– Trump Cancels Historic Summit with North Korea – US 10-Year Falls Below 3%, Gold Jumps Back Above 00 – “Inflation Overshoot Could Be Helpful” – Latest FOMC Minutes– Gold Demand in Turkey as Lira falls sharply, true inflation near 40%– EU Crisis Looming as Italy Plan Outright ‘Money Printing’ with ‘Mini-Bots’– Silver Trading in Tight range, Pressure Building for a Breakout Weekly Report by Daniel MarchEditor Mark O’Byrne Gold and silver both ended the week up 0.93% and 0.61%, as many stock indices falling and ‘risk off’ sentiment returning. Trump surprised markets by cancelled the upcoming meeting with North Korea on Thursday, citing the recent ‘anger and hostilities’ in recent statements as the reason for

Topics:

Mark O'Byrne considers the following as important: 6) Gold and Austrian Economics, 6a) Gold & Bitcoin, Daily Market Update, Featured, GoldCore, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

– Gold Demand in Turkey as Lira falls sharply, true inflation near 40%

– EU Crisis Looming as Italy Plan Outright ‘Money Printing’ with ‘Mini-Bots’

– Silver Trading in Tight $1 range, Pressure Building for a Breakout

Weekly Report by Daniel March

Editor Mark O’Byrne

| Gold and silver both ended the week up 0.93% and 0.61%, as many stock indices falling and ‘risk off’ sentiment returning.

Trump surprised markets by cancelled the upcoming meeting with North Korea on Thursday, citing the recent ‘anger and hostilities’ in recent statements as the reason for the withdrawal. US Yields tumbled on the news (back below 3%) with the precious metals complex benefiting from the safe-haven buying, and gold jumping back above $1300. |

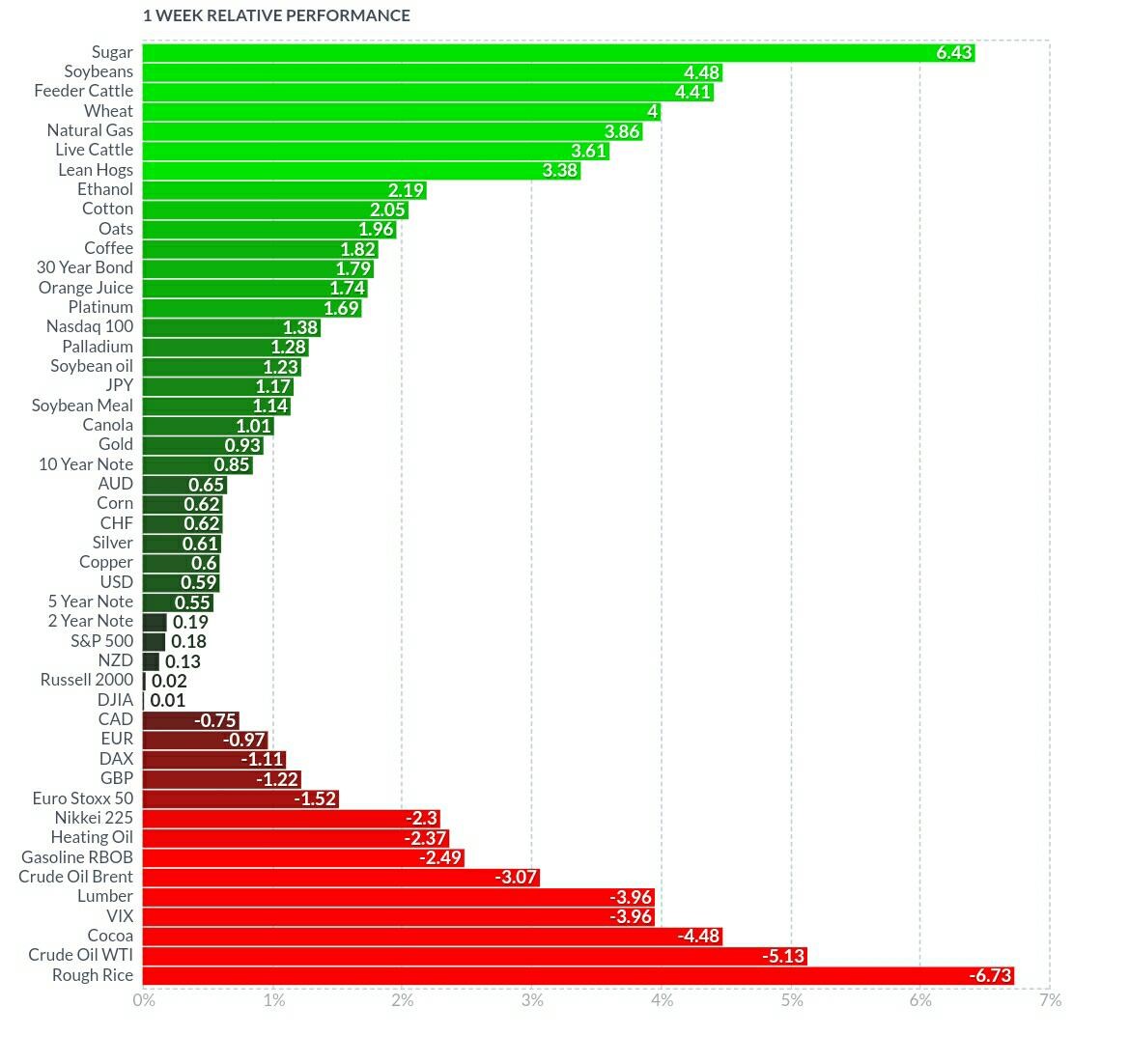

One week relative performance |

| In EUR gold ended up 1.9% at €1,117.73, and in GBP up 2.15% at £978.90, quickly closing in on the £1,000 per ounce level (see below).

With the data clearly pointing to a slowing economy, it was interesting to note the latest FOMC Minutes. In the statement released on Wednesday, the Fed noted a ‘modest inflation overshoot could be helpful’, and more importantly that ‘it may soon to change forward guidance’.Given these admissions, is the Fed giving the best hint yet that they are willing to stoke inflation in an attempt to revive a faltering economy? On economic data, New and Existing Home Sales for April came in less than expected, with New Sales reporting 662k vs 680k, and Retail Sales reporting 546k vs 556k. Perhaps the weaker data is a sign higher rates in the US are starting to deter buyers. Jobless claims in the US rose for the 2nd straight week, with 14,000 more people filling for unemployment insurance. The only data point to buck the trend was the Core Durable Orders rising 0.9% vs 0.5%. However, when you strip out military spending, capital orders actually fell last month. As we have reported before (see link) with a relatively high US 10-Year Yield (when compared to other G10 countries) and a strong US dollar, at some point the divergence will become too great. The Fed will likely be forced to realign to a more accommodative global policy. In other markets this week, crude Oil was one of the worst performers, ending down almost 5% on reports from Opec of plans to boost production. While the industrial metals of platinum, palladium and copper all ended higher (around 1-2%), which was strange given the stronger Dollar Index (up 0.6%), and the weaker than expected economic data. Such a move in the industrial complex questions whether we are heading into a late cycle growth period, similar to the late 1970’s, where commodities move higher, despite the data, stocking inflation along the way. While its too early to say for sure, the evidence is clearly pointing to a stagflationary outlook. And following on this trend, it was interesting to hear the latest view from JP Morgan, where their head of emerging markets, Luis Oganes, would “Not surprised if gold surpasses the $1,700/oz target set for next year.” and “Bullishness is related to the fact that US’ expansionary phase is in the late cycle where gold has historically rallied even after business cycle starts to turn. |

“Expensive” not to own gold in Turkey in recent months, years & throughout historyIn emerging markets, as we covered yesterday, Turkey continued to spiral out of control this week, with the Lira making new lows against the dollar. Possibly the most worrying development this week has been the speed of the Lira’s decline, with analysts estimating every 1% fall in the currency adds a further $1 billion to their debt.

Investors now receive almost 5 Lira for a single US dollar, which is an almost 80% decline in the value of the currency since late January. As a result inflation is soaring, with true inflation well above the official 10.9% being reported. Real or implied inflation is running closer to 40%.

In an interview last month the president of Turkey had the following to say on the situation:

“I made a suggestion at a G20 meeting, why do we make all loans in dollars? With the dollar the World is always under exchange rate pressure. We should save states and nations from this exchange rate pressure. What I’m saying is that these debts should be in Gold. Because at this point the karat of gold is unlike anything else.”

These comments come at a time when Turkey have just repatriated 220 tonnes of gold from the NY Fed. This move from Turkey, echoes the recent trend of global repatriation with Germany, Netherlands, Belgium and Austria, all opting to bring their back into home soil, in a clear sign of distrust for the current system (link).

Turkey, like other European Central Banks, understand the importance of holding gold in their own possession, and more importantly the role it could play in settling future global trade.

| There are signs that the crisis in the EU could be about to come roaring back.

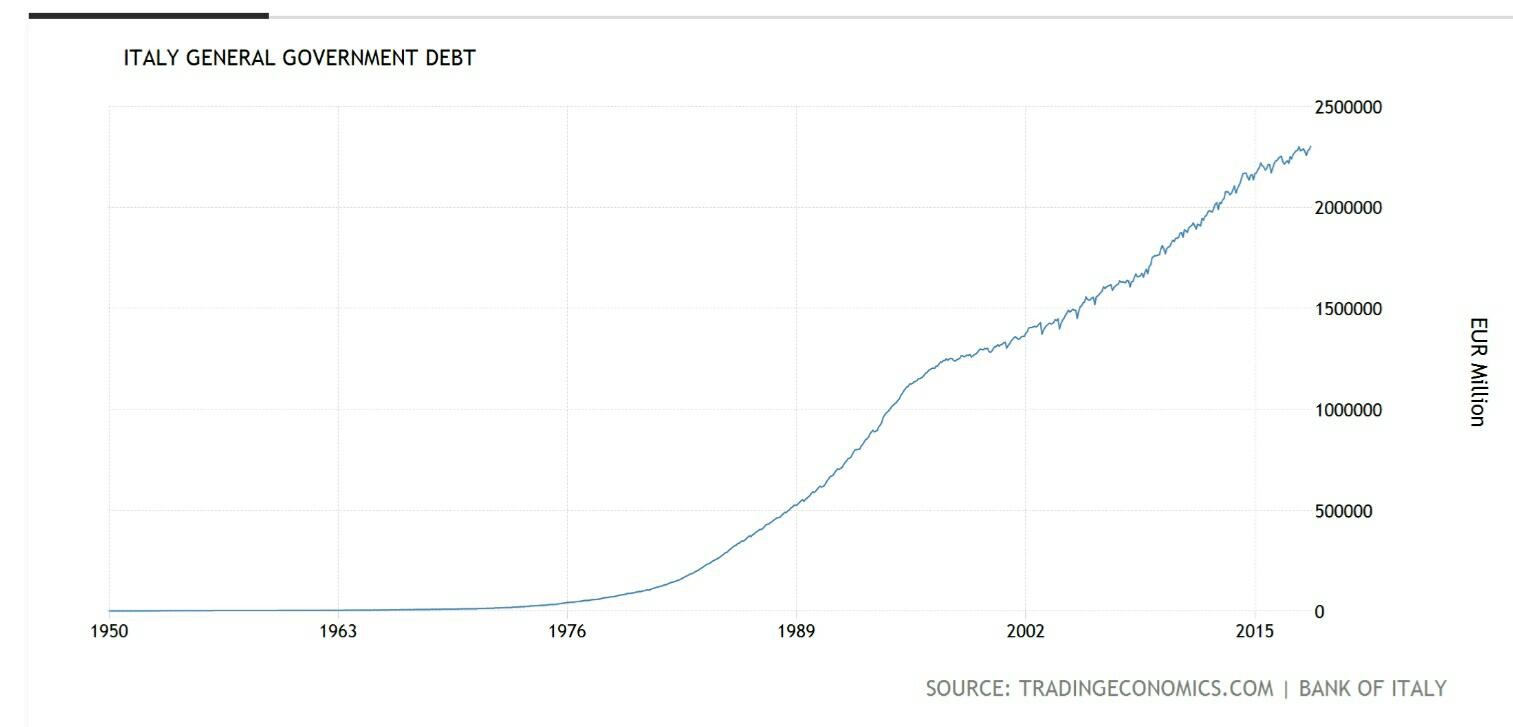

In Italy, the Anti Establishment ‘5 Star’ and far right ‘Lega’ look set to take power. The market continues to be unimpressed with the prospect of an Anti Establishment party ruling over one of the Euro’s founding members, with the yield on the Italian 10-Year continuing to push higher. The European marketplace seems to be particularly concerned with the coalition’s plans to boost spending through issuing ‘Mini-Bots’. A funky name, but a ‘Mini-Bot’, is just an Italian Treasury Bill, with the name a play on the word ‘Buoni Ordinari del Tesoro’. What is interesting about this form of funding, is unlike traditional Treasury bills, that are simply an electronic book keeping entry, the Mini Bot, will be physically printed by state lottery presses – so Italy will be quite literally ‘printing money’. The Mini Bot will be smaller in denomination, compared to traditional Treasury operations, ranging from €1-€500. In addition, the notes will have no interest coupon, nor maturity date, meaning they can circulate with the Italian economy as essentially a parallel currency. The concern for Europe is the potential for these notes to function in the wider economy, with holders bartering their Mini Bots at a discount against the face value for a wider range of goods and services – a potential scenario that would threaten the stability of the European Union. Given this daunting prospect for citizens holding Euros, perhaps now is a good time to protect their future purchasing power, and take some of their wealth offline (link). |

Italy General Government DEBT 1950-2018 |

| History has shown, time and again, the best form of protection when governments seek such fiat expansionary measures, is in the form of physical gold and silver.

From a technical perspective, gold is recovering strongly after dipping below the 200 dma, a trend noted in last week’s article (link). The key test will be see whether it can hold above $1300, and settle back above the 200 dma (currently at $1308, see below) in the run up to the June FOMC meeting, especially given gold’s tendency to sell off in the weeks leading up to the announcement. In silver the situation is even more interesting with both the 50 and 200 week moving averages now at the same level of $16.74. This alignment of the moving averages is further evidence of building energy in the silver market, that when it breaks will likely bring a sizeable move. For investors sitting on the side lines, sure silver may drift 2 or 3 % lower to the bottom of the range from here, but given the upside potential of when is does finally break, do you really want to take the chance of waiting? |

Gold Continuous Contract 2017-2018(see more posts on gold price, ) |

| Silver is trading in perhaps one of the tightest ranges in history, essentially a $1 range from $15.80-$16.80 (see above chart). And while no-one knows for sure the exact timing of a silver breakout, one thing is for sure, the above pattern cannot last for too much longer.

For investors not already positioned, now is a good time to be accumulating physical silver, especially given the low premiums over spot. And for those investors still waiting, just remember that while silver volatility has been low recently, when silver does finally breakout it usually happens very quickly leaving many people behind. |

Silver Continuous Contract 2016-2018(see more posts on silver price, ) |

As many readers will already know the commercials (traditionally the smart money) have been positioning for a breakout in silver for last 7 years (see link).

Looking ahead the main market moving event on the short term will likely be the ongoing developments between the US and North Korea, with changes from either side driving the popular risk on or risk off sentiment on the marketplace.

Also in addition to the on going uncertainty in Italy, Spain have become the latest Eurozone country to be placed ‘under the spot light’, with odds of an early election increasing after a vote of no confidence in the ruling government. Spanish 10-Year yields have jumped sharply this week, with the main concern Spain, could follow Italy in electing an anti-establishment party

There is plenty of economic data next week, so investors should brace for volatility. China report Manufacturing PMI on Wednesday, Europe give the latest inflation readings with CPI data Thursday, and the US provides the latest employment figures with the Non-Farm payrolls.

These geopolitical events, and economic data points will provide the near term direction for stocks, bonds, and most importantly the next direction in gold and silver.

Tags: Daily Market Update,Featured,newsletter