The largest gold nugget in Britain has been found in a Scottish river, as experts reveal that members of the public are taking up hunting after watching YouTube clips. The diver, who wishes to remain anonymous, discovered the £80,000 “doughnut-shaped” nugget using a method called “sniping”, in which a prospector uses a snorkel and hand tools to scan the riverbed for treasures. The 22-carat lump, found in two separate pieces ten minutes apart in an undisclosed river...

Read More »Global ‘Gold Rush’ Beginning As Investors and Central Banks Buy, Repatriate and Move Gold

◆ Gold is flowing to strong hands in safer forms of gold ownership, in safer jurisdictions ◆ Gold and silver bullion coins and bars owned by GoldCore’s clients have been moved from Hong Kong to Singapore ◆ Central bank and institutional gold rush is beginning as prudent money diversifies fx reserves by buying gold & repatriates their gold from London and New York ◆ Central banks are repatriating gold and buying gold as never before due to macroeconomic,...

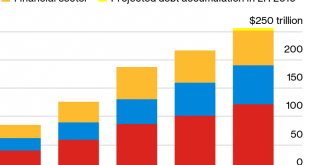

Read More »$255 Trillion Global Debt Bubble May Burst In 2020 – Prepare Now

Source: Bloomberg ◆ Global debt has risen to another record at $255 trillion due to cheap borrowing costs. ◆ A decade of easy money has left the world with a record $250 trillion of government, corporate and household debt. ◆ This is almost three times global economic output and equates to about $32,500 for every man, woman and child on earth. ◆ “With central bank rates at their lowest levels and U.S. Treasuries at their richest valuations in 100 years, we appear to...

Read More »Money and Prices Are a Dynamic System, Report 1 Dec

The basic idea behind the Quantity Theory of Money could be stated as: too much money supply is chasing too little goods supply, so prices rise. We have debunked this from several angles. For example, we can use a technique that every first year student in physics is expected to know. Dimensional analysis looks at the units on both sides of an equation. Money supply is a quantity, a stocks, i.e. dollars or tons in the gold standard. Goods supply is a quantity per...

Read More »Eastern European Nations Buy and Repatriate Gold Due To Growing Risks To Euro and Dollar

◆ Prudent leaders in Eastern European countries are repatriating their national gold reserves and diversifying into gold due to geopolitical risks and monetary risks posed to the dollar, euro and pound ◆ Slovakia has joined China, Russia and a host of countries buying gold or seeking to repatriate their gold from the Bank of England and the New York Federal Reserve ◆ “Brexit and the risk of a global economic crisis put Slovak gold stored in Britain in a dangerous...

Read More »Raising Rates to Fight Inflation, Report 24 Nov

Physics students study mechanical systems in which pulleys are massless and frictionless. Economics students study monetary systems in which rising prices are everywhere and always caused by rising quantity of currency. There is a similarity between this pair of assumptions. Both are facile. They oversimplify reality, and if one is not careful they can lead to spectacularly wrong conclusions. And there are two key differences. One, in physics, students know that...

Read More »Global Gold Buyers Are ‘Confident’ in Gold

‘Retail Gold Insights 2019’ has just been published by the World Gold Council. It is a thematic analysis of their new consumer research survey. With a base of 18,000 participants across India, China, Russia, Germany, the US and Canada, we believe it is the largest ever consumer survey on the global gold market. 5 main themes of the report People are confident in – and loyal to – gold. Gold already has strong foundations and it’s important to know where that...

Read More »CNBC is careful to admit that owning GLD is not owning gold

Chris Powell of GATA writes today about how he finds it interesting that CNBC are careful to admit that owning the GLD ETF is not the same thing as owning physical gold, a theme that has run strongly throughout our market commentaries for many years. He writes… Two cheers for today’s CNBC report celebrating the 15th anniversary of the gold exchange-traded fund GLD, since the report does not pretend that owning GLD is the same as owning the monetary metal itself....

Read More »True US Economy About To Be ‘Revealed’ – Stockman Interview

David Stockman is the former budget director for President Ronald Reagan and author of “Peak Trump: The Undrainable Swamp and the Fantasy of MAGA” He believes that the market “can’t digest” all the money flooding into Wall Street and that the Federal Reserve responded with panic. Click Here to Watch the Full Interview David Stockman Prepare Now! Risk Of Contagion In Today’s Fragile Monetary World ◆ GOLDNOMICS PODCAST – Episode 13 – Lucky for some ! ◆ Why is nobody...

Read More »The Perversity of Negative Interest, Report 17 Nov

Today, we want to say two things about negative interest rates. The first is really simple. Anyone who believes in a theory of interest that says “the savers demand interest to compensate for inflation” needs to ask if this explains negative interest in Switzerland, Europe, and other countries. If not, then we need a new theory (Keith just presented his theory at the Austrian Economics conference at King Juan Carlos University in Madrid—it is radically different)....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org