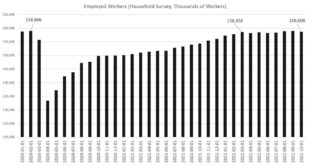

In another sign of weakness for the job market, the total number of employed persons in the United States fell, month over month, in October. That’s the third time in the last seven months this total has fallen, dropping to approximately 158 million. According to new employment data released by the Bureau of Labor Statistics on Friday, the current population survey shows 328,000 fewer people were employed in October than in September, seasonally adjusted. . This...

Read More »Are Robots and AI Really Going to Displace All Workers? Probably Not

Among the components of the World Economic Forum’s Great Reset are a drastically reduced population and the replacement of human labor with robots and artificial intelligence (AI). The question immediately comes to mind: can robots and AI really make all the stuff for the elites after they have gotten rid of the people? Because a plan has been formulated and described does not mean that it is possible to realize. The plan may contradict laws of logic or reality, or...

Read More »Multinational Agrichemical Corporations and the Great Food Transformation

In July 2022, the Canadian government announced its intention to reduce “emissions from the application of fertilizers by 30 percent from 2020 levels by 2030.” In the previous month, the government of the Netherlands publicly stated that it would implement measures designed to lower “nitrogen pollution some areas by up to 70 percent by 2030,” in order to meet the stipulations of the European “Green Deal,” which aims to “make the EU’s climate, energy, transport and...

Read More »Private versus Government Health Insurance: They Are Not the Same

Insurance is a market institution—i.e., it emerged through voluntary exchange aiming at satisfying the needs of the parties involved. Private health insurance should not be mistaken for public health insurance, which constitutes an element of a state’s social policy. They differ to such a great extent that one can even claim that the latter is a contradiction of the former. This essay will show the most notable differences between them. The Main Differences Firstly,...

Read More »Murray Rothbard versus the Progressives

There has been a radical change in the social and political landscape in this country, and any person who desires the victory of liberty and the defeat of Leviathan must adjust his strategy accordingly. New times require a rethinking of old and possibly obsolete strategies. —Murray N. Rothbard1 Murray Rothbard wrote the above words in 1994, shortly before his untimely passing. They sum up the main theme of a series of brilliant articles that he published in the 1990s...

Read More »Can the Dollar Once Again Be Anchored by Gold? One Congressman Believes It Can

Sorry, I've looked everywhere but I can't find the page you're looking for. If you follow the link from another website, I may have removed or renamed the page some time ago. You may want to try searching for the page: Search Searching for the terms %3Futm+source%3Drss%26utm+medium%3Drss%26utm+campaign%3Dpolleit+dollar+again+anchored+gold+one+congressman+believes ...

Read More »About That Nobel: Deconstructing Banking Theories of Diamond and Dybvig

Since the awarding of the Nobel Prize in economics to Ben S. Bernanke, Douglas W. Diamond, and Philip H. Dybvig, most of the media interest has, understandably, concentrated on Bernanke. Mark Thornton wrote a scathing takedown of bailout Ben, while Tyler Cowen inexplicably praised him to the skies (Cowen at least provides a good overview of some of Bernanke’s contributions, such as they are). This has allowed Diamond and Dybvig (DD) to escape much scrutiny, which is...

Read More »Black Hole or Shock Absorber: How Does a Free-Market Economy Respond to Crises?

Mainstream economists view the economy as fickle, unstable, and always in danger of utter collapse. They see the outlook as very bleak if not for the enormous existing superstructure of government intervention, including constant stimulus of “aggregate demand.” In their minds, this essential stabilization would also include the existing intricate arrangement of regulation and restriction, the army of technocratic bureaucrats overlording every market, and the rollout...

Read More »Without Easy Money from the Fed, Home Prices Will Keep Falling

Home price growth of the sort we’ve seen in recent years simply cannot be sustained without a continued commitment to easy money from the central bank, and it shows. Home prices continued to slide in August as the economy cooled, and as the Fed hit the Pause button on quantitative easing while allowing interest rates to rise. Home prices in August were 13.0 percent higher nationally compared with August 2021, according to newly released data from the S&P...

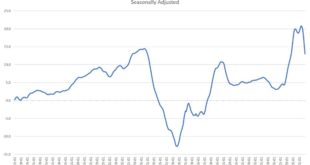

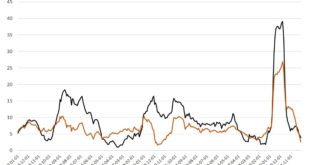

Read More »Latest Recession Alarm: Money-Supply Growth Fell in September to a 37-Month Low

Money supply growth fell again in September, dropping to a 37-month low. August’s drop continues a steep downward trend from the unprecedented highs experienced during much of the past two years. During the thirteen months between April 2020 and April 2021, money supply growth in the United States often climbed above 35 percent year over year, well above even the “high” levels experienced from 2009 to 2013. During September 2022, year-over-year (YOY) growth in the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org