Swiss Franc The Euro has fallen by 0.27% to 1.0881 EUR/CHF and USD/CHF, October 8(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The re-opening of Chinese markets after a long holiday did not produce the volatility that many expected. Chinese stocks alongside most Asia markets traded higher today, and the yuan advanced. After opening higher and extending its recent rally, Europe’s Dow Jones Stoxx 600 turned...

Read More »FX Daily, October 7: Markets Unsettled to Start the Week

Swiss Franc The Euro has risen by 0.05% to 1.0926 EUR/CHF and USD/CHF, October 7(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global capital markets are uneasy as the risks that have dominated investors’ concerns–trade and Brexit–remain front and center today. Expectations are low that this week’s talks between the US and China will lead to a breakthrough or will be sufficient to postpone further the next...

Read More »FX Weekly Preview: China Returns, ECB Record, Fed Minutes and the Week Ahead

Many high-income countries experienced little growth but strong price pressures in the 1970s. Since the mainstream economics said the two were mutually exclusive, a new term had to be created, hence stagflation. Fast forward almost half a century later, and mainstream economists are still having a problem deciphering the linkages between prices and economic activity, such as inflation and employment. Theory needs to accommodate the new facts. Theory is being...

Read More »FX Daily, October 2: Greenback Shows Resiliency, Stocks Don’t

Swiss Franc The Euro has risen by 0.66% to 1.0928 EUR/CHF and USD/CHF, October 2(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Shockingly poor ISM data sent shivers through the market on Tuesday and hand the S&P 500 its biggest loss in five weeks and took the shine off the greenback. The S&P 500 reached a five-day high before reversing course and cast a pall over today’s activity. All the markets were...

Read More »FX Weekly Preview: Forces of Movement at the Start of Q4 19

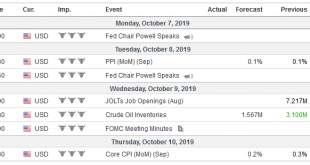

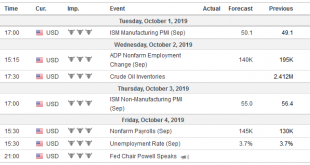

United States The world’s largest economy appears to have grown by about 2% in Q3 at an annualized pace, the same as in Q2, and in line with what many Fed officials understand to be trend growth. The strength of the US labor market underpins consumption, the powerful engine of the US economy. The latest readings of both the labor market and consumption will highlight the economic data in the week ahead. The strength of the recent housing data (starts and sales)...

Read More »FX Daily, September 27: Markets Limp into the Weekend with the Euro Languishing at New Lows and Sterling under Pressure

Swiss Franc The Euro has risen by 0.01% to 1.0851 EUR/CHF and USD/CHF, September 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Equities remain under pressures. The MSCI Asia Pacific Index lower today, though Chinese and Australian shares were firmer. It is the second consecutive week the benchmark has fallen. European equities are firmer, but not enough to offset the losses earlier this week and are set to...

Read More »FX Daily, September 25: Risk Appetite Stymied: Dollar Recovers while Stocks Slide

Swiss Franc The Euro has fallen by 0.13% to 1.0842 EUR/CHF and USD/CHF, September 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global equities and fixed income reacted to the large moves yesterday in the US when the 10-year note yield fell eight basis points, and the S&P 500 fell by 0.85%. Investors have focused on three separate developments and two of which came from President Trump’s speech at the...

Read More »FX Daily, September 24: UK Supreme Court Deals another Defeat to Johnson

Swiss Franc The Euro has fallen by 0.03% to 1.0874 EUR/CHF and USD/CHF, September 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: A fragile calm hangs over the capital markets today. Equities in Asia Pacific were narrowly mixed. Japan, China, and HK advanced. India saw some profit-taking after a two-day surge in response to the unexpected corporate tax cuts but recovered in late dealings. European shares are...

Read More »Where The Global Squeeze Is Unmasked

Trade between Asia and Europe has dimmed considerably. We know that from the fact Germany and China are the two countries out of the majors struggling the most right now. As a consequence of the slowing, shipping companies have had to make adjustments to their fleet schedules over and above normal seasonal variances. It was reported last week that Maersk and MPC would “temporarily suspend” their sailings on one of the biggest routes between Europe and Asia. Weakening...

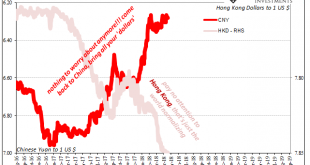

Read More »Dollar (In) Demand

The last time was bad, no getting around it. From the end of 2014 until the first months of 2016, the Chinese economy was in a perilous state. Dramatic weakness had emerged which had seemed impossible to reconcile with conventions about the country. Committed to growth over everything, and I mean everything, China was the one country the world thought it could count on for being immune to the widespread economic sickness. That’s why in early 2016 authorities...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org