills, her department has also been filling back up with the usual stuff, too. Regular T-bills. Going back to October 14, at the same time the CMB’s have been revived, so, too, have the 4-week and 13-week (3-month). Not the 8-week, though. Of the first, it’s been a real tsunami at this tenor, too. Up to early August, Treasury had regularly (weekly) sold $40 billion in one-month paper. From...

Read More »Short Run TIPS, LT Flat, Basically Awful Real(ity)

Over the past week and a half, Treasury has rolled out the CMB’s (cash management bills; like Treasury bills, special issues not otherwise part of the regular debt rotation) one after another: $60 billion 40-day on the 19th; $60 billion 27-day on the 20th; and $40 billion 48-day just yesterday. Treasury also snuck $60 billion of 39-day CMB’s into the market on the 14th to go along with the two scheduled 119-day CMB’s during this period. That’s a quick $220 billion...

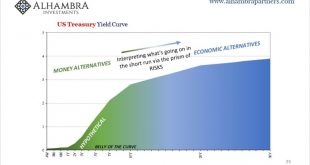

Read More »The Curve Is Missing Something Big

What would it look like if the Treasury market was forced into a cross between 2013 and 2018? I think it might be something like late 2021. Before getting to that, however, we have to get through the business of decoding the yield curve since Economics and the financial media have done such a thorough job of getting it entirely wrong (see: Greenspan below). And before we can even do that, some recent housekeeping at the front of the curve where bill lives. Treasury...

Read More »CPI’s At Fives Yet Treasury Auctions

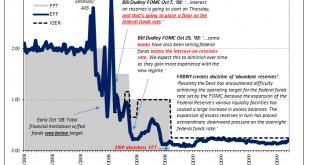

A momentous day, for sure, but one lost in what would turn out to be a seemingly endless sea of them. October 8, 2008, right in the thick of the world’s first global financial crisis (how could it have been global, surely not subprime mortgages?) the Federal Reserve took center stage; or tried to. Having bungled Lehman, botched AIG, and then surrendered to Treasury which then screwed up TARP, the world’s entire financial edifice was burning down while US...

Read More »Golden Collateral Checking

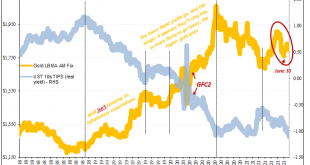

Searching for clues or even small collateral indications, you can’t leave out the gold market. We’ve been on the lookout for scarcity primarily via the T-bill market, and that’s a good place to start, yet looking back to last March the relationship between bills and bullion was uniquely strong. It’s therefore a persuasive pattern if or when it turns up again. To recap the main push of last year’s acute dollar shortage: Over the past several dreadful weeks of...

Read More »Lower Yields And (fewer) Bills

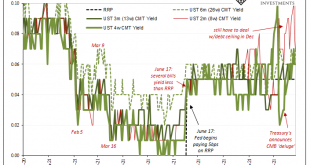

Back on February 23, Federal Reserve Chairman Jay Powell stopped by (in a virtual, Zoom sense) the Senate Banking Committee to testify as required by law. In the Q&A portion, he was asked the following by Montana’s Senator Steve Daines: SENATOR DAINES. I just was looking at the T bill chart and noticing since the 1st of February, the one month rates have dropped in half from 0.06 to today 0.03, two months went from 0.07, to 0.02. We’re starting to get into that...

Read More »RRP No Collateral Coincidences As Bills Quirk, Too

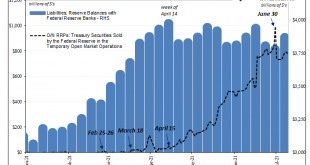

So much going on this week in the bond market, it actually overshadowed the ridiculous noise coming from the Fed’s reverse repo. Some maybe too many want to make a huge deal out of this RRP if only because the numbers associated with it have gotten so big. To end Q2 2021, financial counterparties “lent” just about $1 trillion to the Fed. Holy cow! A trillion! There’s way too much money! Eh. The RRP, especially around its more informative margins, has little to do...

Read More »Rechecking On Bill And His Newfound Followers

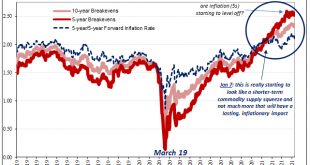

The benchmark 10-year US Treasury has obtained some bids. Not long ago the certain harbinger of bond rout doom, the long end maybe has joined the rest of the world in its global pause if somewhat later than it had begun elsewhere (including, importantly, its own TIPS real yield backyard). Even nearer-in inflation expectations have rounded off at their current top. Perhaps no more than a short-term rest before each rising again, then again with the rest of the...

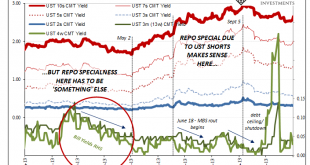

Read More »Deja Vu: Treasury Shorts Meet Treasury Shortages

Investors like to short bonds, even Treasuries, as much as they might stocks and their ilk. It should be no surprise that profit-maximizing speculators will seek the best risk-adjusted returns wherever and whenever they might perceive them. If one, or a whole bunch, has to first “borrow” a security the one doesn’t own in order to sell something at a high price betting the price to go down, you can likewise bet there’s someone out there in the financial landscape more...

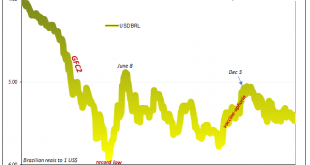

Read More »For The Dollar, Not How Much But How Long Therefore How Familiar

Brazil’s stock market was rocked yesterday by politics. The country’s “populist” President, Jair Bolsonaro, said he was going to name an army general who had served with Bolsomito (a nickname given to him by supporters) during that country’s prior military dictatorship as CEO of state-owned oil giant Petróleo Brasileiro SA. Gen. Joaquim Silva e Luna is being installed, allegedly, to facilitate more direct control of the company by the federal government. With the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org