In the FT, Robert Armstrong reports about the new “JPM coin” launched by JP Morgan. “JPM Coins” will be transferable over a blockchain between the accounts of the bank’s corporate clients, who will purchase and redeem them for dollars at a fixed 1:1 ratio, making them “stablecoins” in the crypto-jargon. The technology will facilitate near-instantaneous settlement of these money transfers and will, according to the bank, mitigate counterparty risk. According to my reading, the coins are...

Read More »JPM Coin

In the FT, Robert Armstrong reports about the new “JPM coin” launched by JP Morgan. “JPM Coins” will be transferable over a blockchain between the accounts of the bank’s corporate clients, who will purchase and redeem them for dollars at a fixed 1:1 ratio, making them “stablecoins” in the crypto-jargon. The technology will facilitate near-instantaneous settlement of these money transfers and will, according to the bank, mitigate counterparty risk. According to my reading, the coins are...

Read More »Swisscom Blockchain head departs abruptly

The state-owned Swiss telecoms operator has branched out into blockchain technology. Daniel Haudenschild has stepped down as Chief Executive Officer of Swisscom Blockchain with immediate effect. The state-owned telecommunications group gave no reason for the shock move by the top manager and shareholder of its blockchain advisory unit. News of Haudenshild’s departure clearly came out of the blue for the Swiss blockchain...

Read More »Blockchain-basierte Abstimmungen?

Die Unabhängigkeitspartei up! hat die Vor- und Nachteile von traditionellen Wahlsystemen und E-Voting verglichen. Wir sind zum Schluss gekommen, dass ein dezentralisiertes, blockchain-basiertes System die Vorteile von beiden Modellen verbinden und so ein sichereres, effizienteres System ermöglichen könnte. Wir haben unsere Überlegungen in einem Positionspapier zusammengefasst.

Read More »Swiss blockchain industry sees meteoric growth

The booming Swiss blockchain sector continues to grow: over 600 companies and institutions are now located in the ‘Crypto Nation’ and neighbouring Liechtenstein, according to recently-released data. The industry employs around 3,000 people in Switzerland and Liechtenstein, as well as many more abroad, says investment group Crypto Valley Venture Capitalexternal link (CV VC). Taken together, the top 50 blockchain...

Read More »Solutions without Historical Templates: Cryptocurrencies and Blockchains

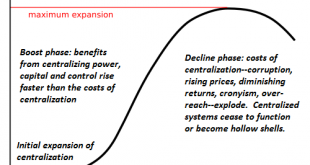

Crypto-blockchain technologies are leveraging the potential of computers and the web for direct political-social innovation. We’re accustomed to three basic templates for system-wide solutions or improvements: 1. an individual “builds a better mousetrap” and starts a company to exploit this competitive advantage; 2. a company invents something that spawns a new industry (the photocopier, the web browser, for example)...

Read More »Cybersecurity

At an MIT book launch in Zurich, David Shrier and Alex Pentland advertized a new book co-edited by them, “New Solutions for Cybersecurity.” Some takeaways from the event: The really dangerous cyber attacks are yet to come. All major governments are directly or indirectly involved. A promising strategy of minimizing risks relies on (i) continuous encryption; (ii) no central storage of data but case by case requests for data; and (iii) log queries to manage/monitor access. The European...

Read More »Oligopolistic Anonymity

On Alphaville, Kadhim Shubber reports that just a few marketplaces handle the vast majority of illicit drugs-vs.-bitcoin trades. In short, the illicit bitcoin ecosystem is centered around a small number of services that could be subject to scrutiny, regulation and co-option by law enforcement. It’s a wild west, but luckily for the police all the bad guys are hanging out at a single saloon.

Read More »A Race To The Potential Behind Bitcoin

The timing just never seems to fall in our favor. If we had had this conversation ten years ago as would have been appropriate, then this evolution might have fell perfectly in our collective laps. Just as the global financial system, really the international, interbank monetary system of the eurodollar, was crashing all around us, the genesis block of the Bitcoin blockchain was hard coded. Within it contained very...

Read More »Blockchain Based Equity Settlement in Australia

In the FT, Jamie Smyth reports that the Australian Securities Exchange plans to introduce a blockchain based equity clearing and settlement system. ASX will operate the system on a secure private network with known participants. The participants must comply with regulation, according to the ASX, which said its system had nothing to do with blockchain technology deployed by cryptocurrencies such as bitcoin.

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org