It’s a peculiarity of the human psyche that it’s remarkably easy to be swept up in bubble mania and remarkably difficult to be swept up in the same way by the bubble’s inevitable collapse. Allow me to summarize the dominant zeitgeist in America at this juncture of history: Grab yourself a big gooey hunk of happiness by turning a few thousand bucks into millions– anyone can do it as long as they visualize abundance and join the crowd minting millions. Beneath the bravado and euphoric confidence in our God-given right to mint millions out of chump change, a secret plea lurks unspoken: please don’t pop our precious bubble! The big gooey hunk of happiness available to all depends on one special form of magic spell: If we don’t call the bubble a bubble, it won’t

Topics:

Charles Hugh Smith considers the following as important: 5.) Charles Hugh Smith, 5) Global Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

It’s a peculiarity of the human psyche that it’s remarkably easy to be swept up in bubble mania and remarkably difficult to be swept up in the same way by the bubble’s inevitable collapse.

Allow me to summarize the dominant zeitgeist in America at this juncture of history: Grab yourself a big gooey hunk of happiness by turning a few thousand bucks into millions– anyone can do it as long as they visualize abundance and join the crowd minting millions.

Beneath the bravado and euphoric confidence in our God-given right to mint millions out of chump change, a secret plea lurks unspoken: please don’t pop our precious bubble!

|

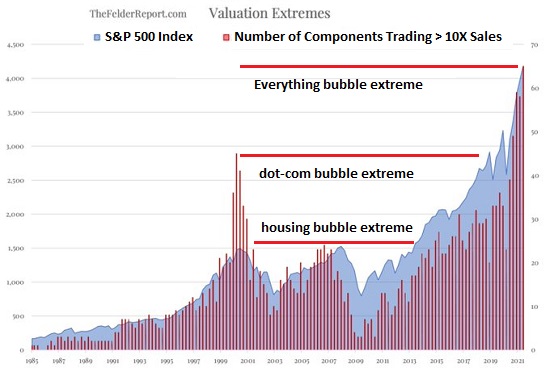

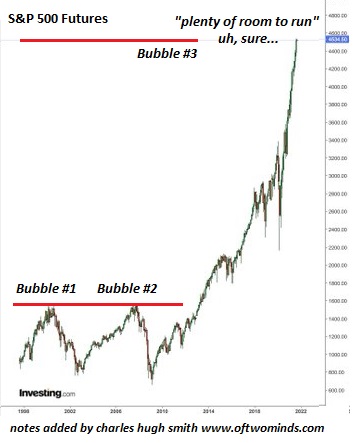

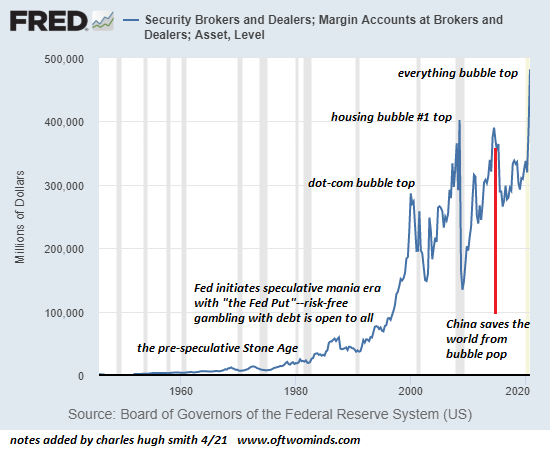

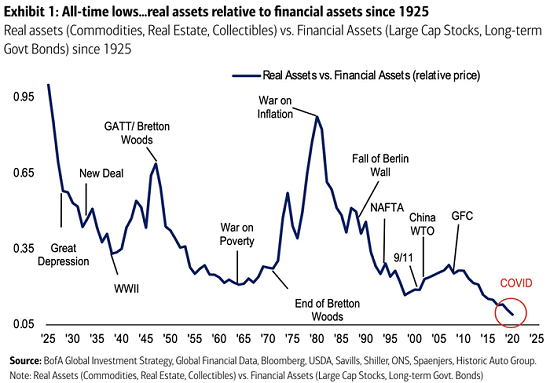

The big gooey hunk of happiness available to all depends on one special form of magic spell: If we don’t call the bubble a bubble, it won’t pop. And so Wall Street shills spew endless “research” (heh) proclaiming that the forward price-earnings ratio of 21.1 will only slightly exceed past norms, and so on–in summary: If we don’t call the bubble a bubble, it won’t pop. What differentiates this bubble from the 1720 South Seas Bubble, the 2000 dot-com bubble or the 2007-08 housing bubble is: this bubble includes every asset class and has sucked the entire populace and economy into its magic maw. The bubble has swept up housing, stocks, junk bonds, commodities, cryptocurrencies, NFTs, and numerous collectibles–the bulk of America’s household assets are now firmly lodged in the maw of the Everything Bubble. Here is a sampling of recent headlines in America: I turned $10,000 into $6 million in six months. My cat turned $6,000 in my RobinHood account into $6 million by walking on my keyboard. I turned $100 my aunt gave me for the birthday into $6 million in one trade, buying way out of the money calls on a meme stock. I turned $23 into $6 million so easily I’m going to sleep my way to $60 million. OK, so these are slight exaggerations, but the zeitgeist is very real. Another differentiating factor is the Everything Bubble has no boundaries. Flipping houses takes work as it is tied to the real-world house being flipped. But NFTs (non-fungible tokens) have no limits: an NFT can represent/instantiate a rock, photo, chipped glass, etc., and there are no limits on how many NFTs can be originated. In the Everything Bubble, it is not surprising that a significant percentage of Americans have bought NFTs and many view NFTs as legitimate investments equivalent to cryptos, stocks, bonds and housing. |

|

| The only problem with the if we don’t call the bubble a bubble, it won’t pop magic mantra is that it has an expiration date. Human greed is unlimited, the number of currency units that can be issued by central banks is unlimited, the number of NFTs that can be originated is unlimited, and magical thinking has no limits, but enough of the assets being inflated in the Everything Bubble have faint ties back to the real world such that the distortions in the imaginary world of infinite wealth end up distorting the real world, which is much less forgiving than the imaginary one.

All speculative manias pop, even if no one calls the mania a bubble. The first declines are bought, as buy the dip has never failed, but since the smart money sold long ago, there isn’t enough dumb money to keep the bubble inflating. Cats walking on keyboards start generating enormous losses, and all the punters who minted money are torn between HODL (hold on for dear life, i.e. never sell) or making outsized gambles on long shots that were guaranteed winners a few months ago. This continues until the $6 million roundtrips back to $6,000, and then the tax bill arrives: somehow minting millions accrued taxes that aren’t entirely offset by the losses. Or the margin call exceeds the liquidated value of the account, and the can’t-lose punter now owes the brokerage major money. But never mind the banquet of consequences currently being laid out: maybe if we all shout please don’t pop our precious bubble! the bubble will never pop and our $6 million will become $60 million and then $600 million. In the manic grip of euphoric confidence, it seems impossible the bubble will ever stop inflating. Every dip generates a rally, and the strategy of rotating out of a weakening sector into a hot-hot-hot sector will obviously work forever. It’s a peculiarity of the human psyche that it’s remarkably easy to be swept up |

|

| The banquet of consequences is being served, and everyone will attend. What you’re served depends on when you sold.

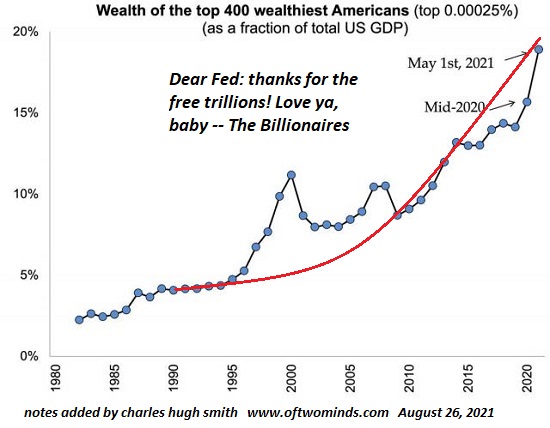

S&P 500 stocks over 10 times annual sales: please don’t pop our precious bubble! S&P 500 Everything Bubble compared to bubbles #1 and #2: please don’t pop our precious bubble! Billionaire wealth increasing in the Everything Bubble: please don’t pop our precious bubble! |

Tags: Featured,newsletter