If there was only one causal factor nudging the economy into recession, it might be a mild, brief recession. But with all five conditions in confluence, this recession will be unlike any other. Recessions reliably arise from the confluence of these conditions. Note that any one condition can trigger a recession, but no one condition guarantees a recession. Severe, long-lasting recessions occur when multiple conditions arise at the same time. 1. The business cycle. The business cycle reflects human nature interacting with finance: as credit loosens, people borrow more to spend and invest, and this generates a self-reinforcing virtuous cycle of expansion. Profits expand, speculation is rewarded and the positive vibes notch up to euphoric confidence in future

Topics:

Charles Hugh Smith considers the following as important: 5.) Charles Hugh Smith, 5) Global Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

If there was only one causal factor nudging the economy into recession, it might be a mild, brief recession. But with all five conditions in confluence, this recession will be unlike any other.

Recessions reliably arise from the confluence of these conditions. Note that any one condition can trigger a recession, but no one condition guarantees a recession. Severe, long-lasting recessions occur when multiple conditions arise at the same time.

1. The business cycle. The business cycle reflects human nature interacting with finance: as credit loosens, people borrow more to spend and invest, and this generates a self-reinforcing virtuous cycle of expansion.

Profits expand, speculation is rewarded and the positive vibes notch up to euphoric confidence in future expansion.

Enterprises over-order to maintain inventories, hire more staff to expand production and go on a shopping spree, snapping up other companies by issuing more stock or borrowing via the bond market.

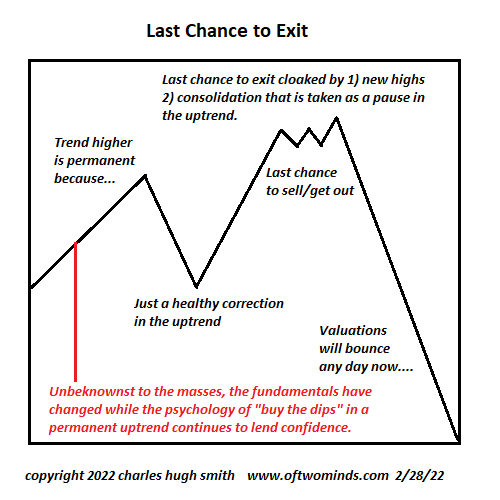

In this confluence of greed and euphoria, people over-borrow and put the money into marginal investments and speculations that unravel. Defaults rise, credit tightens, the mood sours and profits tank. Speculations crash, layoffs boost unemployment, consumers trim debt and enterprises work off excess inventory.

This is a conventional business-cycle recession: excesses are worked off and the dead wood consumed by write-offs and defaults. This a healthy process that is required to set the stage for the next cycle of expansion.

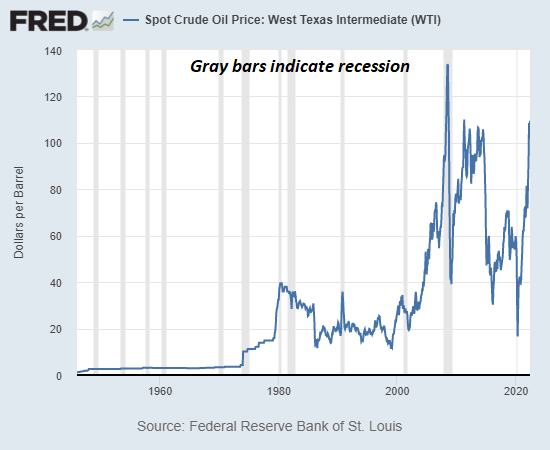

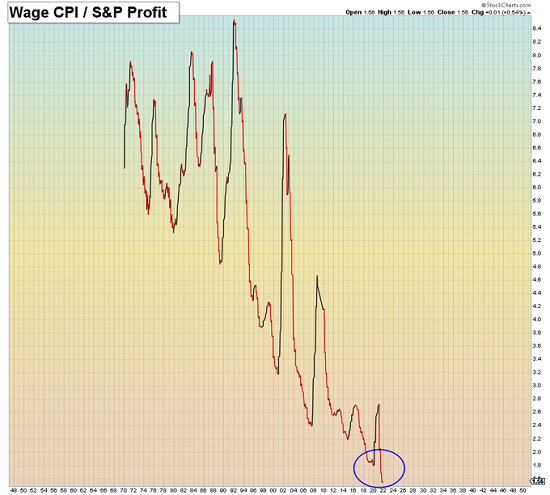

| 2. High energy prices. Higher energy costs don’t necessarily trigger recessions but they can push an overleveraged economy into recession. The basic dynamic is simple: energy costs can rise sharply, while wages rise over time. As consumers pay more for energy, they have less to spend on other goods and services. Discretionary spending falls, triggering a slowdown that dampens borrowing, speculation and the general mood. The virtuous cycle reverses and the slowdown become self-reinforcing.

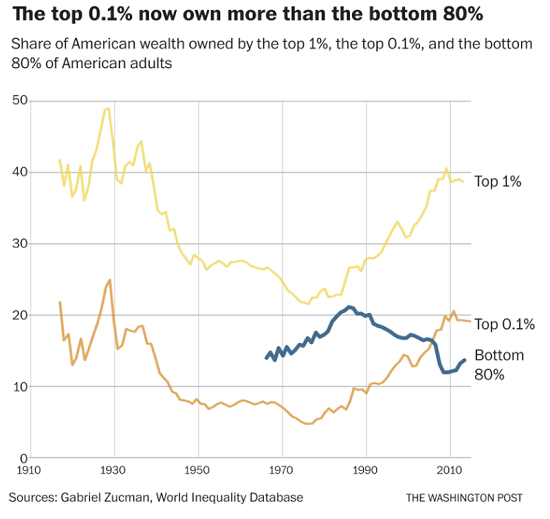

3. Inflationary pressures other than energy. Central bank stimulus (opening the floodgates of low-cost credit) and federal stimulus (free money) both tend to generate inflationary pressure as a flood of new money chases the existing supply of goods and services. Wages that lagged speculative gains and corporate profits may finally start catching up, pushing costs higher. Monopolies and cartels tend to raise prices regardless of other conditions, for example, healthcare, higher education, local government fees and taxes, etc. 4. Excessive debt-funded speculation. Loose credit tends to invite excessive speculation which fuels a wealth effect as speculative gains make us feel we can afford to spend more now that we’re richer. But speculative excesses inevitably reverse and losses generate a reverse wealth effect, dampening both speculation and spending. 5. Secular shifts in the economy. There are many potential sources for secular shifts that play out over years or even decades. Examples include: new global competition (1970s); currency devaluations; costs of cleaning up decades of pollution (1970s); financialization (1980s to the present), geopolitical shifts in alliances, social disorder, demographics (aging of the workforce, mass retirement) and sea changes in the distribution of income and power to labor and capital. Are any of these conditions present in today’s economy? End of business cycle, check. High energy costs, check. Other inflationary pressures, check. Excessive speculation unwinding, check. Secular shifts in the geopolitical landscape, currencies, demographics and labor/capital, check. Just to state the obvious: since stimulus generated the inflation weighing on the economy, stimulus can’t be used to stave off a business-cycle recession. The pendulum has swung to extremes and the banquet of consequences has been set. There are no Hollywood super-heroes who can put off the recessionary reckoning that is long overdue. If there was only one causal factor nudging the economy into recession, it might be a mild, brief recession. But with all five conditions in confluence, this recession will be unlike any other. |

Tags: Featured,newsletter