Readers ask for specific recommendations for successfully navigating the post-credit/speculative-bubble era and I try to do so while explaining the impossibility of the task. As the bogus prosperity economy built on exponential growth of debt implodes, we all seek ways to protect ourselves, our families and our worldly assets. There are any number of websites, subscription services and books which offer two basic “practical recommendations:” 1. Buy gold (and/or...

Read More »Where the Rubber Meets the Road

Longtime correspondent Paul B. suggested I re-publish three essays that have renewed relevance. This is the second essay, from July 2008. Thank you, Paul, for the suggestion. I received this timely inquiry from astute reader Paul B.: I’m interested in # 1, while you seem to take into account 300 million people in your writings–would you comment on rubber-meets-the-road impacts and proactive actions we can take to help shield ourselves (and our local communities) from...

Read More »The Art of Survival, Taoism and the Warring States

Longtime correspondent Paul B. suggested I re-publish three essays that have renewed relevance. This is the first essay, from June 2008. Thank you, Paul, for the suggestion. I’m not trying to be difficult, but I can’t help cutting against the grain on topics like surviving the coming bad times when my experience runs counter to the standard received wisdom. A common thread within most discussions of surviving bad times–especially really bad times–runs more or less...

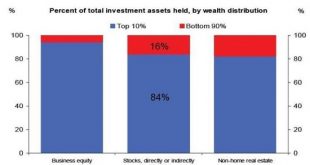

Read More »Why Assets Will Crash

This is how it happens that boats that were once worth tens of thousands of dollars are set adrift by owners who can no longer afford to pay slip fees. The increasing concentration of the ownership of wealth/assets in the top 10% has an under-appreciated consequence: when only the top 10% can afford to buy assets, that unleashes an almost karmic payback for the narrowing of ownership, a.k.a. soaring wealth and income inequality: assets crash. Most of you are aware...

Read More »With Superfluous Demand in Free-Fall, What’s the Upside of Re-Opening a Small Business?

Since superfluous demand was the core driver of most consumer spending, and that demand is in free-fall, what’s the upside of re-opening? The mainstream view assumes everyone will be gripped by an absolutely rabid desire to return to their pre-pandemic frenzy of borrowing and spending and consuming, the more the better. While the urge to believe the Titanic scraping the iceberg will have no consequence and the collision was nothing but a spot of bother is compelling...

Read More »The Crash Has Only Just Begun

Everything, including a rational, connected-to-reality, effective financial system, is on back-order and unlikely to ship any time soon. While the stock market euphorically front-runs the Fed and a V-shaped recovery, the reality is the crash has only just begun. To understand why, look at income and debt. Income–earned and unearned–is in free-fall, while debt–which must be serviced by income–is exploding higher. Bailouts are not a permanent substitute for income. In...

Read More »Overcapacity / Oversupply Everywhere: Massive Deflation Ahead

The price of a great many assets will crash, out of proportion to the decline in demand. Oil is the poster child of the forces driving massive deflation: overcapacity / oversupply and a collapse in demand. Overcapacity / oversupply and a collapse in demand are not limited to the crude oil market; rather, they are the dominant realities in the global economy. Yes, there are shortages in a few high-demand areas such as PPE (personal protective equipment), but across...

Read More »Between a Rock and a Hard Place: Pandemic and Growth

There is no way authorities can limit the coronavirus and restore global growth and debt expansion to December 2019 levels. Authorities around the world are between a rock and a hard place: they need policies that both limit the spread of the coronavirus and allow their economies to “open for business.” The two demands are inherently incompatible, and so neither one can be fulfilled. The problem is the intrinsic natures of the virus and the global economy. This...

Read More »There’s No Going Back, We Can Only Go Forward

What I see is a global collapse of intangible capital that is invisible to most people. It’s only natural that the conventional expectation is a return to the pre-pandemic world is just a matter of time. Whether it’s three months or six months or 18 months, “the good old days” will return just as if we turned back the clock. I think the situation is much more akin to being injured. Since I worked for decades in construction, I’ve had numerous potentially serious...

Read More »Buy The Tumor, Sell the News

The fictitious valuation of the stock market will eventually re-connect with reality in a violent decline. No, buy the tumor, sell the news ™ is not a typo: the stock market is a lethal tumor in our economy and society. Buy the rumor, sell the news encapsulates the old traders’ wisdom that markets rise on the sizzle of hope, promises, projections, Federal Reserve pimping (see below), tax cuts, etc. etc. etc., not on the actual steak of sales and profits. Buy the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org