In 2020, increasing monetary and fiscal stimulus will be the equivalent of spraying gasoline on a fire to extinguish it. Economically, the 11 years since the Global Financial Crisis of 2008-09 have been one relatively coherent era of modest growth, rising wealth/income inequality and coordinated central bank stimulus every time a crisis threatened to disrupt the domestic or global economy. This era will draw to a close in 2020 and a new era of destabilization and...

Read More »Just a Friendly Heads-Up, Bulls: The Fed Just Slashed its Balance Sheet

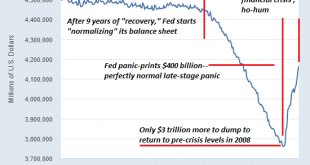

Perhaps even PhD economists notice that manic-mania bubbles always burst–always. Just a friendly heads-up to all the Bulls bowing and murmuring prayers to the Golden Idol of the Federal Reserve: the Fed just slashed its balance sheet–yes, reduced its assets. After panic-printing $410 billion in a few months, a $24 billion decline isn’t much, but it does suggest the Fed might finally be worrying about the reckless, insane bubble it inflated: August 28, 2019: $3.760...

Read More »The Fed Can’t Reverse the Decline of Financialization and Globalization

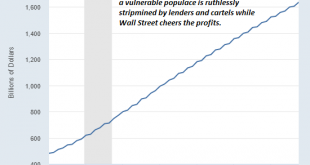

The global economy and financial system are both running on the last toxic fumes of financialization and globalization. For two generations, globalization and financialization have been the two engines of global growth and soaring assets. Globalization can mean many things, but its beating heart is the arbitraging of the labor of the powerless, and commodity, environmental and tax costs by the powerful to increase their profits and wealth. In other...

Read More »Is This “The Top”?

Parabolic moves end when the confidence that the parabolic move can’t end becomes the consensus. The consensus seems to be that the stock market is on its way to much higher levels, and soon. The near-term targets for the S&P 500 (SPX, currently around 3,235) range from 3,500 to 4,000, with longer-term targets reaching “the sky’s the limit.” The consensus reasoning goes like this: — Central banks can print a lot more money — Stocks rise when central banks...

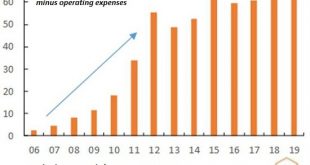

Read More »The Two Charts You Need to Ignore or Rationalize Away in 2020 (Unless You’re a Bear)

If you believe you’ve front-run the herd, you’re now in mid-air along with the rest of the herd that has thundered off the cliff. We’re awash in financial charts, but only a few crystallize an entire year. Here are the two charts that sum up everything you need to know about the stock market in 2020. Put another way–these are the two charts you need to ignore or rationalize away–unless you’re a Bear, of course, in which case you’ll want to tape a printed copy next to...

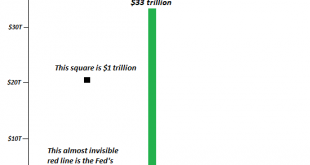

Read More »The Fed’s “Not-QE” and the $33 Trillion Stock Market in Three Charts

One day the stock market ‘falcon’ will no longer hear the Fed ‘falconer’, and the Pavlovian magical thinking will break down as the market goes bidless. The past decade has shown that when the Federal Reserve creates trillions of dollars out of thin air (QE), U.S. stocks rise accordingly. The correlation is very nearly perfect. This has given rise to the belief that buyers of stocks will always be rewarded because “the Fed has our backs.” The evidence for this...

Read More »The Hour Is Getting Late

After 11 years of “the Fed is the market” expansion, the Fed has now reduced its bloated balance sheet by 6.7%. This is normal, right? So here we are in Year 11 of the longest economic expansion/ stock market bubble in recent history, and by any measure, the hour is getting late, to quote Mr. Dylan: So let us not talk falsely now the hour is getting late Bob Dylan, “All Along the Watchtower” The question is: what would happen if we stop talking falsely? What would...

Read More »Is Social Media the New Tobacco?

If we set out to design a highly addictive platform that optimized the most toxic, destructive aspects of human nature, we’d eventually come up with social media. Social problems arise when initially harmless addictions explode in popularity, and economic problems arise when the long-term costs of the addictions start adding up. Political problems arise when the addictions are so immensely profitable that the companies skimming the profits can buy political influence...

Read More »Welcome to the Era of Intensifying Chaos and New Weapons of Conflict

Geopolitics has moved from a slow-moving, relatively predictable chess match to rapidly evolving 3-D chess in which the rules keep changing in unpredictable ways. A declining standard of living in the developed world, declining growth for the developed world and geopolitical jockeying for control of resources make for a highly combustible mix awaiting a spark: welcome to the era of intensifying chaos and the rapid advance of new weapons of conflict as ruling elites...

Read More »Our Fragmentation Accelerates

As our fragmentation accelerates, shared economic interests are ignored in favor of divisive warring camps that share no common interests. That our society and economy are fragmenting is self-evident. This fragmentation is accelerating rapidly, as middle ground vanishes and competing camps harden their positions to solidify the loyalty of the “tribe.” All or nothing, either-or binaries are the order of the day: you’re either 100% with us or 100% against us, you’re...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org