A Spike in Bank Lending to Corporations – Sign of a Dying Boom? As we have mentioned on several occasions in these pages, when a boom nears its end, one often sees a sudden scramble for capital. This happens when investors and companies that have invested in large-scale long-term projects in the higher stages of the production structure suddenly realize that capital may not be as plentiful as they have previously...

Read More »US Money Supply and Fed Credit – the Liquidity Drain Becomes Serious

US Money Supply Growth Stalls Our good friend Michael Pollaro, who keeps a close eye on global “Austrian” money supply measures and their components, has recently provided us with a very interesting update concerning two particular drivers of money supply growth. But first, here is a chart of our latest update of the y/y growth rate of the US broad true money supply aggregate TMS-2 until the end of June 2018 with a...

Read More »Central Bank Investment Strategies

A survey of central banks and sovereign wealth funds by Invesco sheds light on their investment plans. The traditional separation of markets and the state may be helpful for ideological arguments, but the real situation is more complicated. Central banks and their investment vehicles (sovereign wealth funds) are market participants. In some activities, such as custodian, central banks compete with the private sector....

Read More »Merger Mania and the Kings of Debt

Another Early Warning Siren Goes Off Our friend Jonathan Tepper of research house Variant Perception (check out their blog to see some of their excellent work) recently pointed out to us that the volume of mergers and acquisitions has increased rather noticeably lately. Some color on this was provided in an article published by Reuters in late May, “Global M&A hits record $2 trillion in the year to date”, which...

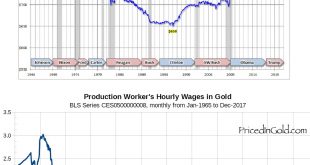

Read More »The Fed’s “Inflation Target” is Impoverishing American Workers

Redefined Terms and Absurd Targets At one time, the Federal Reserve’s sole mandate was to maintain stable prices and to “fight inflation.” To the Fed, the financial press, and most everyone else “inflation” means rising prices instead of its original and true definition as an increase in the money supply. Rising prices are a consequence – a very painful consequence – of money printing. Fed Chair Jerome Powell...

Read More »Credit Spreads: Polly is Twitching Again – in Europe

Junk Bond Spread Breakout The famous dead parrot is coming back to life… in an unexpected place. With its QE operations, which included inter alia corporate bonds, the ECB has managed to suppress credit spreads in Europe to truly ludicrous levels. From there, the effect propagated through arbitrage to other developed markets. And yes, this does “support the economy” – mainly by triggering an avalanche of capital...

Read More »Tales from “The Master of Disaster”

Tightening Credit Markets Daylight extends a little further into the evening with each passing day. Moods ease. Contentment rises. These are some of the many delights the northern hemisphere has to offer this time of year. As summer approaches, and dispositions loosen, something less amiable is happening. Credit markets are tightening. The yield on the 10-Year Treasury note has exceeded 3.12 percent. If yields...

Read More »The Capital Structure as a Mirror of the Bubble Era

Effects of Monetary Pumping on the Real World As long time readers know, we are looking at the economy through the lens of Austrian capital and monetary theory (see here for a backgrounder on capital theory and the production structure). In a nutshell: Monetary pumping falsifies interest rate signals by pushing gross market rates below the rate that reflects society-wide time preferences; this distorts relative prices...

Read More »Spoofing Futures and Banging Fixes: Same Banks, Same Trading Desks

On 29 January 2018, the Commodity Futures Trading Commission (CFTC) Division of Enforcement together with the Criminal Division of the US Department of Justice and the FBI announced criminal and civil enforcement actions against 3 global investment banks and 5 traders for involvement in trade spoofing in precious metals futures contracts on the US-based Commodity Exchange (COMEX). COMEX is by far the largest and most...

Read More »Negative Rates: Rise of the Japanese Androids

Good Intentions One of the unspoken delights in life is the rich satisfaction that comes with bearing witness to the spectacular failure of an offensive and unjust system. This week served up a lavish plate of delicious appetizers with both a style and refinement that’s ordinarily reserved for a competitive speed eating contest. What a remarkable time to be alive. It seemed a good idea at first… - Click to enlarge...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org