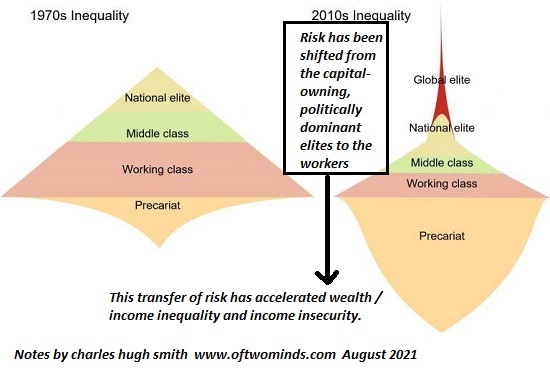

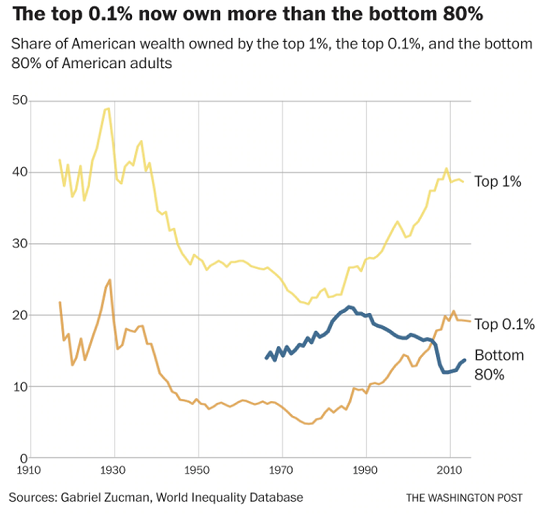

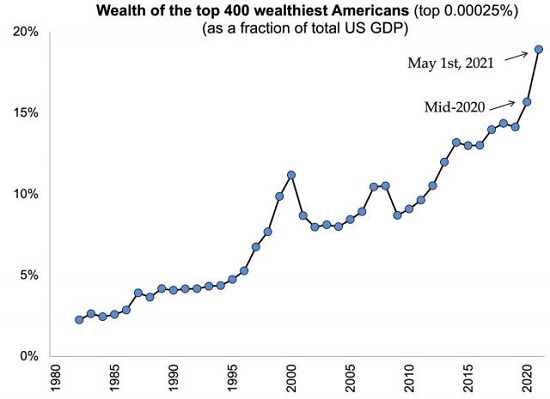

This wholesale transfer of risk from elites to the workers is finally becoming consequential as wealth / income / security inequality is reaching extremes that are destabilizing society and the economy. One of the most consequential financial trends of the past 50 years has been ignored to the point of invisibility. I’m referring to the transfer of risk from the top tier to the middle and working classes. This transfer of risk has been broad-based, covering the entire economic spectrum: 1. Employment has shifted from secure (low risk of uneven / unpredictable incomes for workers) to insecure / precariat (high risk of uneven / unpredictable incomes). Gig workers are classified as contract workers so they receive no benefits. . 2. Healthcare has been shifted

Topics:

Charles Hugh Smith considers the following as important: 5.) Charles Hugh Smith, 5) Global Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

|

This wholesale transfer of risk from elites to the workers is finally becoming consequential as wealth / income / security inequality is reaching extremes that are destabilizing society and the economy. One of the most consequential financial trends of the past 50 years has been ignored to the point of invisibility. I’m referring to the transfer of risk from the top tier to the middle and working classes. This transfer of risk has been broad-based, covering the entire economic spectrum: 1. Employment has shifted from secure (low risk of uneven / unpredictable incomes for workers) to insecure / precariat (high risk of uneven / unpredictable incomes). Gig workers are classified as contract workers so they receive no benefits. |

. |

| 2. Healthcare has been shifted to workers / government as corporations game employee hours to avoid paying healthcare; for those with coverage, monthly co-pays paid by workers are soaring as employers shift costs to employees. Healthcare plans have also shifted costs and risks to workers with high deductible plans, i.e. a simulacrum of healthcare insurance.

3. Private-sector pensions have shifted from defined-benefit pensions (costs and risks carried by employers) to 401K matching contributions (costs and risks carried by employees) 4. Federal Reserve policies have destroyed safe yields on savings and money-market accounts, forcing workers to take on the enormous risks of the rigged stock market casino (which is rigged to benefit high-frequency traders, front-running trading houses, and those with asymmetrically distributed information, i.e. insiders). 5. Tax burdens have shifted to the working poor (high Social Security/Medicare taxes), high-income workers (high income taxes), property owners (soaring property taxes) and small business while corporations and billionaires evade taxes with endless loopholes and subsidies. 6. Global corporations have shifted risk to small business via global environmental, regulatory, labor and currency arbitrage. Local governments fall all over themselves to give global corporations tax breaks and generous subsidies while heaping more junk fees and taxes on small business owned by ordinary citizens. |

. |

| This wholesale transfer of risk from elites to the workers is finally becoming consequential as wealth / income / security inequality is reaching extremes that are destabilizing society and the economy. As Gordon Long and I explain in our new video, The World Just Got a Lot Riskier crony capitalism has transmogrified into predatory capitalism as government, finance and the corporatocracy have allied into a seamless (and seamlessly corrupt) elite class that has offloaded systemic risk onto the unprotected class. As I often note, risk cannot be extinguished, it can only be transferred. Transferring risk to those least able to bear the consequences is in effect transferring risk to the financial system itself, which is magnifying the risks of a systemic breakdown. The herd is slumbering, anesthetized by the narcotic of the Federal Reserve’s infinite moral hazard. Once risk can no longer be suppressed, the herd will awaken and quicken into a stampede in which every individual will thunder off the cliff to catastrophic losses absolutely confident that the Fed has my back. So sorry, but the Fed only protects banking cronies, predatory capitalists, billionaires, front-running financiers and global corporations. Gordon and I discuss these heightened risks in |

. |

Tags: Featured,newsletter