In recent decades, every instance in which the economy contracted two quarters in a row has coincided with a recession. Nonetheless, the Biden Administration and the leadership at the Federal Reserve insist there is no recession now, nor is one even in the works. On the other hand, declining GDP growth, rising credit card debt, disappearing savings, and falling disposable income all point to recession. And now one of the most closely watched recession indicators is...

Read More »Honest Money in Dishonest Hands

For those who would find relief knowing the Bible sanctions a market-derived medium of exchange, Gary North’s Honest Money will come as a godsend (no pun intended). Even for those reprobates who forswear a religious worldview, his book will provide a solid grounding in monetary theory and history. North’s vast understanding of money and banking coupled with his lean, no-jargon writing style takes the labor out of reading. His narrative carries us on a journey from...

Read More »Are Seasonally Adjusted Economic Data Useful?

It is not possible to establish the conditions of the economy by just inspecting the data as a whole, according to many economists. What is required, instead, is to break the data into its key components, which supposedly will enable economists to identify the true state of the economy. Components That Drive the Data According to popular thinking, data that is observed over time—labelled as time series—is driven by four components, these are: The trend component The...

Read More »Myth versus Ideology: Why Free Market Thinking Is Nonideological

I’ll begin with a provocative thesis: socialism is ideological and free market thinking, while involving myth, is nonideological. I will show why socialism is ideological and why free market thinking involves myth but is nonideological by defining the terms myth and ideology and distinguishing them from each other. The term “myth” has several connotations. The most common connotation today is that myth represents false belief. Thus, we see many uses of the term myth...

Read More »Can We Have Scarcity but Reject the “Scarcity Mindset?” in a Word, No

Since I am an economist and my school year is not too far along, my classroom discussion of how all of economics traces back to the fact of scarcity (the combination of limited resources, which implies a limited ability to produce, along with wants that always exceed the amount that can be produced) facing everyone was quite recent. That was why Brad Polumbo’s recent article, “What AOC and Nina Turner Get Wrong about the ‘Scarcity Mindset,’” so quickly drew my...

Read More »The Recession in the Productive Sector Is Here

Governments and central banks have become the lender of first resort instead of the last resort, and this is immensely dangerous. Global debt soars, inflation creeps in, and many of the so-called supply chain disruptions are the result of zombification after years of subsidizing low productivity and penalizing high productivity with increased taxes. There are many reasons why nations should not “spend now and deal with the consequences later.” First, the spending is...

Read More »“Spend Now, and Deal with the Consequences Later” Is the Worst Policy

Quantitative easing was designed as a tool to provide time for governments to implement structural reforms, boost growth, and strengthen the economy. However, it has become a tool to increase the size of government and take increasingly riskier levels of debt. The United States economy has not strengthened in the period of enormous fiscal and monetary stimuli, as the latest data shows. It needs increasing units of debt to generate a new unit of gross domestic product...

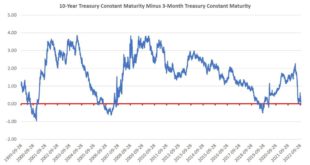

Read More »Federal Reserve Tampering with Interest Rates Distorts the Shape of the Yield Curve

For many commentators, a change in the shape of the differential between the long-term interest rate and the short-term interest rate—i.e., the yield spread provides an indication of the likely direction of the economy in the months ahead. Thus, an increase in the yield spread raises the likelihood of a possible strengthening in economic activity in the months to come. Conversely, a decline in the yield spread is seen as indicative of a possible economic downturn...

Read More »The Hardheaded Thought of Ludwig von Mises: Ever Attacked and Ever Triumphant

Such is the intellectual stature of Ludwig von Mises that even many decades after his passing the opponents of classical liberalism and laissez-faire capitalism continue to attack his life’s work. A recent instance of this phenomenon is an article published in Jacobin by Matt McManus, which, rather unoriginally, accuses Mises of being a “market ideologue” rather than a “hardheaded thinker.” As readers of this website may expect, McManus fails to substantiate his...

Read More »Slavery Did Not Promote Capitalism: The New Economic History of Capitalism Is Simply Wrong

The “new history of capitalism” (NHC) continues to receive widespread acclaim despite mounting inaccuracies. Although critical reviews have punctured adherents’ arguments many still cling to wrongheaded assumptions that exaggerate the role of slavery and cotton in powering America’s economic progress. Several industries were complicit in fueling slavery, but their success was never hinged on slave production. In fact, slavery proved to be a hindrance to commercial...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org