This collapse of price will manifest in all sorts of markets that are based on debt-funded purchases of desires rather than a warily prudent priority on needs. Since markets are supposed to discover the price of excesses and scarcities, it’s a mystery why everything that is in oversupply is still grossly overpriced as global demand slides off a cliff: oil, semiconductors, Uber rides, AirBNB listings and many other risk-on / global growth stories are still priced as...

Read More »The Fed Has Created a Monster Bubble It Can No Longer Control

The Fed must now accept responsibility for what happens in the end-game of the Moral-Hazard Monster Bubble it created. Contrary to popular opinion, the Federal Reserve didn’t set out to create a Monster Bubble that has escaped its control. Also contrary to popular opinion, the Fed will be unable to “never let stocks fall ever again–ever!” for the simple reason that the monster it has created– a monster mania of moral hazard in which all risk has vanished...

Read More »China’s Fatal Dilemma

Ending the limited quarantine and falsely proclaiming China safe for visitors and business travelers will only re-introduce the virus to workplaces and infect foreigners. China faces an inescapably fatal dilemma: to save its economy from collapse, China’s leadership must end the quarantines soon and declare China “safe for travel and open for business” to the rest of the world. But since 5+ million people left Wuhan to go home for New Years, dispersing throughout...

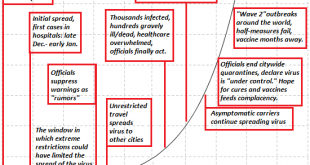

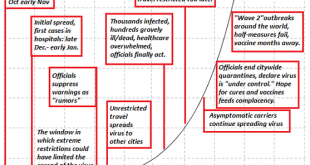

Read More »Controlling the Narrative Is Not the Same as Controlling the Virus

Are these claims even remotely plausible for a highly contagious virus that spreads easily between humans while carriers show no symptoms? It’s clear that the narrative about the coronavirus is being carefully managed globally to minimize the impact on global sentiment and markets. Authorities are well aware of the global economy’s extreme fragility, and so Job One for authorities everywhere is to scrub the news flow of anything that doesn’t support the implicit...

Read More »Pandemic, Lies and Videos

Will we wonder, what were we thinking? and marvel anew at the madness of crowds? When we look back on this moment from the vantage of history, what will we think? Will we think how obvious it was that the coronavirus deaths in China were in the tens of thousands rather than the hundreds claimed by authorities? Will we think how obvious it was that the virus would spread around the globe, wreaking havoc on the global economy and social order, even as the authorities...

Read More »Brace for Impact: Global Pandemic Already Baked In

If we accept what is known about the virus, then logic, science and probabilities all suggest we brace for impact. Here’s a summary of what is known or credibly estimated about the 2019-nCoV virus as of January 31, 2019: 1. A statistical study from highly credentialed Chinese academics estimates the virus has an RO (R-naught) of slightly over 4, meaning every carrier infects four other people on average. This is very high. Run-of-the-mill flu viruses average about...

Read More »Second-Order Effects: The Unexpectedly Slippery Path to Dow 10,000

Dow 30,000 is “unsinkable,” just like the Titanic. A recent Barrons cover celebrating the euphoric inevitability of Dow 30,000 captured the mainstream zeitgeist perfectly: Corporate America is firing on all cylinders, the Federal Reserve’s god-like powers will push stocks higher regardless of any other reality, blah blah blah. While the financial media looked elsewhere for its amusement, the coronavirus epidemic in China just poured fentanyl in the Dow 30,000...

Read More »Could the Coronavirus Epidemic Be the Tipping Point in the Supply Chain Leaving China?

Everyone expecting a quick resolution to the epidemic and a rapid return to pre-epidemic conditions would be well-served by looking beyond first-order effects. While the media naturally focuses on the immediate effects of the coronavirus epidemic, the possible second-order effects receive little attention: first order, every action has a consequence. Second order, every consequence has its own consequence. So the media’s focus is the first-order consequences: the...

Read More »The Future of What’s Called “Capitalism”

The psychotic instability will resolve itself when the illusory officially sanctioned “capitalism” implodes. Whatever definition of capitalism you use, the current system isn’t it so let’s call it “capitalism” in quotes to indicate it’s called “capitalism” but isn’t actually classical capitalism. Try a few conventional definitions on for size: Capitalism allocates capital to its most productive uses. Does the current system actually do this? You must be joking....

Read More »Calling Things by Their Real Names

One does not need money to convey one’s thoughts, but what money does allow is the drowning out of speech of those without money by those with a lot of money. In last week’s explanation of why the Federal Reserve is evil, I invoked the principle of calling things by their real names, a concept that drew an insightful commentary from longtime correspondent Chad D.: Thank you, Charles, for calling out the Fed for their evil ways. We have to properly name things before...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org