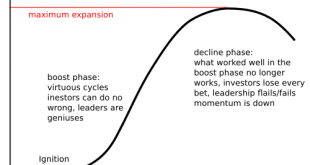

The decline phase of the S-Curve is just beginning. Globalization and Imperial Pretensions have been decaying for years; now the tide has turned definitively against them. The Covid-19 pandemic didn’t cause the demise of globalization and Imperial Pretensions; it merely pushed the rickety structures over the edge. It’s human nature to reckon the current trend will continue running more or less forever, and that temporal, contingent structures are...

Read More »And Then Came the Lawsuits: Pandemic in a Litigious Society

This is the upside of hyper-litigiousness: prevention is prioritized as the most effective means of limiting future liability. Never mind prevention or vaccines; the big question is “who can we sue after this blows over to rake in millions of dollars?” Yes, this is pathetic, tragic, perverse and evil, but that’s reality in a hyper-litigious society like the U.S. Many people are struck by the apparent over-reaction of Corporate America to the Covid-19 threat, but this...

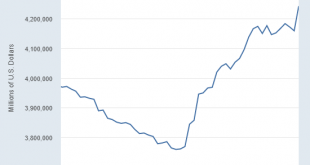

Read More »What the Fed Can Do: Print and Buy, Buy, Buy

Everyone with a pension fund or 401K invested in stocks better hope the Fed becomes the buyer of last resort, and soon. Much has been written about what the Federal Reserve cannot do: it can’t stop the Covid-19 pandemic or reverse the economic damage unleashed by the pandemic. But let’s not overlook what the Fed can do: create U.S. dollars out of thin air and use these dollars to buy assets either directly or through proxies. Let’s also not overlook how much the Fed...

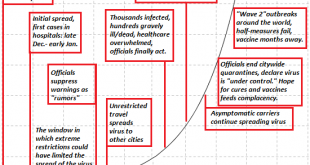

Read More »The Gathering Storm: Could Covid-19 Overwhelm Us in the Months Ahead?

Either the science is wrong and the complacent will be proven correct, or the science is correct and the complacent will be wrong. The present disconnect between the science of Covid-19 and the status quo’s complacency is truly crazy-making, as we face a binary situation: either the science is correct and all the complacent are wrong, or the science is false and all the complacent are correct that the virus is no big deal and nothing to fret about. Complacency is...

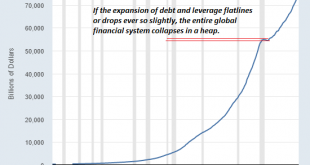

Read More »Did Covid-19 Just Pop All the Global Financial Bubbles?

Once confidence and certainty are lost, the willingness to expand debt and leverage collapses. Even though the first-order effects of the Covid-19 pandemic are still impossible to predict, it’s already possible to ask: did the pandemic pop all the global financial bubbles? The reason we can ask this question is the entire bull mania of the 21st century has been based on a permanently high rate of expansion of leverage and debt. The lesson of the 2008-09 Global...

Read More »The Limits of Force: A Bayonet in the Back Will Not Restore China’s Economy

Force cannot restore legitimacy, trust or confidence, nor can it magically erase the consequences of a still-unfolding national trauma. The Chinese authorities threatening to punish workers who refuse to return to work are getting a lesson in the limits of force in an unprecedented national trauma: a bayonet in the back will not restore the legitimacy and confidence that have been lost. There are two enormous blind spots in conventional media coverage of the...

Read More »Could the Covid-19 Pandemic Collapse the U.S. Healthcare System?

Disregard these second-order effects at your own peril. A great many systems that are assumed to be robust are actually fragile. Exhibit #1 is the global financial system, of course, but Exhibit #2 may well be the healthcare system globally and in the U.S. Observers have noted that the number of available beds in U.S. hospitals is modest compared to the potential demands of a pandemic, and others have wondered who will pay the astronomical bills that will be...

Read More »No, The Fed Will Not “Save the Market”–Here’s Why

The greater the excesses, speculative euphoria and moral hazard, the greater the reversal. A very convenient conviction is rising in the panicked financial netherworld that the Federal Reserve and its fellow dark lords will “save the market” from COVID-19 collapse. They won’t. I already explained why in The Fed Has Created a Monster Bubble It Can No Longer Control (February 16, 2020) but it bears repeating. Contrary to naive expectations, the Fed’s primary job isn’t...

Read More »When Will We Admit Covid-19 Is Unstoppable and Global Depression Is Inevitable?

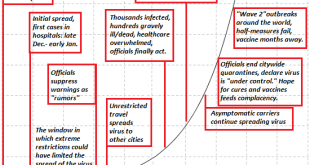

Given the exquisite precariousness of the global financial system and economy, hopes for a brief and mild downturn are wildly unrealistic. If we asked a panel of epidemiologists to imagine a virus optimized for rapid spread globally and high lethality, they’d likely include these characteristics: 1. Highly contagious, with an R0 of 3 or higher. 2. A novel virus, so there’s no immunity via previous exposure. 3. Those carrying the pathogen can infect others while...

Read More »Covid-19: Global Retrenchment Will Obliterate Sales, Profits and Yes, Big Tech

If you think global demand will rebound as global debt and confidence implode, you better not be making consequential decisions based on Euphorestra-addled magical thinking. Even before the Covid-19 pandemic, the global economy was slowing for two reasons: 1) everybody who can afford it already has it and 2) overcapacity. One word captures the end-of-the-cycle stagnation: saturation. Everyone who can afford a smartphone (or can borrow to buy one) already has...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org