If we no longer have the capacity to distinguish between moral legitimacy and self-serving corruption, then we might as well eliminate the Middleman and vote directly for Pfizer or Merck. There’s a fancy word for cutting out the Middleman: disintermediation. Removing intermediaries who take a cut but neither produce nor add value makes perfect sense, reducing costs and increasing efficiency. Maybe it’s time to eliminate the politicians who soak up hundreds of...

Read More »The Economy / Market Look “Healthy” Until They Have a Seizure and Collapse

So one index or asset or another hits a new high, wow, more proof everything is so robust and healthy, we never had it so good–right up to the seizure and collapse. Some readers occasionally make the point that I’ve been predicting a market crash for ten years and been dead-wrong for ten years. I’m all for mocking presumptuous pundits of either the tin-foil hat or mainstream variety, but that’s not quite what I’ve been saying for 13 long, tedious years. What I’ve...

Read More »What Will Surprise Us in 2022

What seemed so permanent for 13 long years will be revealed as shifting sand and what seemed so real for 13 long years will be revealed as illusion. Magical thinking isn’t optimism, it is folly. Predictions are hard, especially about the future, but let’s look at what we already know about 2022. Viewed from Earth orbit, 2022 is Year 14 of extend and pretend and too big to fail, too big to jail and Year 2 of global supply chains break and energy shortages. The essence...

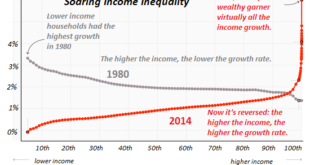

Read More »Watch the Top 5percent – They’re the Key to the Whole Economy

Go ahead and become dependent on asset bubbles and the free spending of the top 5%, and optimize your economy to serve this “growth,” but be prepared for the consequences when the costs of this optimization and dependency come due. Here’s the problem with concentrating most of the income and wealth in the top 5%: the whole economy now depends on their spending and “the wealth effect” of bubbles driving that spending. As the charts below show, the top tier of...

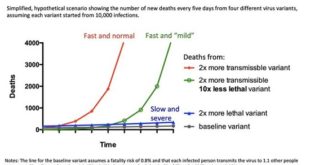

Read More »One Chart Traders Might Want to Ponder

But when the Fed’s fundamental powerlessness is revealed and the buy-the-dippers have been forced to liquidate, the true meaning of “mild” contagion will become apparent. Since I’d rather not be renditioned to a rat-infested, freezing cell in an unnamed ‘stan, I’m circumspect about viruses in general. (The WiFi signal is probably weak due to all the masonry walls and metallic torture devices, and as for the food–grilled rat, anyone?) My essay Virus Z: A Thought...

Read More »How Vulnerable Is Your Personal Supply Chain?

How vulnerable is your personal supply chain? For the average American, the answer is: very. Americans consider abundance and ready availability as birthrights so basic they’re like the air we breathe. The idea that shelves could become bare and stay bare is incomprehensible. yet that is the world we’re entering, for a number of complex reasons. One is that the world added not just another billion humans (now 7.9 billion), but one billion middle-class consumers,...

Read More »Smart Enough to Get Rich, Not Smart Enough to Keep It

Are we smart enough to keep our oh-so-easily conjured riches? If we continue to believe that doing more of what’s failed spectacularly will deliver permanently expanding riches, then the answer is no. Near the end of his monumental 400+-page analysis of the notion that alternative energy sources can replace hydrocarbon fuels, (Energy and Human Ambitions on a Finite Planet), Thomas Murphy discusses the really big picture: mass extinction events and species’ role in...

Read More »Get in Crash Positions

When the market goes bidless, it’s too late to preserve capital, never mind all those life-changing gains. Everyone with some gray in their ponytails knows the stock market has ticked every box for a bubble top, so everybody get in crash positions: Let’s run through the requirements for a bubble top: 1. Retail investors (i.e. dumb money) are all in and buying the dip with absolute confidence. As the gray-ponytail traders know, there are many moving parts to the...

Read More »Xi’s Gambit: China at the Crossroads

If Xi’s gambit succeeds, China could become a magnet for global capital. If success is only partial or temporary, China may well struggle with the structural excesses that are piling up not just in China but in the entire global economy. As noted here last month, the Chinese characters that comprise “crisis” are famously–and incorrectly–translated as “danger” and “opportunity.” The more accurate translation is “precarious” plus “juncture” or “change point.” (Thank...

Read More »The Long Cycles Have All Turned: Look Out Below

But alas, humans do not possess god-like powers, they only possess hubris, and so all bubbles pop: the more extreme the bubble, the more devastating the pop. Long cycles operate at such a glacial pace they’re easily dismissed as either figments of fevered imagination or this time it’s different. But since Nature and human nature remain stubbornly grounded by the same old dynamics, cycles eventually turn and the world changes dramatically. Nobody thinks the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org