Swiss Franc The Euro has fallen by 0.31% to 1.092 EUR/CHF and USD/CHF, September 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global equities are extending their recent gains while bonds remain on the defensive. The dollar is firm. There is a degree of optimism that is prevailing. There are some more overtures in terms of US-Chinese trade. In Hong Kong, developers and banks led an equity rally on ideas...

Read More »FX Daily, September 10: Turn Around Tuesday

Swiss Franc The Euro has fallen by 0.22% to 1.0933 EUR/CHF and USD/CHF, September 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The momentum from the end of last week carried into yesterday’s activity, but the momentum began fading. Today, equities were mixed in Asia Pacific and weaker in Europe. The Dow Jones Stoxx 600 reversed lower yesterday and is slipped further today. The S&P 500 may gap lower at...

Read More »Is The Negativity Overdone?

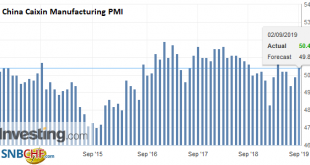

Give stimulus a chance, that’s the theme being set up for this week. After relentless buying across global bond markets distorting curves, upsetting politicians and the public alike, central bankers have responded en masse. There were more rate cuts around the world in August than there had been at any point since 2009. And there’s more to come. As Bloomberg reported late last week: Over the next 12 months, interest-rate swap markets have priced in around 58 more...

Read More »FX Daily, September 9: Market Sentiment Still Constructive

Swiss Franc The Euro has risen by 0.52% to 1.0944 EUR/CHF and USD/CHF, September 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The improvement of investor sentiment seen last week is carrying over into the start of the new weeks. Global equities are firm as are benchmark yields. Asia Pacific equities advanced, except in Hong Kong, where Chief Executive Lam’s promise to formally withdraw the controversial...

Read More »FX Daily, September 06: Focus Shifts to North American Jobs Before Turning Back to Europe next Week

Swiss Franc The Euro has risen by 0.79% to 1.0905 EUR/CHF and USD/CHF, September 06(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Investors hope that the world took a step away from the abyss in recent days. Developments in Hong Kong, US-China talking, a political and economic crisis in Italy appears to have been averted, and a risk of a no-deal Brexit has lessened. Asia Pacific equities closed the week...

Read More »“The Eurozone faces the worst combination of economic and systemic risk”

Eurozone faces the worst combination Interview with Alasdair Macleod: The past few months have been an exciting time for gold investors, as the precious metal has seen a spike in demand after serious economic concerns and geopolitical tensions unsettled the markets. Many mainstream analysts have pointed to a number of recent events, from the US-China trade war escalations to the inverted yield curve, to explain the recent gold rally. Although these developments...

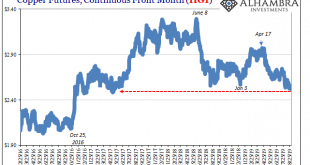

Read More »Copper Confirmed

Copper prices behave more deliberately than perhaps prices in other commodity markets. Like gold, it is still set by a mix of economic (meaning physical) and financial (meaning collateral and financing). Unlike gold, there doesn’t seem to be any rush to get to wherever the commodity market is going. Over the last several years, it has been more long periods of sideways. That’s what makes any potential breakout noteworthy. Dr. Copper’s place in the hierarchy is...

Read More »What Happened Monday

Markets in the US and Canada were closed on Monday for national Labor Day holidays. Here is a succinct summary of key developments that will set the backdrop for Tuesday. 1. On September 1, the new round of tariffs in the US-China fight took effect. The US placed a 15% tariff on around 3000 Chinese goods that thus far had escaped action. China put a 10% level on 1700 US goods. No date has been given for the next round of face-to-face talks that were expected this...

Read More »“The Eurozone faces the worst combination of economic and systemic risk”

Interview with Alasdair Macleod: The past few months have been an exciting time for gold investors, as the precious metal has seen a spike in demand after serious economic concerns and geopolitical tensions unsettled the markets. Many mainstream analysts have pointed to a number of recent events, from the US-China trade war escalations to the inverted yield curve, to explain the recent gold rally. Although these developments certainly play a part in short-term price moves and are of...

Read More »“The Eurozone faces the worst combination of economic and systemic risk”

Interview with Alasdair Macleod: The past few months have been an exciting time for gold investors, as the precious metal has seen a spike in demand after serious economic concerns and geopolitical tensions unsettled the markets. Many mainstream analysts have pointed to a number of recent events, from the US-China trade war escalations to the inverted yield curve, to explain the recent gold rally. Although these developments certainly play a part in short-term price moves and are of...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org