Americans hated it when the Federal Reserve handed trillions of dollars to crooked Wall Street banks following the 2008 Financial Crisis. Politicians were confronted about the merits of central banking and bailouts. For the first time in history, college students were chanting “End the Fed” at campaign rallies as Ron Paul took the central bank to task during his presidential campaigns. Virtually everyone in America vehemently opposed the central bank handing piles of...

Read More »Trump Pumps Market With Trade Talks, Stocks Move Higher, Gold Lower

Sue Trinh, Managing Director of global macro strategy at Manulife Investment Management, speaking on Bloomberg. She had some interesting comments regarding the current market structure, in the shadow of the FED, which is expected to drop rates yet again. Ms Trinh sees boosts in asset prices not translating into any real uptick in the real economy. She also sees some cracks in the one bright spark that is the US consumer. She points to lower US job openings in...

Read More »Bitcoin Myths, Report 27 Oct

Keith gave a keynote address—the only speaker with an hour to cover his topic—at the Gold and Alternative Investments Conference in Sydney on Saturday. Said topic was the nature of money. “Money is a matter of functions four: a medium, a measure, a standard, a store.” Most of the talk was structured around discussing these functions. Medium is pretty obvious: the dollar is the universal medium of exchange. It is basically frictionless, trading at zero spread (with...

Read More »Bundesbank Buys Gold – Increasing Concerns About Deutsche Bank, European Banks, the Euro and Dollar

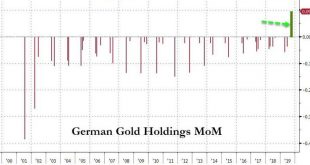

◆ The End Of Fiat In One Chart? ◆ For the first time in 21 years, Germany has openly bought gold into its reserve holdings ◆ With ECB mutiny and Deutsche Bank’s rapid demise, fears are rising of a looming financial crisis, and with that, Germany has shown a renewed interest in gold German Gold Holdings MoM, 1999-2019 - Click to enlarge ◆ Which came after Germany’s stunning announcement in January 2013 that the Bundesbank would repatriate 674 tons of gold from the...

Read More »JPMorgan Warns U.S. Money Market Stress to ‘Get Much Worse’

◆ Severe funding pressures in U.S. money markets tipped to resurface heading into year-end by JPMorgan who warn that financial stresses are likely to ‘get much worse’ ◆ Goldman Sachs and Bank of America also warn funding issues remain (see below) ◆ Federal Reserve will start buying $60 billion of Treasury bills every month ◆ Funding markets are on notice for a possible year-end liquidity crunch ◆ Growing stresses in U.S. banking and financial system should support...

Read More »Germany Increase Gold Reserves In September For The First Time In 21 Years – IMF

◆ The gold reserves of the German Bundesbank rose in September for the first time in 21 years; German gold reserves rose to 108.34 million ounces in September from 108.25 million ounces last month ◆ It was the Germany’s first gold purchase since 1998 and while the amounts are not huge at 90,000 troy ounces, it highlights the Bundesbank and German concerns about the global monetary system and euro itself as Christine Lagarde takes over the ECB ◆ International...

Read More »Yes, Gold “Just Sits There” and That’s Quite a Feat

The Wall Street Journal’s Jason Zweig famously referred to gold as a “Pet Rock” in 2015. He was blasted by people who understand that gold is no passing fad, and it serves some very important roles in an investment portfolio. The valuable roles played by gold have been well covered here. It’s a hedge against both inflation and deflation, it represents true diversification for portfolios stuffed with conventional securities, and it is a way of protecting wealth...

Read More »Wealth Accumulation Is Becoming Impossible, Report 20 Oct

We talk a lot about the falling interest rate, the too-low interest rate, the near-zero interest rate, the zero interest rate, and the negative interest rate. Hat Tip to Switzerland, where Credit Suisse is now going to pay depositors -0.85%. That is, if you lend your francs to this bank, they take some of them every year. Almost 1% of them. A bank deposit comes with a risk. But instead of compensating you for the risk, the bank pays you nothing. So it’s a return-free...

Read More »IMF Warning: ‘World’s Financial System Is More Stretched, Unstable and Dangerous Than It Was On the Eve of the Lehman Crisis’

◆ The International Monetary Fund (IMF) has again warned that the world’s financial system is more stretched, unstable and dangerous than it was on the eve of the Lehman crisis ◆ Quantitative easing, zero percent interest rates and massive financial repression has pushed investors – and in the case of pension funds or life insurers, actually forced them – into taking on ever more risk ◆ Ambrose Evans-Pritchard analyses the IMF warning in The Telegraph and concludes...

Read More »Libra cryptocurrency soldiers on despite key departures

Can Libra survive without partners such as Mastercard and Visa? (Copyright 2016 The Associated Press. All Rights Reserved. This Material May Not Be Published, Broadcast, Rewritten Or Redistribu) Facebook’s cryptocurrency payments project, Libra, has suffered a major blow with the withdrawal of seven key partners. But the Geneva-based Libra Association continues to battle on against a regulatory onslaught by adopting a charter and forming an executive team. Set in...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org