An excellent conference organized by the Monetary Law Forum Switzerland focused on blockchain use cases from a central bank perspective. Program, links to slides. I discussed the macroeconomic perspective and argued for “reserves for all.” Some related links: Nivaura and Allen & Overy (backing Nivaura). OTC Swiss Blockchain, by Roman Bischoff.

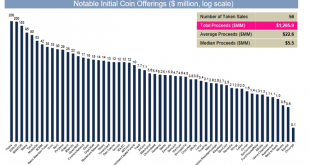

Read More »The World’s Largest ICO Is Imploding After Just 3 Months

Earlier this summer, Tezos smashed existing sales records in the white-hot IPO market after the company’s pitch to build a better blockchain for cryptocurrencies made it one of the buzziest ICOs in the world. As we noted at the time, the company capitalized on that buzz by courting VC firms and other institutional investors with a $50 million token pre-sale. After the company opened up selling to the broader public,...

Read More »Arguments for Interest Paying, Account Based, CBDC

In an NBER working paper and a column on VoxEU, Michael Bordo and Andrew Levin make the case for central bank issued digital currency (CBDC). Bordo and Levin favor an account-based CBDC system (managed or supervised by the central bank) rather than central bank issued tokens in the blockchain. They emphasize the Friedman rule and the fact that interest paying CBDC affords the possibility to satisfy the rule: These … goals – … a stable unit of account and an efficient medium of exchange –...

Read More »ICOs and Frequent Flyer Miles

The Economist on “initial coin offerings:” Many ICOs are designed to finance applications that will make use of the blockchain … In some cases, the “coins” can be exchanged for services on the site. In a way, this is like selling air miles in a startup airline; investors can either use the miles for flights or hope they can trade them at a profit. For the business, it is also a way of creating demand for the product they are selling. But in plenty of cases, an ICO is just a way of raising...

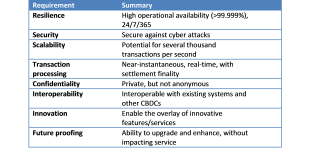

Read More »Desirable Features of Central Bank Issued Digital Currency

On bankunderground, Simon Scorer reminds us that a central bank issued digital currency (CBDC) need not operate on a distributed ledger platform. The two do not have much to do with each other. Scorer suggests a series of technical requirements for a CBDC: And he concludes that a distributed ledger does not meet all requirements. It’s unlikely that all of the above attributes could be perfectly met with today’s technology; you may need to make compromises between features – e.g. the...

Read More »Bitcoin Fork, Hyped ICOs – Immutable Gold and Silver

Bitcoin Fork, Hyped ICOs – Immutable Gold and Silver Latest developments show risks in crypto currencies Confusion as bitcoin may split tomorrow SEC stepped into express concern over ICOs ICOs have so far raised $1.2 billion in 2017 ICOs preying on lack of understanding from investors Physical gold not vulnerable to technological risk Beauty and safety in simplicity of gold and silver Forks and ICOs solves bitcoin v...

Read More »Bitcoin, Arbitrage, and the Human Side of the Blockchain

On Bloomberg view, Matt Levine discusses the recent bitcoin fork. The handling of long and short positions on Bitfinex, a bitcoin exchange, created an arbitrage opportunity, until Bitfinex changed its mind. Bitfinex announced a policy to deal with the fork, people took advantage of the policy, and Bitfinex changed its mind after the fact. Each of its decisions was rational, and quite plausibly the fairest option available to it. None of those decisions were required by, like, the nature...

Read More »Trust and Money

In the Trustlines Network every user is acting as a bank by granting credit lines to friends they trust. This allows to issue people powered money between friends and facilitate secure payments between strangers, by sending payments along a chain of trusting friends. Think of IOUs or cheques and netting in the blockchain.

Read More »Connecting Central Bank Payments Systems

In the FT, Martin Arnold reports about a new cross-border payment method tested by the Bank of England. The “interledger” program transfers money “near-instantaneously and without settlement risk.” The Bank of England set up two simulated RTGS systems on a cloud computing platform, using the Ripple interledger to simultaneously process “a successful cross-border payment”. This is not necessarily good news for the blockchain community. The Bank of England’s proof of concept is “about...

Read More »Initial Coin Offerings and the Pecking Order

On Alphaville, Izabella Kaminska comments on the pecking order induced by initial coin offerings (ICOs). All of this raises an important point about actual shareholder rights within these structures. Say a legally-incorporated institution with actual shareholders dishes out an uncapped amount of tokens promising a share of revenues or dividends via the ICO process. Do shareholders’ rights to those revenue/dividends trump rights of the token holders? And if so, how does that square with...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org