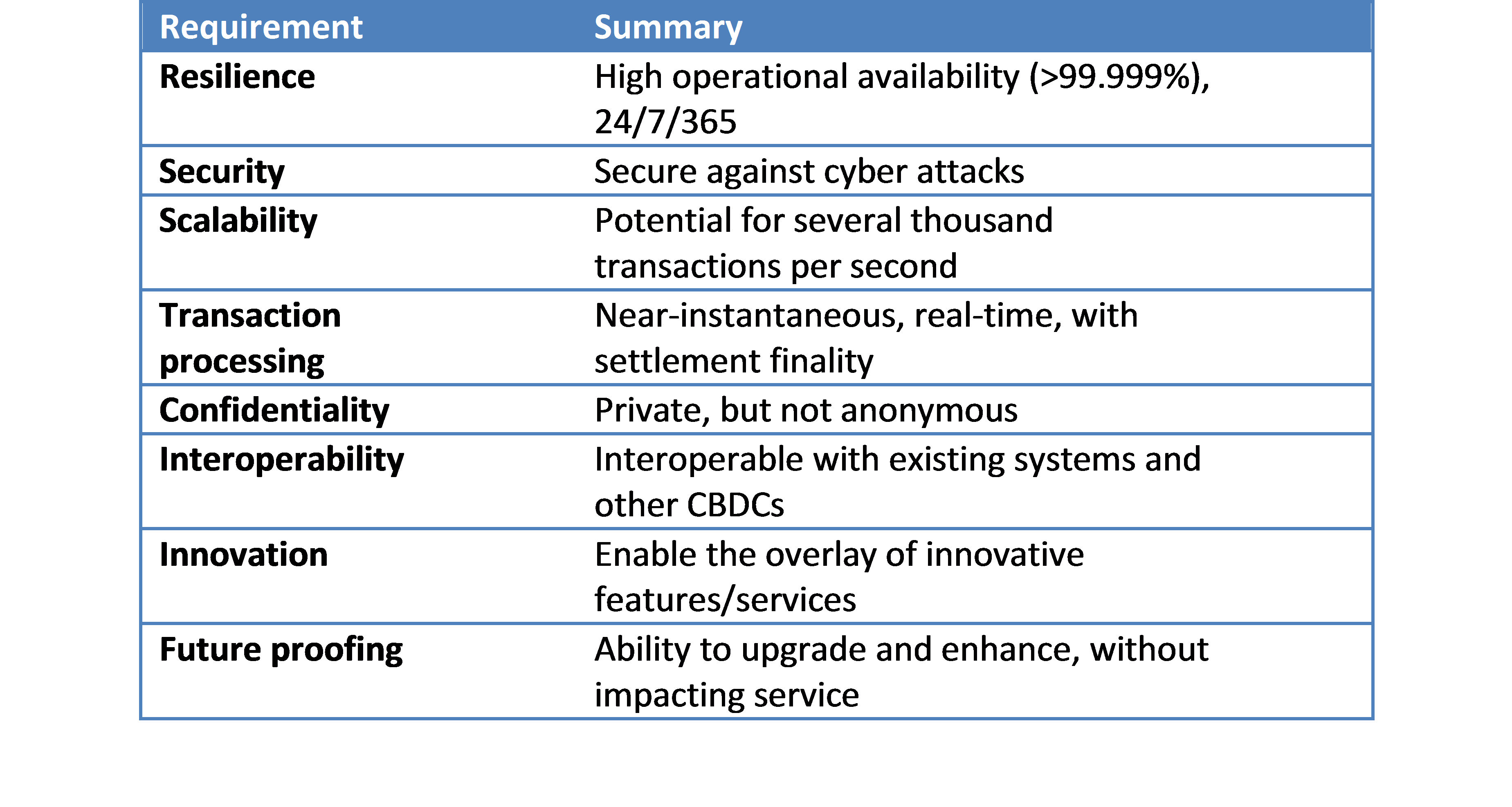

On bankunderground, Simon Scorer reminds us that a central bank issued digital currency (CBDC) need not operate on a distributed ledger platform. The two do not have much to do with each other. Scorer suggests a series of technical requirements for a CBDC: And he concludes that a distributed ledger does not meet all requirements. It’s unlikely that all of the above attributes could be perfectly met with today’s technology; you may need to make compromises between features – e.g. the trade-off between resilience and privacy … CBDC is far from just a simple question of technology; any central bank contemplating CBDC will need to answer a host of fundamental economic questions, as well as considering how feasible it is to achieve all the required features and what type of technology

Topics:

Dirk Niepelt considers the following as important: Blockchain, Central bank issued digital currency, Distributed ledger, Notes, Reserves, technology

This could be interesting, too:

Fintechnews Switzerland writes Crypto VC Funding Remains Steady at USB in 2024

Fintechnews Switzerland writes 10 Must Read Bitcoin and Blockchain Blogs and Webpages

Fintechnews Switzerland writes BlackRock Plans to Launch Bitcoin-Linked ETP in Switzerland

Dirk Niepelt writes Does the US Administration Prohibit the Use of Reserves?

On bankunderground, Simon Scorer reminds us that a central bank issued digital currency (CBDC) need not operate on a distributed ledger platform. The two do not have much to do with each other.

Scorer suggests a series of technical requirements for a CBDC:

And he concludes that a distributed ledger does not meet all requirements.

It’s unlikely that all of the above attributes could be perfectly met with today’s technology; you may need to make compromises between features – e.g. the trade-off between resilience and privacy …

CBDC is far from just a simple question of technology; any central bank contemplating CBDC will need to answer a host of fundamental economic questions, as well as considering how feasible it is to achieve all the required features and what type of technology might enable this.