The value of these super-abundant follies will trend rapidly to zero once margin calls and other bits of reality drastically reduce demand. Inflation, deflation, stagflation–they’ve all got proponents. But who’s going to be right? The difficulty here is that supply and demand are dynamic and so there are always things going up in price that haven’t changed materially (and are therefore not worth the higher cost) and other things dropping in price even though they...

Read More »When Risk and Opportunity Become Personal

The opportunity to lower our exposure to risk is always present in some fashion, but embracing this opportunity becomes critical when precarity and change-points rise like restless seas. The Chinese characters that comprise the equivalent of “crisis” are famously–and incorrectly–translated as “danger” and “opportunity.” This mis-translation has reached the peculiar prominence of being repeated often enough to be taken as accurate, but according to Wikipedia and...

Read More »When Everything Is Artifice and PR, Collapse Beckons

The notion that consequence can be as easily managed as PR is the ultimate artifice and the ultimate delusion. The consequences of the drip-drip-drip of moral decay is difficult to discern in day-to-day life. It’s easy to dismiss the ubiquity of artifice, PR, spin, corruption, racketeering, fraud, collusion and narrative manipulation (a.k.a. propaganda) as nothing more than human nature, but this dismissal of moral decay is nothing more than rationalizing the rot to...

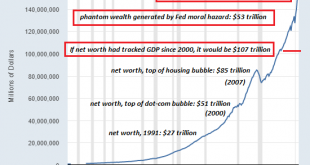

Read More »The Fed’s Moral Hazard Monster Is About to Lay Waste to “Wealth”

If the Fed set out to destroy the financial system, they’re very close to finishing the job. If you set out to destroy markets and the financial system, your most important weapon is moral hazard, the disconnection of risk and consequence. You disconnect risk from consequence by rewarding those making the riskiest bets and bailing out gamblers whose bets went bad. You reward those making the riskiest bets by pushing markets higher regardless of any other factors....

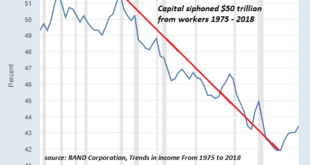

Read More »Top 1% Gains More Wealth Than the Combined GDPs of Japan, Germany, UK, France, India and Italy, Bottom 50%–You Get Nothing

Given that political power in America is a pay-to-play auction in which the highest bidder wins, how this incomprehensibly lopsided ownership of wealth plays out is an open question. Wealth inequality easily falls into an abstraction unless we contextualize it in meaningful ways. I’ve annotated two St. Louis Federal Reserve (FRED) charts–the net worth of America’s top 1% and the net worth of America’s bottom 50% of households, roughly 66 million households–to show...

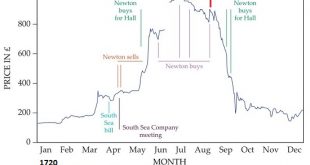

Read More »Paging Isaac Newton: Time to Buy the Top of This Bubble

Despite Newton’s tremendous intelligence and experience, he fell victim to the bubble along with the vast herd of credulous greedy punters. One of the most famous examples of smart people being sucked into a bubble and losing a packet as a result is Isaac Newton’s forays in and out of the 1720 South Seas Bubble that is estimated to have sucked in between 80% and 90% of the entire pool of investors in England. Some have claimed that Newton did not buy early in...

Read More »Look Out Below: Why a Rug-Pull Flash Crash Makes Perfect Sense

It makes perfect financial sense to crash the market and no sense to reward the retail options marks by pushing it higher. An extraordinary opportunity to scoop up mega-millions in profits has arisen, and grabbing all this free money makes perfect financial sense. Now the question is: will those who have the means to grab the dough have the guts to do so? Here’s the opportunity: retail punters have gone wild for call options, churning $2.6 trillion in mostly...

Read More »The Contrarian Trade of the Decade: The Dollar Refuses to Die

Which is more valuable: Wall Street’s debt/asset bubbles or the global empire? You can’t have both, so choose wisely. The consensus makes sense: the U.S. dollar is doomed because the Federal Reserve and the Treasury will conjure trillions of new dollars out of thin air to prop up the status quo entitlements, monopolies, cartels and debt/asset bubbles, and since little of this issuance actually increases productivity, all it will accomplish is the dilution /...

Read More »Eight Reasons Scarcities Will Increase Rather Than Evaporate

Who knew it would be so easy? All we have to do is collect urine and we’ll be flying our electric air taxi tomorrow! While the private-jet crowd is busy selling a future of 1 billion electric vehicles, 1 billion windmills, 1 billion solar arrays, hundreds of thousands of electric aircraft, thousands of new nuclear power plants and trillions more in “wealth” accumulating in their bloated ledgers, reality is intruding on their technocratic fantasies. The primary...

Read More »One Solution to Soaring Food Prices: Start Your 2022 Garden Now

There is a great deal of joy and satisfaction in gardening; benefits include saving money, eating healthier, sharing the bounty with others and reducing the derealization / derangement of modern life. There are few reasons to expect food prices to drop and many reasons to expect even higher prices ahead. Headlines like this are now standard: Global Food Prices Hit Fresh Decade High In October, and there is little evidence that the drivers of higher food...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org