It’s time to reprogram the conditions of the economy to serve the many rather than the few. Star Trek’s Kobayashi Maru training exercise tests officer candidates’ response to a no-win scenario:any attempt to rescue the crippled ship’s crew results in the destruction of the candidate’s ship, while standing by and taking no action results in the loss of the Kobayashi Maru’s crew. Captain Kirk famously defeated this no-win scenario by reprogramming the simulation to...

Read More »The Difference Between a Forecast and a Guess

Every forecast or guess has one refreshing quality: one will be right and the rest will be wrong. What’s the difference between a forecast and a guess? On one level, the answer is “none”: the future is unknown and even the most informed forecast is still a guess. The evidence for this is the remarkable number of informed forecasts that prove to be as completely off-base as the wildest guesses. On another level, there is a big difference between an informed forecast...

Read More »Could Retail “Bagholders” Spark a Rally “Smart Money” Will Be Forced to Chase?

There would be some deliciously karmic justice in the “dumb money” driving a rally that forced the “smart money” to cover their shorts and chase the rally that shouldn’t even be happening. Being cursed with contrarianism, as soon as a trade gets crowded and the consensus is one way, I start looking for whatever is considered so unlikely that it’s essentially “impossible.” Sorry, I can’t help myself. The crowded trades are 1) long the Commodity Super-Cycle and 2) long...

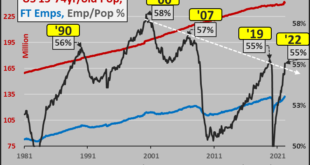

Read More »What Happens When the Workforce No Longer Wants to Work?

Workers are voting with their feet, and that’s difficult to control. When values and expectations change, everything else eventually changes, too. What happens when the workforce no longer wants to work? We’re about to find out. As with all cultural sea changes, macro statistics don’t tell the full story. The sea change is better illuminated by anecdotal evidence: workers constantly quitting to take better jobs; zero loyalty to corporate employers; workers cutting...

Read More »There’s No Stopping a Recessionary Reckoning

If there was only one causal factor nudging the economy into recession, it might be a mild, brief recession. But with all five conditions in confluence, this recession will be unlike any other. Recessions reliably arise from the confluence of these conditions. Note that any one condition can trigger a recession, but no one condition guarantees a recession. Severe, long-lasting recessions occur when multiple conditions arise at the same time. 1. The business cycle....

Read More »“Pay-to-Play” for the Rest of Us

The more kafkaesque quagmires you’ve slogged through, the more you hope “pay-to-play for the rest of us” beomes ubiquitous. You know how “pay-to-play” works: contribute a couple of million dollars to key political players, and then get your tax break, subsidy, no-bid contract, etc., slipped into some nook or cranny of the legislative process that few (if any) will notice because the legislation is hundreds of pages long or a “gut and replace” magic wand was wielded...

Read More »Who’s Going to Fix What’s Broken?

When nobody cares that systems have broken down and there is no will or interest in fixing essential systems, there is no happy ending. Who fixes systems when they break down? The answer appears to be: nobody. Here are three everyday examples from my own life, breakdowns which may be random and rare but which the odds suggest are systemic. Let’s assume I’m not an unlucky one in a million but just another recipient of systemic breakdown. 1. U.S. Mail forwarding six...

Read More »Why America Decays: The Tyranny of Self-Interest

Only those societies which still have a functional public interest / common good will survive; those ruled by the tyranny of self-interest will fall. I’ve discussed the moral rot consuming the American Project in blog posts and my books. This moral rot–perhaps better described as civic decay–is so pervasive and ubiquitous that we are forgiven for assuming “this is the way it’s always been.” This inability to discern the rot is the result of the gradualness of the...

Read More »Livelihoods in a Degrowth Economy

The sooner we start preparing for degrowth, the better off we’ll be. A Chinese proverb captures this succinctly: By the time you’re thirsty, it’s too late to dig a well. Let’s consider livelihood options in an unsustainable economy of extremes that are unraveling, an economy that is being forced to transition to Degrowth. Nassim Taleb’s book Antifragile explains the differences between fragile systems (systems that cannot survive instability), resilient systems...

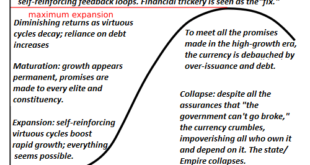

Read More »Checking In On Five Long-Term Cycles

The decline phase of S-Curves can be gradual or a cliff-dive. Way back in 2007 I charted five long-wave cycles that I reckoned consequential: 1. Public debt (accumulating federal deficits) 2. Inflation 3. Oil (energy) 4. Interest rates 5. Speculative fever Fifteen years ago, my chart look-ahead was about three years, to 2010, with the basic idea being that these long-term cycles had already turned or were about to turn. Looking back, I should have added a few...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org