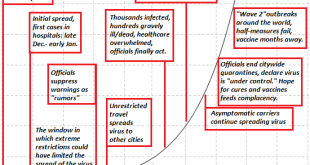

Recall that the initial deaths and related costs are only the first-order effects; policy makers have to consider the second-order effects. Everyone who reckons that the lockdown is needless and more destructive than the pandemic that triggered it has to answer this question: then why did China lockdown half its economy? The reasoning of those who reckon the lockdown is needless can be summarized as follows: 1. The lockdown is based on poorly executed extrapolations...

Read More »When Bulls Are Over-Anxious to Catch the Rocketship Higher, This Isn’t the Bottom

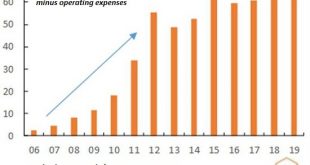

Everyone with any position in today’s market will be able to say they lived through a real Bear Market. In the echo chamber of a Bull Market, there’s always a reason to get bullish: the consumer is spending, housing is strong, the Fed has our back, multiples are expanding, earnings are higher, stock buybacks will push valuations up, and so on, in an essentially endless parade of self-referential reasons to buy, buy, buy and ride the rocketship higher. The classic...

Read More »The Wonderful Insanity of Globalization

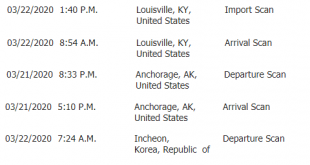

So here’s an April Fools congrats to globalization’s many fools. The tradition here at Of Two Minds is to make use of April Fool’s Day for a bit of parody or satire, but I’m breaking with tradition and presenting something that is all too real but borders on parody: the wonderful insanity of globalization. Like the famous emperor with no clothing, globalization’s countless glorious benefits have been flogged by neoliberal elites and its corporate media shills with...

Read More »The New (Forced) Frugality

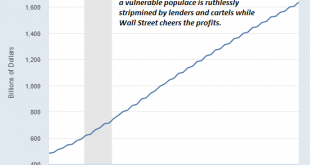

There are only two ways to survive a decline in income and net worth: slash expenses or default on debt. In post-World War II America, the cultural zeitgeist viewed frugality as a choice: permanent economic growth and federal anti-poverty programs steadily reduced the number of people in deep economic hardship (i.e. forced frugality) and raised the living standards of those in hardship to the point that the majority of households could choose to be frugal or live...

Read More »The Pandemic Is Accelerating the Breakdown That Began a Decade Ago

The feedback loop has reversed: by saving more, people will spend, borrow and speculate less, draining the fuel from any broadbased expansion. In eras of confidence and certainty, people save less and spend more freely. When we’re confident that good times are not only here but will continue, we not only spend more freely, we’re more inclined to borrow money and speculate on the shimmering promises of more good times ahead. In eras of uncertainty, people save more...

Read More »Helicopter Money: Short-Term Relief Won’t Cure our Financial Disease

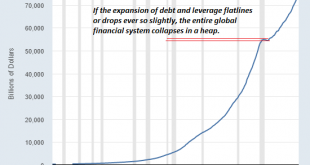

Gordon and I discuss these topics in this 37-minute video: The collateral supporting the global mountain of debt is crumbling as speculative bubbles deflate. A great many freebies are being tossed in the Helicopter Money basket. That households experiencing declines in income need immediate support is obvious, as is the need to throw credit lifelines to small businesses. But beyond those essentials, the open-ended nature of Helicopter Money has unleashed a frenzy of...

Read More »The System Will Not Return to “Normal,” and That’s Good; We Can Do Better

Essential home lockdown reading. The pandemic is revealing to all what many of us have known for a long time: the status quo was designed to fail and so its failure was not just predictable but inevitable. We’ve propped up a dysfunctional, wasteful and unsustainable system by pouring trillions of dollars in borrowed money down a multitude of ratholes to avoid a reckoning and a re-set. And very predictably, that’s the “solution” to the unraveling triggered by the...

Read More »The Global Repricing of Assets Can’t Be Stopped

All bubbles pop, period. The financial elites are pushing a narrative that asset prices, sales and profits will all return to January 2020 levels as soon as the Covid-19 pandemic fades. Get real, baby. Nothing is going back to January 2020 levels. Rather than the “V-shaped recovery” expected by Goldman Sachs et al., the crash in asset prices will eventually gather momentum. Why? It’s simple: for 20 years we’ve over-invested in speculative bubbles and squandered...

Read More »Covid-19 Helicopter Money: Go Big Now or Go Home

This is why it’s imperative to go big now, and make plans to sustain the most vulnerable households and small employers not for two weeks but for six months–or however long proves necessary. That governments around the world will be forced to distribute “helicopter money” to keep their people fed and housed and their economies from imploding is already a given. Closing all non-essential businesses and gatherings will crimp the livelihood of millions of households and...

Read More »The Covid-19 Dominoes Fall: The World Is Insolvent

Subtract their immense debts and they have negative net worth, and therefore the market value of their stock is zero. To understand why the financial dominoes toppled by the Covid-19 pandemic lead to global insolvency, let’s start with a household example. The point of this exercise is to distinguish between the market value of assets and net worth, which is what’s left after debts are subtracted from the market value of assets. Let’s say the household has done very...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org